When I look back at my FRM journey, it feels like a dream come true. Clearing FRM Part 2 in August 2025 attempt while working full-time at SBI Bank in Kolkata was never going to be easy. I had only 90 days to prepare, and my daily schedule was already packed with office commitments. Yet, I achieved top quartiles in all subjects and cleared the exam in one go.

Table of Contents

ToggleThe biggest reason behind this success was my decision to join RBei Classes – the Best FRM Coaching for working professionals in India. With their high-quality preparation material, structured lectures, and the personal mentorship of Deepak Goyal Sir, I could manage my preparation effectively despite my hectic banking job.

In this blog, I want to share my story of struggle, discipline, and success—why I chose FRM, how I managed my time, and why RBei Classes was the turning point in my preparation.

Why I Chose FRM While Working in SBI Bank?

Working in the banking sector at SBI Kolkata, I often noticed how risk management professionals played a crucial role in shaping strategies, handling credit risk, market risk, and operational risk. I realized that the future of banking lies in financial risk management.

Although I had a stable job, I always aspired to grow faster in my banking career. That’s when I came across the Financial Risk Manager (FRM) certification.

Some reasons why I chose FRM were:

- Global Recognition: FRM is one of the most prestigious certifications in the world of finance and risk management.

- Career Growth in Banking: Having FRM on my profile would give me an edge over my peers in promotions and international opportunities.

- Relevance in My Role: As I was already handling risk-related aspects in SBI, FRM matched perfectly with my work responsibilities.

- Future Opportunities: With increasing demand for risk managers in banks, NBFCs, and investment firms, I knew FRM would open new doors.

But the challenge was – how would I manage my preparation with a full-time job?

Why I Chose RBei Classes for FRM Preparation?

When I started searching for the best FRM coaching for working professionals, I came across multiple options. However, I wanted something practical, flexible, and mentorship-driven because my time was limited.

After talking to colleagues and going through multiple reviews, one name stood out – RBei Classes.

Here’s why I chose RBei:

- Highest FRM Pass Rates in India – The results spoke for themselves. RBei consistently produces toppers and students with top quartiles.

- Mentorship of Deepak Goyal Sir – Unlike other institutes, here the founder himself teaches. His teaching style is practical, simple, and connects theory with real banking examples.

- Best Preparation Material – RBei provided structured notes, summaries, and question banks that saved me a lot of time.

- Flexibility for Working Professionals – Since I had limited hours after office, the recorded lectures and doubt-solving sessions made it possible to stay consistent.

- Personal Guidance – Deepak Sir is always available to guide. Whenever I felt low, his mentorship gave me confidence to push harder.

This combination of quality, mentorship, and structured approach made RBei the perfect choice for me.

My FRM Part 2 Preparation Journey with 90 Days Strategy

I joined RBei Classes on 25th April 2025, exactly 90 days before my August attempt. Initially, I was nervous, but the study plan provided by RBei gave me a clear roadmap.

Step 1: Structured Study Plan

Deepak Sir helped me create a day-wise timetable. I followed it religiously. The plan included:

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

- Completing lectures within 45 days

- Practicing questions daily

- Weekly revision and mock tests

Step 2: Daily Schedule with Full-Time Job

Since I worked at SBI, my office hours were strict. Still, I managed:

- Morning (2 hours before office) – Watched recorded lectures or revised notes

- Evening (3–4 hours after office) – Solved practice questions and mock tests

- Weekends (6–7 hours) – Focused on difficult topics like Credit Risk, Market Risk, and Operational Risk

On average, I studied 5–6 hours a day. Initially, it felt impossible, but the engaging lectures and structured material from RBei made it easier.

Step 3: Focus on Revision and Practice

The key to my success was multiple revisions. Instead of reading everything once, I revised each topic at least 3 times. The question banks from RBei were a game-changer, as they closely resembled the exam pattern.

