Table of Contents

ToggleFinancial Modelling Case Studies are one of the most powerful ways to master Practical Financial Modelling. At RBei Classes, known as the best coaching classes for Financial Modelling and Investment Banking course, we believe that theory alone is never enough. Instead, students must dive deep into real-world financial modelling, learn how businesses are valued, and understand how industry professionals apply models such as M&A Models, DCF Models, and Equity Valuation Models in actual scenarios. This blog will walk you through detailed financial modelling case studies, ensuring you not only learn concepts but also apply them practically in your career.

Whether you are preparing for investment banking, equity research, or corporate finance, mastering these practical case studies is a must. Moreover, by the end of this blog, you will clearly understand how to approach real-world financial modelling and why RBei Classes has been trusted by thousands of learners globally.

Why Financial Modelling Case Studies Are Essential

Transitioning from classroom learning to real-world application often feels overwhelming. Many students learn formulas and Excel shortcuts, yet struggle to apply them in live corporate finance situations. That’s where financial modelling case studies bridge the gap.

Case studies replicate real-life corporate transactions, valuation methods, and financial decisions. With them, you:

- Understand how companies are valued.

- Learn to build M&A deal structures.

- Gain insights into forecasting revenues, costs, and profitability.

- Apply DCF Models and Equity Valuation Models in real market scenarios.

- Develop confidence in interpreting and presenting financial results.

In short, practical financial modelling case studies transform you from a learner into a professional who can handle the demands of investment banking and corporate finance.

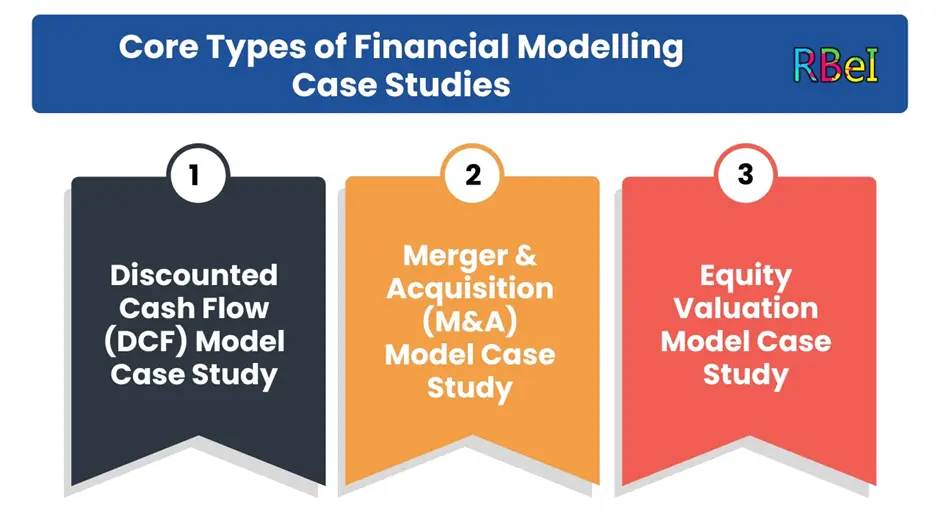

Core Types of Financial Modelling Case Studies

To grasp practical financial modelling, you must be familiar with the main types of models that professionals use. Below are the most impactful models you’ll encounter:

1. Discounted Cash Flow (DCF) Model Case Study

The DCF Model is the backbone of valuation. It helps analysts estimate the intrinsic value of a company by projecting free cash flows and discounting them to the present value.

Case Example:

Imagine valuing Infosys Ltd. Using financial statements, you forecast revenues for the next 5 years, calculate free cash flows, and discount them using the company’s weighted average cost of capital (WACC). By comparing intrinsic value with market price, you decide whether the stock is undervalued or overvalued.

At RBei Classes, we make students solve such DCF case studies step by step, teaching them how to source assumptions, justify projections, and stress-test results.

2. Merger & Acquisition (M&A) Model Case Study

M&A Models are used to evaluate whether combining two companies creates shareholder value.

Case Example:

Consider HDFC Bank’s merger with HDFC Ltd. The model forecasts combined revenues, synergies, integration costs, and accretion/dilution impact on EPS. Analysts compare standalone vs. merged performance to determine if the merger benefits shareholders.

In class, we guide students on:

- Building pro-forma financial statements.

- Identifying cost and revenue synergies.

- Calculating goodwill and purchase price allocation.

- Assessing whether the deal is accretive or dilutive.

This kind of M&A financial modelling case study gives students real investment banking exposure before entering the job market.

3. Equity Valuation Model Case Study

Equity Valuation is at the core of investment banking and equity research. Professionals use multiples such as P/E, EV/EBITDA, and P/B ratios to compare companies.

