Choosing the right path after completing Class 12 in the Commerce field is a crucial turning point for your career and personal development. With the dynamic growth of the Indian and global economy, commerce students have access to a wide range of promising academic and professional courses. In this detailed blog on the Best courses after 12th Commerce, you’ll find all the essential details—including fees, duration, coaching, syllabus, job opportunities, and salary packages—for nine major courses you can pursue after Class 12 in Commerce.

Table of Contents

Toggle- CFA (Chartered Financial Analyst)

- FRM (Financial Risk Manager)

- ACCA (Association of Chartered Certified Accountants)

- Financial Modelling

- B.Com (Bachelor of Commerce)

- BBA (Bachelor of Business Administration)

- CA (Chartered Accountant)

- CS (Company Secretary)

- Digital Marketing

1. CFA (Chartered Financial Analyst)

Overview:

CFA is one of the most coveted finance credentials globally, focusing on investment management, portfolio analysis, equity research, and more. Awarded by the CFA Institute (USA), it is ideal for those aiming for careers in finance, investment banking, or asset management.

Eligibility:

- Graduate degree (or in final year of graduation)

- 4,000 hours of relevant work experience for charter

Fees:

| One-time Registration | ₹37,000 |

| Exam Fee per Level | ₹74,000 – ₹98,000 |

| Study Materials | ₹25,000 – ₹40,000 |

| Coaching per Level | ₹30,000 – ₹70,000 |

| Total (approx.) | ₹3,00,000 – ₹4,00,000 |

Duration:

- 2 to 4 years (if all three levels are cleared in succession)

- 1.5 to 2 years possible for accelerated candidates

Coaching:

Top coaching centers include RBei Classes, Kaplan Schweser, Wiley CFA, IMS Proschool, and others. Both online and offline options are widely available. Choose based on your learning style and location.

Syllabus:

- Ethics and Professional Standards

- Quantitative Methods

- Economics

- Financial Reporting and Analysis

- Corporate Finance

- Equity Investments

- Fixed Income

- Derivatives

- Alternative Investments

- Portfolio Management and Wealth Planning

Job Opportunities:

- Portfolio Manager

- Investment Banker

- Equity Research Analyst

- Risk Manager

- Financial Analyst

Salary Package:

| Level | Salary |

| Entry Level | ₹6–10 lakh/yr |

| Mid-Level | ₹12–25 lakh/yr |

| Senior | ₹25–50 lakh/yr |

| Global (International Placements) | $70,000–$200,000/yr |

2. FRM (Financial Risk Manager)

Overview:

FRM is a highly recognized certification for risk management professionals, awarded by the Global Association of Risk Professionals (GARP).

Eligibility:

- Open to graduates (no specific graduation required)

- Requires 2 years of work experience (in risk profile role) for certification

Fees:

| Component | Cost |

|---|---|

| Registration (One-time) | $400 |

| Exam Fee (per part) | $600–$800 (2 parts) |

| Coaching (per part) | ₹25,000–₹40,000 |

| Total (approx.) | ₹1,25,000–₹1,75,000 |

Duration:

- Minimum: 1 year (if Parts I & II cleared in consecutive attempts)

- Most candidates take 1.5–2 years

Coaching:

Leading Indian institutes and online platforms (EduPristine, Quintedge, Miles Education) offer structured FRM training programs.

Syllabus:

- Foundations of Risk Management

- Quantitative Analysis

- Financial Markets and Products

- Valuation and Risk Models

- Market Risk, Credit Risk, Operational and Integrated Risk Management

- Risk Management, Current Issues in Financial Markets

Job Opportunities:

- Market Risk Analyst

- Credit Risk Specialist

- Risk Manager

- Treasury Manager

- Risk Consultant

Salary Package:

| Level | Salary Range |

|---|---|

| Entry | ₹6–9 lakh/yr |

| Experienced | ₹12–25 lakh/yr |

| Global | $50,000–$150,000/yr |

3. ACCA (Association of Chartered Certified Accountants)

Overview:

The ACCA is an international accountancy certification with wide recognition, especially in the UK, EU, and Middle East. It offers a global career with roles in audit, taxation, accountancy, and consulting.