Step 4: Mock Tests & Mentorship

The mock tests conducted by RBei helped me evaluate my preparation level. After every test, I discussed my weak areas with Deepak Sir, who guided me personally on how to improve.

This continuous feedback loop ensured that I was always on track.

Why RBei Classes is the Best FRM Coaching for Working Professionals?

If you are a working professional like me, you know how difficult it is to balance office and studies. That’s where RBei Classes truly stands out.

- Simple & Clear Explanations: The lectures break down even the toughest FRM concepts into simple real-life examples.

- Complete Coverage: Every topic is covered from basic to advanced, so I never felt lost.

- Mentorship Culture: Unlike other institutes, here teachers actually care about your progress.

- Time-Saving Notes: The summary sheets and key formula notes saved me from wasting time on unnecessary reading.

- Top Quartiles Guarantee: With the right strategy, many students like me have cleared with top quartiles in all subjects.

No wonder RBei has the highest FRM pass rates in India.

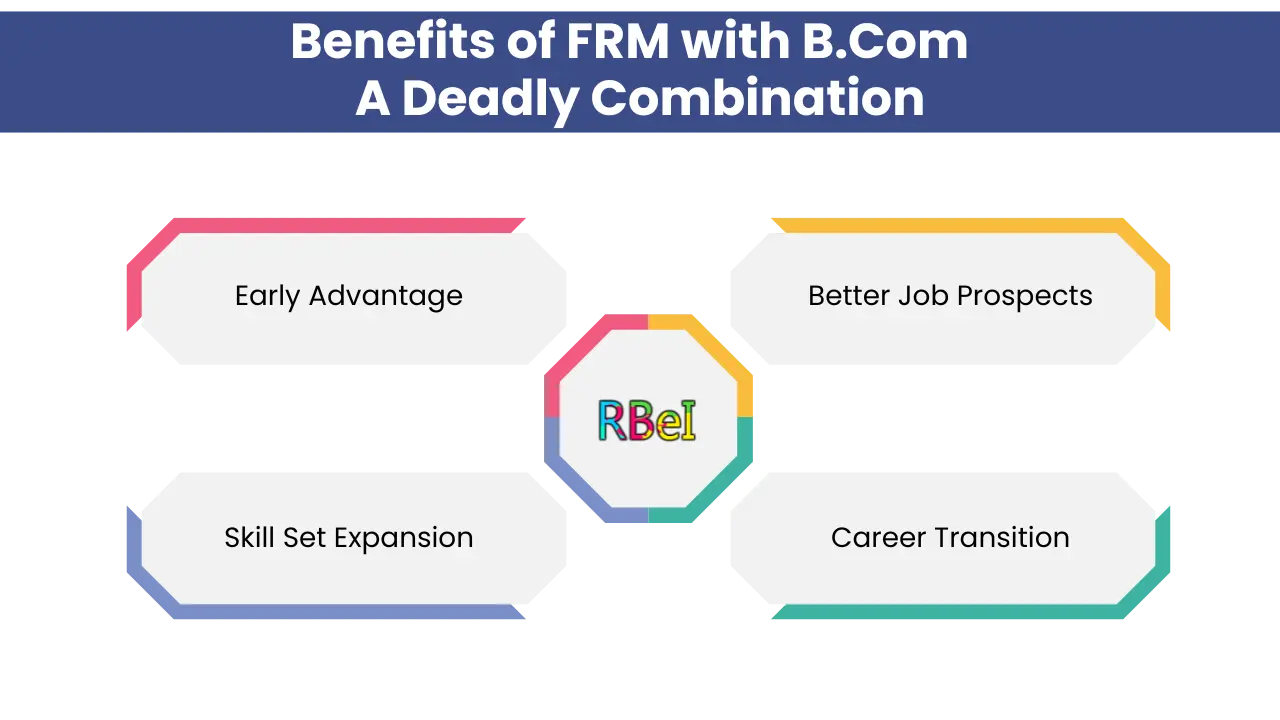

Benefits of FRM in My Banking Career

Clearing FRM Part 2 in August 2025 attempt has already made a huge difference in my professional life.

- My seniors at SBI Kolkata recognized the value of my FRM certification.

- I got shortlisted for a risk management role within my department.

- The certification boosted my confidence and credibility in discussions with clients and regulators.

- I now have a global qualification that opens doors to opportunities in investment banking, consulting, and risk advisory roles worldwide.

For anyone in banking or finance, FRM is more than a degree—it’s a career accelerator.

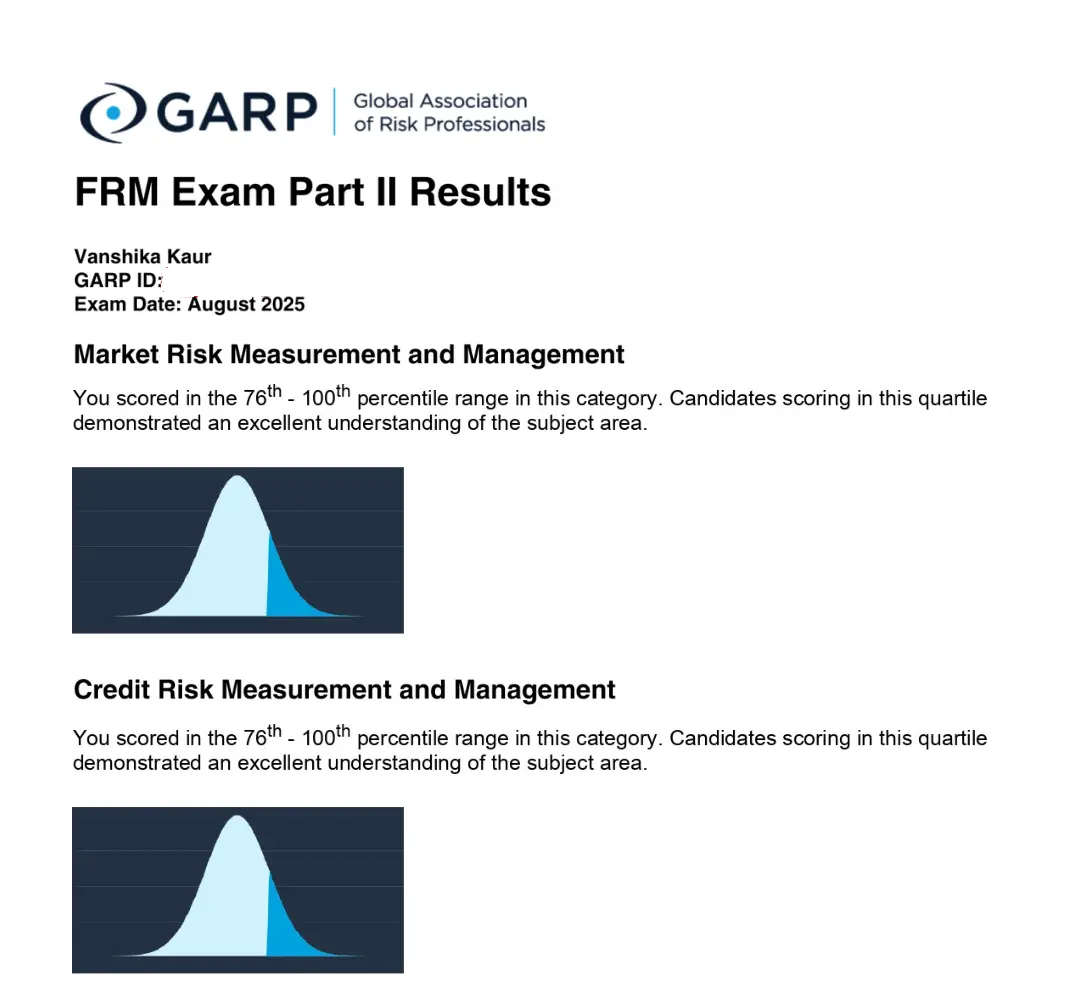

How I Achieved Top Quartiles in All FRM Subjects?

