If you are planning to build a strong career in risk management and finance, understanding the FRM Salary potential is one of the first steps to making a wise decision. Choosing the Best FRM Course, enrolling in effective FRM Coaching, and following the right FRM Course curriculum can directly influence your earning potential and career growth. In today’s competitive job market, the FRM designation is not just a certificate—it’s a gateway to high-paying global opportunities, career stability, and professional recognition. This blog will guide you through FRM salaries across roles, countries, and experience levels, while also helping you select the Best FRM Course and coaching program to maximize your earning potential.

Table of Contents

Toggle

Understanding the FRM Salary Landscape

Before diving into numbers, it’s essential to understand why FRM Salary figures are often higher compared to many other finance certifications. The Financial Risk Manager (FRM) certification, offered by the Global Association of Risk Professionals (GARP), is recognized in over 190 countries. This global acceptance means that professionals with FRM credentials are in demand across industries like banking, investment, insurance, consulting, and fintech.

Moreover, risk management has become a priority for organizations post-2008 financial crisis and, more recently, during global market uncertainties. As a result, FRM holders enjoy competitive salaries, faster promotions, and greater job security.

Factors Affecting FRM Salary

While the FRM credential itself boosts your earning potential, several factors determine the exact FRM Salary you might earn.

1. Experience Level

- Entry-Level (0–2 years): In India, fresh FRM-certified professionals can expect salaries ranging from ₹6–10 lakhs annually. In the US, the range is $70,000–$90,000.

- Mid-Level (3–7 years): Salaries jump to ₹12–20 lakhs in India and $90,000–$130,000 in the US.

- Senior-Level (8+ years): Senior risk managers, heads of risk, or chief risk officers can earn ₹25–50 lakhs in India and $150,000–$250,000+ in the US.

2. Location

Global FRM Salary levels differ by region:

- United States: Among the highest, due to demand in Wall Street banks, investment firms, and hedge funds.

- India: Rapidly growing demand in BFSI, analytics, and consulting sectors.

- Singapore, Hong Kong, UAE: Attractive tax benefits and high pay scales for risk professionals.

3. Industry

- Investment Banking: Highest pay packages due to high-risk portfolios.

- Commercial Banking: Stable salaries, slightly lower than IB.

- Fintech & Analytics: Growing demand with competitive pay.

- Consulting Firms: Lucrative bonuses on top of base salaries.

How the Best FRM Course Can Influence Your Salary

Enrolling in the Best FRM Course is not just about passing the exam—it’s about building practical skills that make you valuable in the job market. A good course ensures:

- Concept Mastery: Understanding market risk, credit risk, operational risk, and risk models in depth.

- Application Skills: Real-life case studies and financial simulations.

- Exam Strategy: Effective time management and question-solving techniques.

By learning from experienced trainers and updated study material, you are more likely to clear both FRM Part I and Part II in your first attempt, which directly accelerates your career growth and salary potential.

