In the world of finance, professionals constantly seek credentials that can differentiate them from the crowd and open doors to elite career opportunities. Among these, the CFA designation stands out globally. The CFA is the most respected qualification in finance, recognized by employers, regulators, and industry peers alike. Many finance aspirants wonder why this certification holds unparalleled prestige, and in this blog, we will explore the reasons behind its global reputation, its rigorous curriculum, and the career advantages it offers. By understanding why the CFA is the most respected qualification in finance, candidates can better appreciate its value and commit to the journey with clarity and purpose.

Table of Contents

ToggleUnderstanding the CFA Designation

Before we delve into why the CFA is the most respected qualification in finance, it’s important to understand what the CFA designation entails. The Chartered Financial Analyst (CFA) certification is awarded by the CFA Institute, a globally recognized professional body in investment management and finance.

Key aspects of the CFA program include:

- Global Recognition: The CFA charter is recognized in over 165 countries, making it a truly international credential.

- Rigorous Curriculum: Covering ethics, investment tools, portfolio management, and wealth planning, the CFA curriculum is both broad and deep.

- Professional Standards: CFA candidates must adhere to a strict code of ethics and professional conduct, emphasizing integrity in financial decision-making.

Understanding these fundamentals sets the stage for appreciating why the CFA is the most respected qualification in finance.

The Rigorous Nature of the CFA Program

One of the primary reasons why the CFA is the most respected qualification in finance is its unmatched rigor.

1. Multi-Level Examination

The CFA program consists of three levels of exams: Level I, Level II, and Level III. Each level tests candidates on different aspects of finance:

- Level I: Focuses on foundational concepts and investment tools.

- Level II: Emphasizes asset valuation and complex analysis.

- Level III: Centers on portfolio management and wealth planning.

Passing all three levels requires dedication, consistent effort, and mastery of concepts, which is why professionals who achieve the CFA charter are highly respected.

2. High Failure Rate

Historically, CFA exams have a pass rate below 50% for each level. This low pass rate underscores the difficulty and ensures that only highly committed and competent candidates earn the designation.

3. Comprehensive Curriculum

The depth and breadth of the curriculum prepare candidates to tackle real-world financial challenges, reinforcing why the CFA is the most respected qualification in finance.

Ethical Standards and Professional Integrity

Another critical reason why the CFA is the most respected qualification in finance is its emphasis on ethics.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

1. Code of Ethics

CFA charter holders must follow a strict code of ethics, which includes principles such as honesty, diligence, and transparency. This ethical foundation builds trust among clients and employers, giving CFA professionals a distinct advantage in the competitive finance world.

2. Professional Conduct

The CFA Institute enforces standards of professional conduct, ensuring that charterholders uphold the highest levels of integrity in their work. This ethical commitment further reinforces the CFA’s reputation as a credential that combines knowledge with integrity.

Global Recognition and Career Opportunities

The CFA’s global recognition is another reason it is considered the most respected qualification in finance.

1. International Acceptance

From New York to London to Singapore, the CFA designation is respected by employers worldwide. Many top financial institutions consider it a key qualification for roles in investment banking, asset management, research, and corporate finance.

2. Career Advancement

Holding a CFA charter opens doors to senior-level positions, including portfolio manager, financial analyst, risk manager, and chief investment officer. Employers recognize the CFA as a mark of competence, commitment, and professionalism.

3. Networking Opportunities

The CFA Institute offers a global network of professionals, providing access to conferences, workshops, and local societies. This network is invaluable for career growth, mentorship, and knowledge sharing.

Rigorous Work Ethic and Time Commitment

The CFA designation is respected not only for its content but also for the dedication required to earn it.

1. Time Commitment

Candidates typically spend 300-400 hours per exam level. Balancing work, personal life, and preparation requires exceptional discipline. This intense preparation ensures that CFA charter holders are both knowledgeable and resilient.

2. Continuous Learning

Even after obtaining the CFA charter, professionals are expected to engage in continuous learning to stay updated on industry trends. This lifelong commitment to professional growth contributes to the CFA’s esteemed reputation.

Why Employers Value the CFA Charter

Employers highly value the CFA charter for several reasons:

- Technical Expertise: CFA charter holders possess deep analytical skills and investment knowledge.

- Ethical Assurance: Employers can trust charter holders to adhere to high ethical standards.

- Problem-Solving Abilities: The rigorous exams cultivate critical thinking and strategic decision-making skills.

- Global Competence: The CFA curriculum equips professionals to operate in international financial markets.

These qualities make the CFA a unique and highly respected credential in finance.

Testimonials from Finance Professionals

Many CFA charterholders highlight the career impact of the designation:

- John D., Portfolio Manager: “Earning the CFA charter transformed my career. Employers immediately recognized my commitment and expertise, opening doors to roles I never thought possible.”

- Priya S., Investment Analyst: “The CFA program not only sharpened my technical skills but also strengthened my ethical decision-making. It truly is the most respected qualification in finance.”

These testimonials underscore the CFA’s value and its respect across the financial industry.

CFA vs Other Finance Certifications

While there are multiple finance certifications, such as CPA, FRM, or CAIA, the CFA stands out for its global recognition, ethical emphasis, and comprehensive investment focus. Unlike other credentials that may specialize in one niche, the CFA equips professionals with holistic knowledge across finance, making it the most respected qualification in finance.

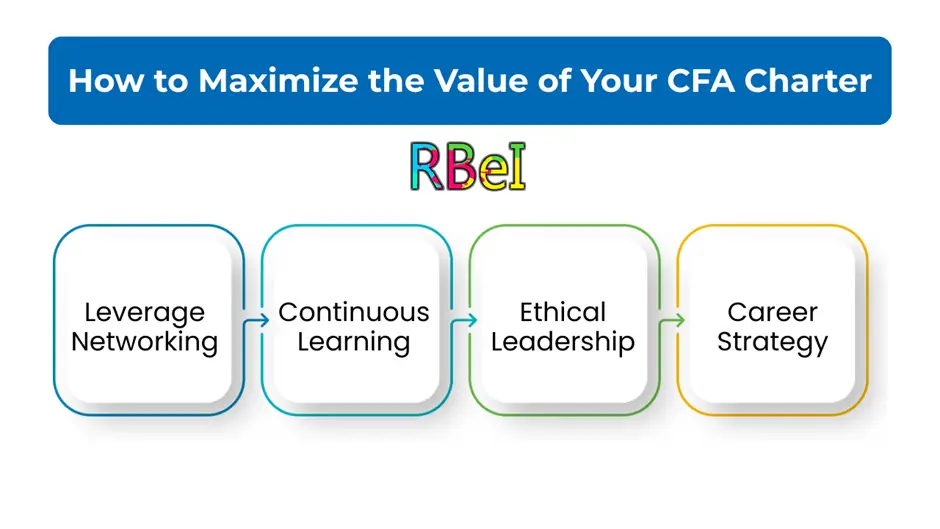

By following these steps, CFA charter holders can fully harness the respect and opportunities their designation offers.

Final Thoughts

The CFA is the most respected qualification in finance for multiple reasons: its rigorous curriculum, ethical standards, global recognition, and the dedication required to earn it. Achieving the CFA charter is not just a milestone; it is a testament to a professional’s knowledge, integrity, and commitment to excellence.

For aspiring finance professionals, investing in the CFA journey is more than an academic pursuit—it is a career-defining decision that opens doors, builds credibility, and provides lifelong benefits.