If you are planning a career in finance, one of the most common dilemmas is whether to pursue a CFA (Chartered Financial Analyst) or an MBA (Master of Business Administration). Both are prestigious qualifications, both open doors to exciting job opportunities, and both require a significant investment of time and money. However, the right choice depends on your career goals, budget, learning style, and the specific areas of finance you want to specialize in.

Table of Contents

ToggleIn this guide, we will compare CFA vs MBA in detail — covering areas of studies, job opportunities, best institutes, course duration, cost, timings, and ultimately, which one is the best for you. Along the way, we will also discuss best CFA courses, top MBA colleges, CFA exam cost, CFA exam dates, CFA salary, and CFA job opportunities.

Understanding CFA and MBA in Finance

Before comparing CFA vs MBA, it is important to understand what each qualification offers.

CFA (Chartered Financial Analyst) – The CFA program is a globally recognised professional credential offered by the CFA Institute. It is highly specialised and focuses deeply on investment management, portfolio analysis, equity research, corporate finance, and financial modelling.

MBA (Master of Business Administration) – An MBA is a postgraduate degree that provides a broad understanding of business administration, management, marketing, operations, and finance. While you can specialise in finance, the curriculum covers many areas beyond just investment analysis.

Key difference – CFA is finance-focused, while an MBA provides a broader business education.

Areas of Study – CFA vs MBA

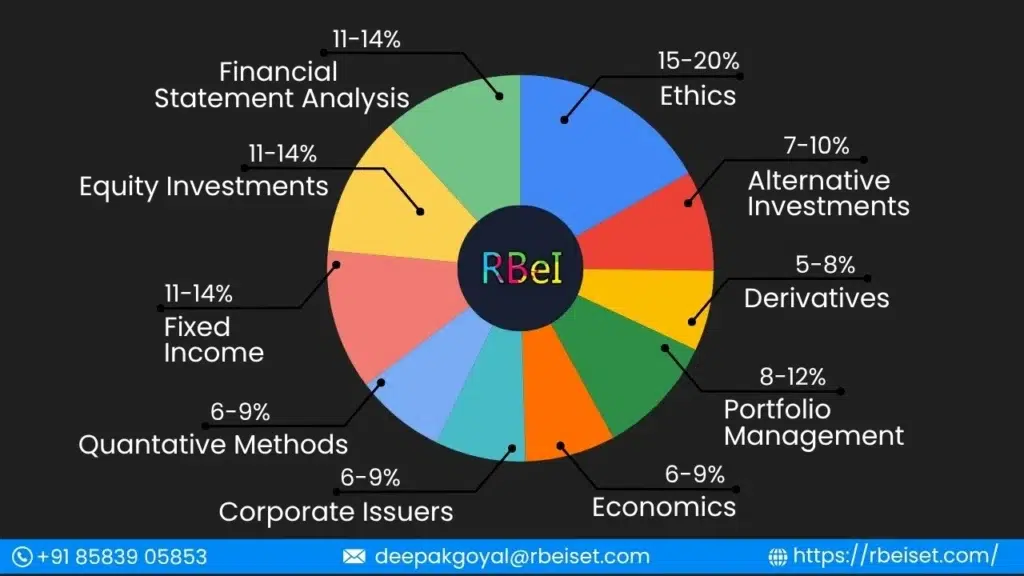

CFA Areas of Study:

- Ethics and Professional Standards

- Quantitative Methods

- Economics

- Financial Reporting and Analysis

- Corporate Finance

- Equity Investments

- Fixed Income

- Derivatives

- Alternative Investments

- Portfolio Management and Wealth Planning

MBA Areas of Study:

- Marketing Management

- Organisational Behaviour

- Financial Management

- Operations Management

- Business Strategy

- Economics for Managers

- Accounting for Managers

- Human Resource Management

- Entrepreneurship

- Electives (e.g., Corporate Finance, Investment Banking, International Business)

Takeaway:

If you are determined to build a career specifically in finance, especially in investment analysis or portfolio management, CFA’s laser focus on finance makes it more valuable. If you want a broader business role with leadership opportunities, MBA might suit you better.