Role of FRM Coaching in Salary Growth

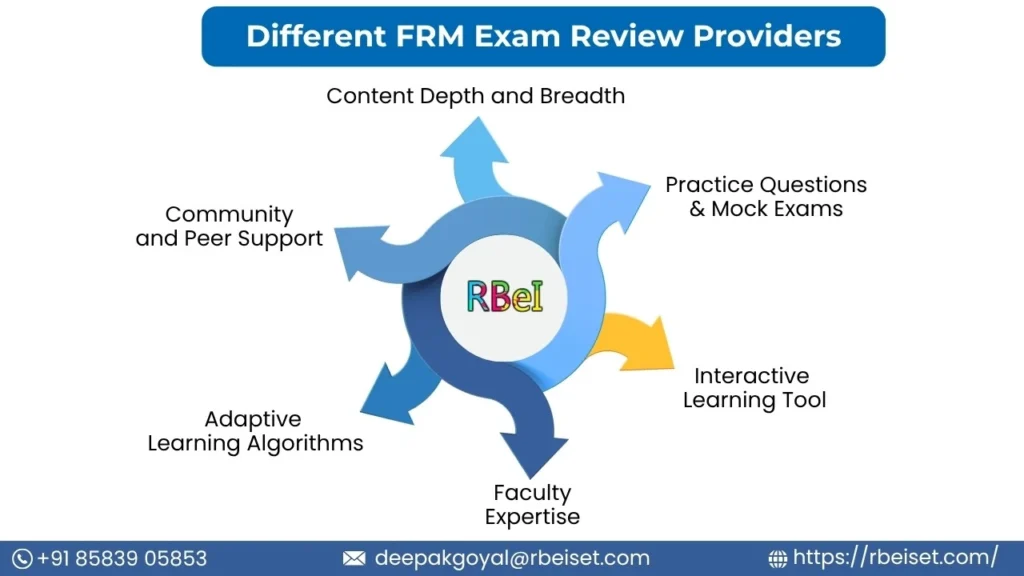

Quality FRM Coaching can be the difference between just passing the exam and excelling in your career. Coaching institutes often provide:

- Industry insights from experienced risk managers.

- Networking opportunities with alumni and industry professionals.

- Guidance on job placements, resume building, and interview preparation.

For example, a candidate who joins structured FRM Coaching may secure a better-paying job within months of certification compared to someone preparing without guidance. The return on investment here can be significant—sometimes your first salary increment alone covers the coaching fees.

FRM Salary by Job Roles

Below is a breakdown of average salaries for popular FRM-certified job profiles:

| Job Role | India (₹ per year) | US ($ per year) |

| Risk Analyst | 6–10 LPA | 70,000–90,000 |

| Credit Risk Manager | 12–18 LPA | 90,000–120,000 |

| Market Risk Manager | 15–22 LPA | 100,000–140,000 |

| Operational Risk Manager | 12–20 LPA | 95,000–130,000 |

| Chief Risk Officer | 35–50 LPA | 200,000–300,000+ |

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

Global FRM Salary Trends

The FRM designation opens doors worldwide. Let’s explore salary trends:

- North America: High salaries with significant performance bonuses.

- Europe: Strong demand in London, Frankfurt, and Paris.

- Middle East: Tax-free income and growing finance hubs like Dubai and Abu Dhabi.

- Asia-Pacific: Competitive pay with rising opportunities in Singapore, Hong Kong, and Sydney.

FRM vs Other Finance Certifications – Salary Comparison

When compared to CFA, MBA (Finance), or PRM (Professional Risk Manager), FRM often yields comparable or higher salaries in risk-related roles. While CFA focuses more on investment analysis, FRM’s specialization in risk management makes it particularly valuable in today’s volatile markets.

How to Negotiate a Better FRM Salary

To maximize your FRM Salary:

- Leverage Your Certification: Highlight your FRM credential in salary discussions.

- Showcase Practical Skills: Employers value applied knowledge over theory.

- Stay Updated: Learn new risk technologies and regulations.

- Consider Global Roles: Relocation can boost your pay by 50–100%.

Step-by-Step Guide to Maximizing FRM Salary

- Choose the Best FRM Course that matches your learning style and career goals.

- Enroll in Quality FRM Coaching to ensure you clear both parts quickly.

- Gain Practical Experience through internships or risk-related projects.

- Network with Professionals via LinkedIn, events, and alumni groups.

- Target High-Paying Industries like investment banking or fintech.

- Continuously Upskill with data analytics, AI in risk, and regulatory updates.

The Return on Investment (ROI) of FRM

An FRM certification often pays back its cost within 6–18 months of entering the job market. Considering the relatively low exam and coaching costs compared to MBA programs, FRM offers one of the highest ROI in finance.

Final Thoughts

The FRM Salary potential is more than just a number—it’s a reflection of the skills, credibility, and career opportunities you gain with this globally recognized credential. By choosing the Best FRM Course, investing in quality FRM Coaching, and strategically planning your career moves, you can enjoy both financial rewards and professional satisfaction. Whether you aim to work in a top investment bank, a global consulting firm, or a fintech startup, the FRM designation can help you get there faster and with higher pay.

Recent Job Openings in Risk Management

Here are some recent and noteworthy job openings in the risk management domain that can give readers a snapshot of current opportunities:

India-Based Roles

- American Express India is actively hiring multiple positions such as Analyst – Ops Risk Management, Analyst – Operations Risk, and Analyst – Risk Management (Regulatory Reporting) in Gurgaon, reflecting robust demand for risk analysts.