Eligibility:

- 10+2 pass with 65% in English/Math, 50% in other subjects

Fees:

| Component | Cost |

|---|---|

| Registration | £89 (approx. ₹9,000) |

| Annual Subscription | £122/year (approx. ₹12,000) |

| Exam Fee (13 papers) | £98–£120/paper (₹1.15–1.4 lakh total) |

| Coaching | ₹1.2–2 lakh (varies by provider) |

| Total (approx.) | ₹2.5–₹3.5 lakh |

Duration:

- Minimum: 2.5–3 years (13 exams plus Ethics & 3 years experience)

- Flexible & can be pursued alongside graduation

Coaching:

- IMS Proschool

- FinTram Global

- Zell Education

Syllabus:

- Knowledge Level: Business & Technology, Management Accounting, Financial Accounting

- Skills Level: Taxation, Audit & Assurance, Financial Reporting, Corporate Law, Performance Management

- Professional Level: Strategic Business Leadership, Advanced Financial Management, Advanced Audit

Job Opportunities:

- Auditor

- Financial Analyst

- Tax Consultant

- Chartered Accountant (global)

- Finance Manager

Salary Package:

| Level | Salary Range |

|---|---|

| Entry | ₹5–8 lakh/yr |

| Experienced | ₹10–20 lakh/yr |

| International | £30,000–£75,000/yr+ |

4. Financial Modelling

Overview:

The Financial Modelling course builds excel-based analytical skills for those aspiring to work in investment banking, equity research, business analysis, or corporate finance.

Eligibility:

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

- Open to all graduates/final year students (preferred commerce/economics background)

Fees:

- ₹20,000–₹60,000 (course-specific, usually for 3-6 months)

- Online programs (Coursera, EduPristine, NSE Academy, WallStreet School), BSE/NSE Certs

Duration:

- 3–6 months (regular fast-track)

Coaching:

- WallStreet School

- IMS ProSchool

- Corporate Bridge

- NSE Academy

Syllabus:

- Excel proficiency

- Financial Statement Analysis

- Business Valuation

- DCF Modelling

- M&A Modelling

- Case Studies

Job Opportunities:

- Equity Research Analyst

- Investment Banking Associate

- Credit Analyst

- Corporate Finance Analyst

Salary Package:

- ₹4–10 lakh/yr depending on skill

5. B.Com (Bachelor of Commerce)

Overview:

A popular foundational degree for commerce students, B.Com offers a wide perspective on business, finance, accounting, and management.

Eligibility:

- 10+2 with Commerce/Science

Fees:

- ₹10,000–₹1,00,000/year (private/public university)

Duration:

- 3 years (regular)

Coaching:

- Top universities (SRCC, Lady Shri Ram, Christ University, Symbiosis, NMIMS)

Syllabus:

- Financial Accounting

- Business Law

- Corporate Law

- Taxation

- Auditing

- Economics, Business Communication

Job Opportunities:

- Accountant

- Auditor

- Bank jobs

- Tax Consultant

Salary Package:

₹2–6 lakh/yr starting

6. BBA (Bachelor of Business Administration)

Overview:

BBA gives an early start for management careers and is the first step towards an MBA or roles in corporate management.

Eligibility:

- 10+2 with any stream (Commerce preferred)

Fees:

- ₹45,000–₹2,00,000/year (varies by institute)

Duration:

- 3 years

Coaching:

- Christ University, NMIMS, Symbiosis, IIM Indore (IPM)

Syllabus:

- Principles of Management

- Economics

- Accounting

- Business Law

- Communication Skills

- Marketing, HR, Finance

Job Opportunities:

- Management Trainee

- Sales Executive

- Marketing Associate

Salary Package:

₹3–6 lakh/yr starting

7. CA (Chartered Accountant)

Overview:

CA is India’s most respected finance and accounting degree, awarded by ICAI, covering auditing, tax, law, finance, and accounting.

Eligibility:

- 10+2, pass CPT/CA Foundation

Fees:

- Approx. ₹80,000–₹1.5 lakh (overall all stages)

Duration:

- 5–7 years (foundation to final)

Coaching:

- VSI Jaipur, Aldine, JK Shah, Aakash Institute

Syllabus:

- Accounting, Tax, GST, Auditing, Corporate Law, Business Economics

Job Opportunities:

- Auditor, GST Expert, Finance Controller, Tax Consultant

Salary Package:

- ₹6–12 lakh/yr starting

- ₹15–35 lakh/yr senior roles

8. CS (Company Secretary)

Overview:

CS is a premier professional program regulated by ICSI, focused on company law, compliance, and governance.

Eligibility:

- 10+2 (any stream)

Fees:

- ₹30,000–₹60,000 approx.

Duration:

- 3–4 years (Foundation, Executive, Professional levels)

Coaching:

- ICSI Chapters, Top private tutors

Syllabus:

- Corporate Laws, Business Law, Taxation, Securities Law, Company Secretarial Practices

Job Opportunities:

- Compliance Officer, Legal Advisor, Corporate Planner

Salary Package:

- ₹4–8 lakh/yr starting

- ₹12–20 lakh/yr at senior levels

9. Digital Marketing

Overview:

Digital Marketing is a trending field that blends creativity and analytics to promote products/services online.