Job Opportunities – CFA vs MBA

CFA Job Opportunities:

- Portfolio Manager

- Equity Research Analyst

- Risk Manager

- Credit Analyst

- Investment Banker (Specialised roles)

- Asset Manager

- Wealth Manager

MBA Job Opportunities:

- Management Consultant

- Investment Banker (Generalist roles)

- Corporate Finance Manager

- Marketing Manager

- Operations Head

- Business Development Manager

- Entrepreneur

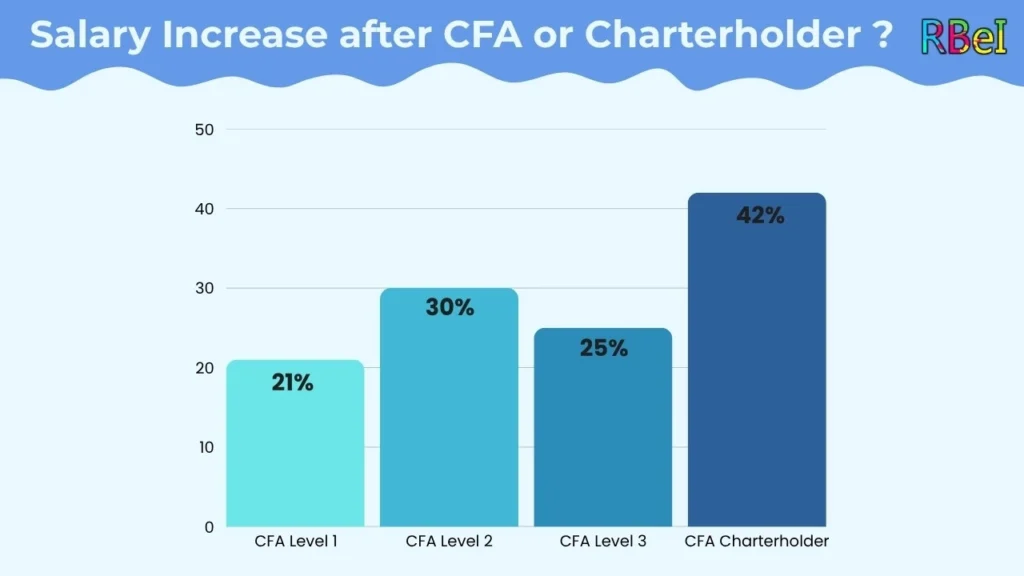

CFA Salary – On average, a CFA charterholder in India can expect between ₹8–15 lakhs annually, while in global markets, it can go well above $100,000 with experience.

MBA Salary – Top MBA graduates in India can earn ₹12–20 lakhs annually, with elite B-school graduates earning much higher.

Takeaway:

CFA gives you strong credibility in finance-specific roles, while MBA opens doors to both finance and broader management roles.

Cost – CFA vs MBA

CFA Exam Cost:

The CFA cost is much lower compared to an MBA. You pay a one-time registration fee of around USD 350–450, and exam fees of USD 940–1250 per level (early or standard registration). Overall, completing all three levels may cost you around USD 3,000–4,000 (₹2.5–3.5 lakhs).

MBA Cost:

An MBA in India can cost anywhere between ₹10 lakhs to ₹30 lakhs, depending on the institute. For top international MBA programs, the cost can exceed ₹70 lakhs–1 crore.

Takeaway:

CFA is significantly more affordable than an MBA, making it an excellent option if you want high-quality finance education without spending a fortune.

Timings and Duration

CFA Course Duration:

Most candidates take about 2.5–4 years to complete all three levels. Exams are held multiple times a year — CFA exam dates vary depending on the level.

MBA Course Duration:

A full-time MBA usually takes 2 years in India, and 1–2 years abroad. Part-time and executive MBA options may take longer.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

Takeaway:

CFA allows you to work while studying, while MBA usually requires a full-time commitment.

Best CFA Course and Coaching

Choosing the best CFA course is critical to clearing the exams. Look for coaching institutes that offer:

- Concept clarity

- Real-life finance examples

- Flexible learning modes (online/offline)

- Mock tests and doubt-solving sessions

- Guidance from experienced CFA charterholders

One of the highly-rated options in India is RBei Classes, known for excellent CFA coaching, high success rates, and practical learning.

Best MBA Colleges

In India, the top MBA colleges for finance include:

- Indian Institute of Management (IIM) Ahmedabad, Bangalore, Calcutta

- Indian School of Business (ISB) Hyderabad

- Xavier School of Management (XLRI) Jamshedpur

- Faculty of Management Studies (FMS) Delhi

- SP Jain Institute of Management and Research (SPJIMR) Mumbai

Globally, top MBA programs include: Harvard Business School, Wharton, Stanford GSB, London Business School, and INSEAD.