Case Example:

Suppose you are tasked with valuing Zomato Ltd. You benchmark it against global food delivery companies like DoorDash. Using multiples such as EV/Sales, you estimate Zomato’s fair market value.

Students at RBei Classes not only build the Equity Valuation Model but also prepare investment pitch presentations, mirroring what analysts do in global IB firms.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

Real-World Financial Modelling Case Studies You Must Learn

Let’s now go deeper with industry-specific examples. Each case study highlights how financial modelling is applied practically.

Case Study 1: Valuing a Tech Company Using a DCF Model

- Industry: IT Services

- Company: Infosys Ltd.

- Objective: Identify if Infosys stock is undervalued.

Steps Taken:

- Collected 5 years of financial statements.

- Projected revenues based on IT industry growth and Infosys’ historical performance.

- Estimated operating margins and calculated free cash flows.

- Applied a discount rate of 10% (based on WACC).

- Compared intrinsic value to market capitalization.

Insight: The DCF Model indicated Infosys was trading close to its fair value, reinforcing the reliability of DCF in equity research.

Case Study 2: M&A Deal Between HDFC Bank and HDFC Ltd.

- Industry: Banking & Financial Services

- Objective: Evaluate post-merger synergies.

Steps Taken:

- Built standalone financials for both entities.

- Estimated cost savings (branch overlap reduction, IT integration).

- Forecasted increased lending opportunities due to housing finance portfolio.

- Measured EPS accretion/dilution.

- Evaluated goodwill created post-merger.

Insight: The merger created strong strategic value, showing how M&A models are critical in real decision-making.

Case Study 3: Startup Valuation – Zomato IPO

- Industry: Food Delivery

- Objective: Assess Zomato’s valuation before IPO.

Steps Taken:

- Compared Zomato’s EV/Sales multiple to global peers.

- Adjusted valuation to India’s market dynamics.

- Projected future revenue growth with rising internet penetration.

- Conducted sensitivity analysis on profitability timelines.

Insight: Investors realized Zomato was a growth play rather than a profitability play. This kind of case study trains students to handle startup valuations with confidence.

Case Study 4: Oil & Gas Company Financial Model

- Industry: Energy

- Company: ONGC

- Objective: Forecast production and profitability under fluctuating crude prices.

Steps Taken:

- Projected revenue based on production volume and crude oil prices.

- Incorporated cost structures and exploration expenses.

- Modeled scenarios with different oil price levels.

- Conducted sensitivity and scenario analysis.

Insight: Demonstrated how financial modelling adapts to cyclical industries and why analysts must stress-test assumptions.

Case Study 5: Private Equity LBO Model

- Industry: Retail

- Objective: Evaluate buyout of a retail chain using debt financing.

Steps Taken:

- Structured acquisition financing with equity and debt mix.

- Forecasted cash flows to test debt repayment ability.

- Estimated exit multiple for 5 years.

- Calculated IRR and NPV.

Insight: LBO Models train students to think like private equity investors, focusing on cash flow sufficiency and leverage risks.

Lessons Learned from Financial Modelling Case Studies

Each case study provides unique takeaways:

- DCF teaches intrinsic valuation.

- M&A models show synergy realization.

- Equity Valuation models help in market comparisons.

- LBO models highlight leveraged investment strategies.

- Sector-specific models (oil & gas, startups) show adaptability of financial modelling.

By practicing such cases, students move from textbook learners to professionals ready for investment banking and equity research roles.

How RBei Classes Makes You Industry-Ready

At RBei Classes, we don’t just teach theory. Instead, we focus on hands-on practical financial modelling using case studies from multiple industries. Students work on:

- Real M&A transactions.

- Live IPO valuations.

- Comprehensive equity research reports.

- DCF models of listed companies.

With mentorship from Deepak Goyal Sir (who has guided 10,000+ students globally), learners gain confidence and skills to crack high-paying roles in finance.

Linking Learning – What to Read Next

To strengthen your foundation, explore our related blogs:

- What is Financial Modelling? A Beginner’s Guide

- What is Investment Banking? Complete Overview

- Explore Our Financial Modelling & Investment Banking Course

Final Thoughts

Mastering financial modelling case studies is not just about solving Excel sheets. It is about thinking like an analyst, forecasting like a strategist, and presenting like an investment banker. When you learn through practical financial modelling at RBei Classes, you gain the confidence to evaluate companies, mergers, IPOs, and industry scenarios just like top Wall Street and Dalal Street professionals.

If you are serious about your finance career, start learning with real-world financial modelling examples today. Enroll with the best coaching classes for Financial Modelling and Investment Banking course – RBei Classes – and take the first step toward building a successful career.

What are Financial Modelling Case Studies and why are they important?