Many people ask me how I managed to score top quartiles in all FRM Part 2 subjects despite such limited time. The answer is simple:

- RBei’s Structured Plan – I followed exactly what Deepak Sir told me.

- Focused Study Hours – Instead of wasting time, I utilized every available hour.

- Multiple Revisions – Each topic revised at least 3 times.

- Mock Tests & Feedback – Continuous evaluation and improvement.

- Mentorship & Motivation – Deepak Sir’s guidance kept me focused till the end.

This approach not only helped me pass but also excel.

Final Words: My Advice to Future FRM Aspirants

If you are a working professional preparing for FRM, let me tell you – it is absolutely possible. All you need is:

- Right Coaching – Choose RBei Classes because they truly understand working professionals.

- Discipline & Consistency – Even 5–6 hours a day is enough if used wisely.

- Mentorship – Don’t hesitate to ask for guidance.

- Smart Preparation – Focus on revision, practice, and exam strategy.

I cleared FRM Part 2 in my August 2025 attempt with just 90 days of preparation while working full-time, and you can too. If I can do it, so can you.

RBei Classes has been the backbone of my success, and I would recommend it to every working professional aspiring to pass FRM with top quartiles.

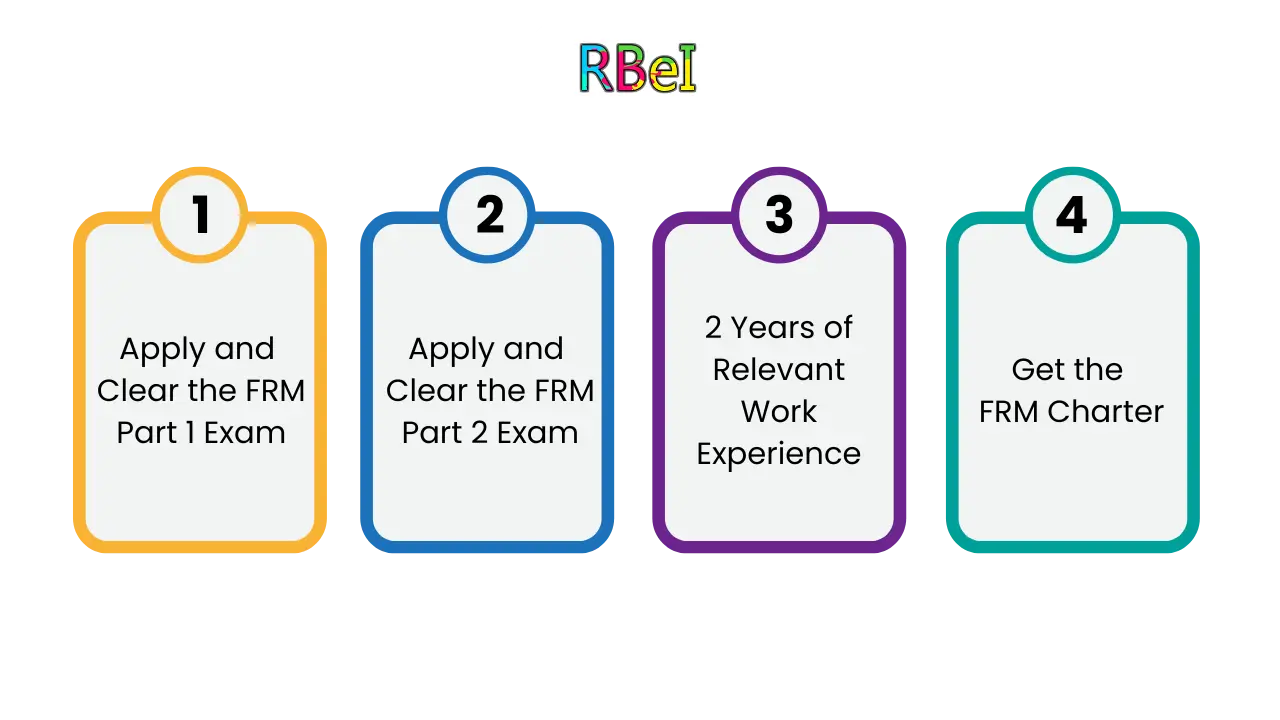

What is FRM and why should I pursue it?

The Financial Risk Manager (FRM) certification is a globally recognized qualification offered by the Global Association of Risk Professionals (GARP). It focuses on market risk, credit risk, operational risk, liquidity risk, and investment management.

Pursuing FRM is highly beneficial because:

- It is globally recognized, making your profile stand out in international banking and finance.

- It helps you secure roles in risk management, treasury, investment banking, consulting, and asset management.

- In India, FRM-certified professionals often work with top banks like SBI, HDFC, ICICI, global investment banks, Big 4 firms, and consulting giants.

- It accelerates career growth for working professionals, especially in risk, compliance, and analytics.

If you are working in a bank or finance company, FRM gives you an edge in promotions and specialized roles.

What are the career opportunities after FRM?

After completing FRM, you can explore a wide range of opportunities across banking, NBFCs, investment firms, fintech, and consulting companies.

Some top roles include:

- Risk Manager / Senior Risk Analyst

- Credit Risk Manager

- Market Risk Analyst

- Operational Risk Consultant

- Treasury Manager

- Portfolio Risk Specialist

- Regulatory and Compliance Manager

In India, FRM professionals can expect starting packages between ₹8–15 LPA in risk-related roles. With experience, compensation can go beyond ₹25–30 LPA in leadership positions.

Globally, FRM opens opportunities in Wall Street banks, London-based investment firms, and Singapore/Hong Kong financial hubs.

Which is the Best FRM Coaching for Working Professionals in India?

The best FRM coaching for working professionals in India is RBei Classes.

Here’s why:

- Highest FRM Pass Rates in India – RBei consistently delivers toppers and top-quartile results.

- Tailored for Working Professionals – Flexible schedules, recorded lectures, and focused study plans.

- Mentorship of Deepak Goyal Sir – Known for simplifying concepts with real-world banking examples.

- Comprehensive Material – Time-saving summary notes, formula sheets, and exam-focused question banks.

- Personal Guidance – Deepak Sir is personally available to solve doubts, unlike most institutes.

If you’re working full-time and want to clear FRM in the first attempt with top quartiles, RBei Classes is the best choice in India.

Can I do FRM along with other courses like CFA or MBA?

Yes, absolutely! Many students combine FRM with CFA, MBA, or even data-related courses like Python and Power BI.

- FRM + CFA → Perfect combination if you want to build a career in investment banking, portfolio management, and risk analytics.

- FRM + MBA → Best for those aiming at leadership roles in corporate finance, banking, or consulting.

- FRM + Data Skills (Python, SQL, Power BI) → Highly in-demand for quantitative finance, risk modeling, and fintech roles.

Pro Tip: If you are already working in banking or finance, doing FRM first makes sense because it is shorter (2 levels) and highly relevant. You can always pursue CFA or MBA later.

How long does it take to prepare for FRM Part 1 and Part 2?

- FRM Part 1 → Usually requires 5–6 months of preparation (around 300–350 study hours).

- FRM Part 2 → Can be done in 3–5 months if you are consistent (around 250–300 study hours).

For working professionals, it is possible to clear in 90 days (like I did for FRM Part 2) with a proper study plan + right coaching (RBei).

Preparation Tips:

- Start early and follow a structured timetable.

- Revise at least 3 times before the exam.

- Practice mock tests and past exam-style questions.

- Use concise notes and summary sheets to save time.

With the right guidance, even a working professional can clear FRM in the first attempt.