CFA Exam Dates

The CFA Institute conducts exams multiple times a year. Approximate CFA exam months are:

- Level I: February, May, August, November

- Level II: May, August, November

- Level III: February, August

Planning your preparation according to these dates can improve your chances of success.

CFA vs MBA – Which One is Best for You?

Here’s a quick decision guide:

| Criteria | CFA | MBA |

| Focus | Finance only | Business & Management |

| Cost | ₹2.5–3.5 lakhs | ₹10–30 lakhs (India), ₹70L+ (abroad) |

| Duration | 2.5–4 years (flexible) | 1–2 years full-time |

| Entry Requirement | Bachelor’s degree or final-year student | Bachelor’s degree, competitive entrance exams |

| Global Recognition | High in finance industry | High in corporate/business world |

| Salary Potential | ₹8–15L+ | ₹12–20L+ |

| Job Opportunities | Finance-specific roles | Multiple industries and roles |

Final Verdict:

- Choose CFA if you want an affordable, globally respected, finance-specialised qualification and prefer self-paced learning while working.

- Choose MBA if you want a broader career scope, leadership opportunities, and networking benefits, and have the budget and time for a full-time program.

Final Words

When it comes to CFA vs MBA, there is no universal winner — only the one that aligns with your goals. If your passion lies in portfolio management, equity research, or investment banking (specialised roles), CFA is a powerful choice. If you aspire to lead companies, explore multiple industries, or start your own venture, MBA might be the better fit.

1. Which is better for a finance career: CFA or MBA?

The CFA offers deep expertise in investment analysis, portfolio management, and financial ethics, while the MBA provides broad business leadership education and networking opportunities. The choice depends on whether you want specialisation or a broader scope.

2. Can you do both CFA and MBA, and is it worth it?

Yes. Combining an MBA’s leadership and strategic skills with the CFA’s technical finance depth can be a powerful combination—especially for senior roles in investment banking, asset management, or corporate leadership.

3. How long does it take and what’s the cost for CFA vs MBA?

The CFA typically takes 2.5–4 years and costs between ₹2.5–3.5 lakhs in total. An MBA usually takes 1–2 years full-time and costs anywhere from ₹10 lakhs (Indian institutes) to ₹70 lakhs or more (international programs).

4. What career paths do CFA vs MBA lead to, and how do salaries compare?

CFA charterholders often work as portfolio managers, research analysts, or risk managers, with salaries ranging from ₹8–15 lakhs in India (and higher abroad). MBA graduates often move into corporate finance, management consulting, or general management, with salaries ranging from ₹12–20 lakhs for top institutions.

5. Which qualification suits my learning style and career phase better?

The CFA is self-paced and flexible, ideal for professionals who want to study while working. The MBA is more structured and immersive, perfect for those who can commit full-time and value peer learning and networking.

1. Delhi – Priya S. (Equity Research Analyst)

“After completing my MBA, I started CFA Level I prep. The CFA coursework deepened my technical skills, while the MBA helped me land interviews. Now, working in equity research, I feel well-rounded. CFA vs MBA wasn’t a choice—combining both gave me confidence and credibility.”

2. Mumbai – Rohit K. (Portfolio Management Associate)

“I chose CFA over MBA because I wanted to specialize early. Studying each night after work, I cleared Level I on my first try. I’m now part of a portfolio team; the CFA has earned respect from seniors for its rigor and finance focus.”

3. Chennai – Ananya R. (Corporate Finance Executive)

“I pursued a top-tier MBA in Chennai, which opened doors to leadership roles in finance departments. Looking back, CFA might have been too niche for my goal to manage corporate strategy. CFA vs MBA—MBA was the right fit for me.”

4. Kolkata – Arjun M. (Investment Banking Analyst)

“I started with CFA during college, but later realized that investment banking firms valued the network and brand of an MBA more. So I’m working and saving up for an MBA, using CFA to keep my technical skills sharp.”

5. Bengaluru – Kavya S. (Product Finance Lead)

“I used CFA to enter financial analytics roles, then did an executive MBA part-time in Bengaluru to level up in leadership and cross-function exposure. CFA for depth, MBA for breadth—and now I drive finance strategy across products.”