Answer: Financial Modelling Case Studies are real-world applications of financial models used to analyze companies, mergers, IPOs, or investment opportunities. Instead of just learning formulas, students apply concepts like DCF Model, M&A Model, and Equity Valuation Model to actual company data.

They are important because:

- They replicate how analysts work in investment banks and consulting firms.

- They bridge the gap between theory and practice.

- They help students learn problem-solving in real financial scenarios.

- They make you job-ready by preparing you to handle client projects, pitchbooks, and valuation reports.

Without case studies, financial modelling is incomplete. At RBei Classes, students work on Infosys DCF valuation, HDFC-HDFC Merger model, and Zomato IPO case study to build practical expertise.

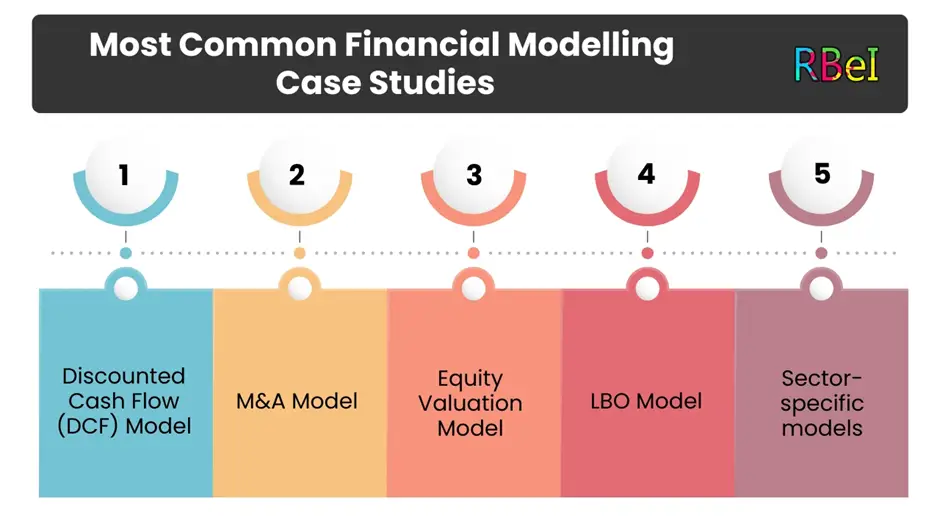

What are the most common Financial Modelling Case Studies I should focus on?

Answer: Some of the most relevant and frequently used financial modelling case studies include:

- Discounted Cash Flow (DCF) Model – Valuing listed companies like Infosys or Reliance.

- M&A Model – Assessing post-merger synergies (e.g., HDFC Bank and HDFC Ltd. merger).

- Equity Valuation Model – Comparing multiples for IPO-bound firms (e.g., Zomato IPO).

- LBO Model – Leveraged buyouts for private equity deals.

- Sector-specific models – Such as oil & gas projections, e-commerce startup growth, or banking stress test models.

Focusing on these ensures you cover the core financial decision-making areas across industries.

How do Financial Modelling Case Studies help in investment banking careers?

Answer: Financial Modelling Case Studies are the backbone of investment banking interviews and job roles. Here’s why:

- In M&A advisory, you need to analyze deal structures and synergies using M&A models.

- In Equity Research, you forecast earnings and build DCF or comparable-based valuation models.

- In Private Equity, you structure buyouts through LBO models and calculate IRRs.

- In Capital Markets, IPO valuations are built using case studies on recent market listings.

Recruiters often ask candidates to solve case studies in Excel during interviews. By practicing with RBei Classes, you can confidently answer technical and practical questions in investment banking roles.

What is the difference between learning theory and solving Financial Modelling Case Studies?

Answer: Learning theory is like knowing the formula for free cash flows or understanding what WACC means. However, when you solve Financial Modelling Case Studies, you go much deeper:

- You apply formulas to real company financial statements.

- You make assumptions about growth, costs, and market conditions.

- You conduct scenario and sensitivity analysis to test risks.

- You prepare professional presentations and reports, just like analysts in IB firms.

In short:

- Theory = Knowing the concepts.

- Case Studies = Applying concepts in real business problems.

That’s why recruiters and corporates prefer candidates who have solved live case studies during their learning

Can beginners handle Financial Modelling Case Studies or are they only for advanced learners?

Answer: Yes, beginners can absolutely handle financial modelling case studies if they start with the right approach. At first, case studies may seem complex because they involve data gathering, assumptions, and forecasting. However, with structured guidance, even a beginner can progress step by step.

For example, at RBei Classes, beginners start with:

- Basic DCF case studies (valuing a simple company).

- Move to comparables and equity valuation models.

- Then, progress to M&A and LBO case studies.

By gradually increasing the complexity, students build confidence and eventually master real-world financial modelling. So, you don’t need to be advanced — you just need the right coaching and practice.