Eligibility:

- No strict requirement (Class 12 or Graduate)

Fees:

- ₹25,000–₹80,000 (3-6 months course)

Duration:

- 3–6 months

Coaching:

- UpGrad, Digital Vidya, NIIT, Coursera

Syllabus:

- SEO, SEM, Social Media, Email Marketing, Content, Analytics

Job Opportunities:

- Digital Marketing Executive

- Social Media Manager

- SEO Analyst

- PPC Specialist

Salary Package:

- ₹3–8 lakh/yr starting

Quick Comparison Table

| Course | Fees | Duration | Coaching | Syllabus Highlights | Job Opportunities | Salary (INR/year) |

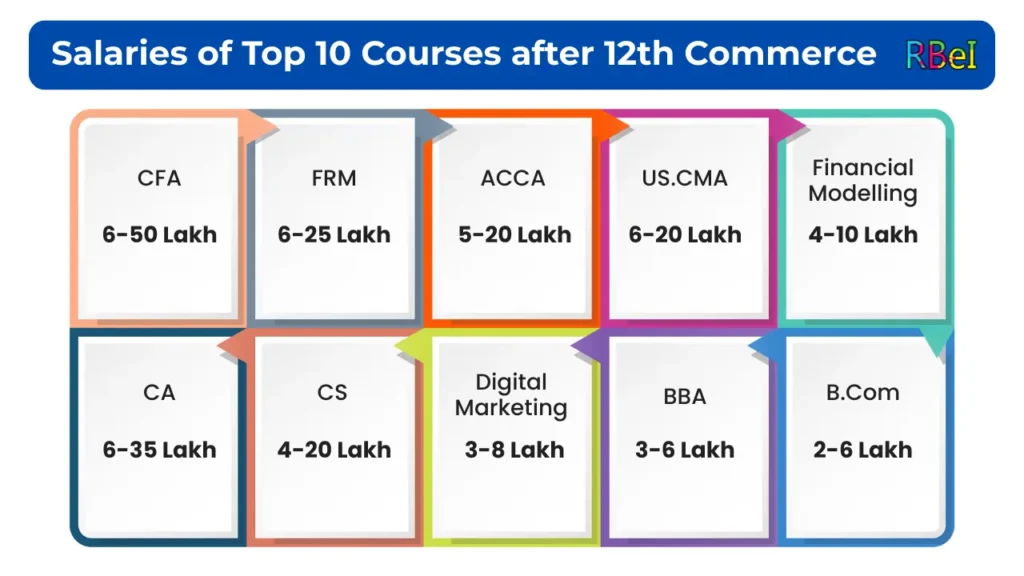

| CFA | ₹3–4 lakh | 2–4 years | RBei Classes, IMS | Finance, Investments, Economics | Analyst, PM, Inv. Banker | 6–50 lakh |

| FRM | ₹1.25–1.75 lakh | 1–2 years | EduPristine, RBei Classes | Risk, Quant, Markets | Risk Analyst, Manager | 6–25 lakh |

| ACCA | ₹2.5–3.5 lakh | 2.5–3 years | IMS, Zell | Audit, Tax, Accountancy | Auditor, Consultant | 5–20 lakh+ |

| Financial Modelling | ₹20–60,000 | 3–6 months | WallStreet School | Excel, Valuation, DCF, M&A | Analyst, IB, Credit Analyst | 4–10 lakh |

| B.Com | ₹10,000–1 lakh/year | 3 years | SRCC, NMIMS | Accounting, Law, Taxes | Accountant, Tax Expert | 2–6 lakh |

| BBA | ₹45,000–2 lakh/year | 3 years | NMIMS, Christ | Mgmt, Marketing, HR | Manager, Sales, Marketing | 3–6 lakh |

| CA | ₹80,000–1.5 lakh | 5–7 years | VSI, JK Shah | Audit, Tax, Law | CA, Audit, Controller | 6–35 lakh |

| CS | ₹30,000–60,000 | 3–4 years | ICSI | Law, Compliance | CS, Compliance Officer | 4–20 lakh |

| Digital Mktg | ₹25,000–80,000 | 3–6 months | UpGrad, Coursera | SEO, Social Media | SEO, Digital Mktg Manager | 3–8 lakh |

Conclusion

Choosing the right course after Class 12th in Commerce depends on your interests, career aspirations, and educational goals. Each of these programs offers unique rewards, challenges, and opportunities, whether you want a specialized professional qualification (like CFA/CA/FRM/ACCA) or wish to build a strong foundation with a broader graduation (like B.Com or BBA).

Read Also: