Embarking on the journey to become a Financial Risk Manager (FRM) is both challenging and rewarding. The FRM certification, offered by the Global Association of Risk Professionals (GARP), is recognized globally and signifies a high level of expertise in financial risk management. To navigate this path successfully, a well-structured study plan, effective preparation strategies, and the right resources are essential.

Table of Contents

ToggleUnderstanding the FRM Exam Structure

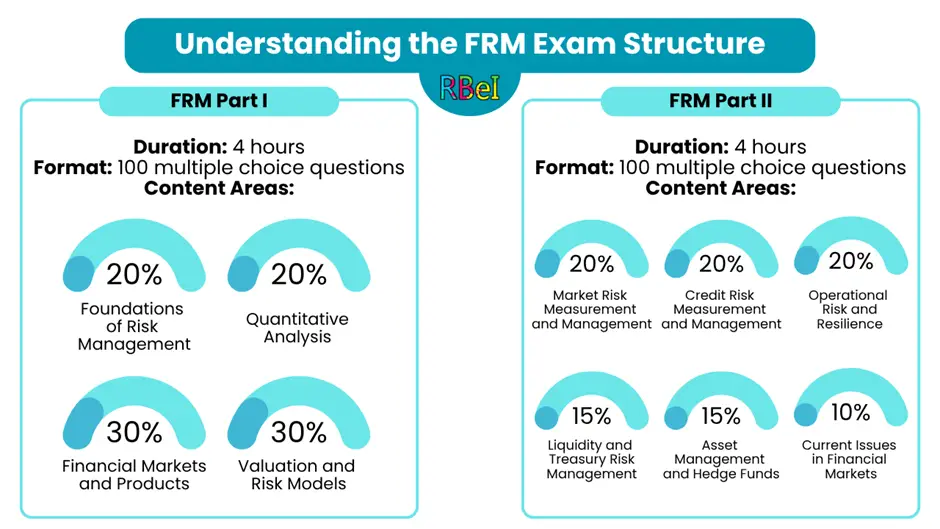

The FRM examination is divided into two parts, each focusing on different aspects of financial risk management:

Crafting an Effective FRM Study Plan

1. Start Early and Plan Ahead

Begin your preparation at least 4–6 months before the exam date. This allows ample time to cover all topics thoroughly and to review and practice before the exam. A study plan of 275 to 350 hours is recommended for Part I.

2. Break Down the Curriculum

Divide the curriculum into manageable sections based on the exam weightings. Focus on high-weight topics like Financial Markets and Products for Part I and Market Risk Measurement for Part II. This targeted approach ensures efficient use of study time.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

3. Allocate Time Wisely

Dedicate specific hours each week to study. For example, 1.5–2 hours on weekdays and 3–4 hours on weekends. Consistency is key to retaining information and building momentum.

4. Incorporate Practice Questions

Regularly solve practice questions to reinforce learning and identify areas needing improvement. Utilize question banks and mock exams to simulate actual exam conditions

5. Review and Revise

Allocate the last month before the exam for intensive revision. Focus on weak areas and take full-length mock exams to build confidence and improve time management.

Recommended Resources for FRM Preparation

Official GARP Materials

GARP provides the official FRM curriculum, which is comprehensive and aligned with the exam syllabus. Additionally, GARP offers complimentary practice exams for both Part I and Part II candidates

Third-Party Study Providers

- Kaplan Schweser: Offers study notes, question banks, and mock exams tailored for FRM candidates.

- AnalystPrep: Provides video lessons, study notes, and practice questions with performance tracking tools

- Fintelligents: Features a structured study planner and topic-wise sequence for efficient preparation

Online Platforms and Forums

- Reddit (r/FRM): A community where candidates share experiences, strategies, and resources.

- Bionic Turtle: Offers detailed study materials and practice questions with explanations

Study Plan Templates

FRM Part I Study Plan

| Week | Topics Covered | Hours |

| 1–2 | Foundations of Risk Management | 20 |

| 3–4 | Quantitative Analysis | 20 |

| 5–6 | Financial Markets and Products | 30 |

| 7–8 | Valuation and Risk Models | 30 |

| 9–10 | Review and Practice | 30 |

| 11 | Mock Exams and Final Revision | 20 |

FRM Part II Study Plan

| Week | Topics Covered | Hours |

| 1–2 | Market Risk Measurement and Management | 20 |

| 3–4 | Credit Risk Measurement and Management | 20 |

| 5–6 | Operational Risk and Resilience | 20 |

| 7–8 | Liquidity and Treasury Risk Management | 15 |

| 9–10 | Asset Management and Hedge Funds | 15 |

| 11 | Current Issues in Financial Markets | 10 |

| 12 | Review and Practice | 30 |

Conclusion

Achieving success in the FRM exams requires a strategic approach, dedication, and the right resources. By following a structured study plan, utilizing quality study materials, and practicing consistently, you can enhance your chances of passing the FRM exams and advancing your career in financial risk management.