- On LinkedIn, there are over 5,000+ Risk Analyst roles across India, including titles like Credit Risk Manager (DMI Finance, Delhi), Investment Risk – Risk Manager, AVP (Deutsche Bank, Mumbai), Manager – Risk MIS (SBI Card, Gurugram), and Market Risk Manager (Axis Capital, Mumbai).

- Shine.com lists recent openings such as Ops Risk Manager (Airtel, Haryana), Market Risk Manager (KPMG India, Maharashtra), Operational Risk Manager (Riskpro India, Maharashtra), and various IT Risk / Compliance roles (Navi Mumbai & beyond).

- Via Cutshort, a GRC Consultant (Mumbai/Navi Mumbai) and a Risk Management Analyst – Capital Markets (Bengaluru/Mumbai) are actively recruiting, offering annual packages up to ₹21 L and ₹28 L respectively.

- For Third-Party Risk Management (TPRM), LinkedIn shows roles like Deputy VP – Vendor Security Risk Governance (SBI Card, Gurugram), Manager/AVP – TPRM (BNP Paribas, Bengaluru), and Fraud Risk Manager (NPCI BHIM, Mumbai)—showcasing growing regulatory and vendor risk demand.

- Michael Page India features senior leadership roles like Chief Risk Officer (Mumbai), Head – Operations Risk (Delhi), and Director – Quality Risk Management (Gurgaon), indicating avenues for seasoned professionals.

Delhi NCR Snapshot

- Searching specifically in Delhi, Indeed reveals over 800+ risk management job postings, including roles such as Deputy Manager / Consultant – Third-Party Risk Management (Deloitte, Delhi), Project Risk & Contract Management (L&T, Delhi), Credit Control / Risk Management Officer (DBS Bank, Delhi), and Assistant Manager – Third-Party Risk Management (Deloitte, Delhi).

Global Opportunities

- In Singapore, a Risk Manager – South East Asia position at Afterpay/Wise was posted in January 2025. It’s geared towards candidates providing second-line risk oversight across Southeast Asia.

- In the United States, Intel Corporation is seeking a Risk & Insurance Manager in Santa Clara to lead global insurance programs, including captive management and claims, governance, and analytics.

Why This Matters for Your Readers

By integrating these recent job listings, your blog becomes more than just informational—it becomes strategically actionable. It connects how choosing the Best FRM Course, investing in FRM Coaching, and completing an effective FRM Course lead directly to tangible job opportunities across diverse geographies and levels—from entry-level to leadership.

Would you like me to weave these job examples into the blog narrative with transition words and ensure they fit seamlessly? I can also highlight how each role aligns with career progression after FRM certification.

Let me know if you’d like specific job links formatted or added to the blog as call-out sections!

Sources

Placement Support from RBei Classes

One of the biggest advantages of choosing RBei Classes for your FRM preparation is the dedicated placement support that bridges the gap between certification and career success. Many students complete the Best FRM Course and excel in exams but struggle to find the right opportunity. RBei Classes ensures you don’t face that challenge.

Here’s how RBei Classes supports your job hunt:

1. Dedicated Placement Cell – A specialized team works closely with top banks, consulting firms, fintech companies, and investment houses to identify hiring needs for FRM-certified professionals.

2. Exclusive Job Alerts – Students get priority access to recent openings in risk management, credit analysis, and market risk, both in India and globally. These include opportunities similar to those listed in the Recent Job Openings in Risk Management section.

3. Resume Building & LinkedIn Optimization – Trainers help you craft an FRM-focused CV and a professional LinkedIn profile to attract recruiters.

4. Mock Interviews & Case Studies – RBei Classes conducts industry-specific mock interviews and real-world case study discussions so you can confidently handle technical and HR rounds.

5. Alumni Network – With hundreds of past students now working at leading institutions like JPMorgan, HSBC, Deloitte, Axis Bank, and KPMG, the alumni network opens direct referral channels for new graduates.

6. Soft Skills & Salary Negotiation Workshops – Apart from technical expertise, you’ll get training on communication, presentation skills, and strategies to negotiate a competitive FRM Salary.

Many students who prepared with RBei Classes not only cleared both FRM parts in their first attempt but also secured jobs within weeks of certification—often with salary packages above market averages.