Table of Contents

ToggleIntroduction

When students think about high-paying careers in finance, two popular terms often come up: Investment Banking vs Financial Modelling. While both are interconnected, they are not the same. Many aspirants confuse them, assuming financial modelling is a career path, but in reality, it is a core skill used in investment banking and other finance jobs.

In this blog, we will clearly explain Financial Modelling vs Investment Banking, compare job roles, career scope, and salary differences, and help you decide whether an Investment Banking Course vs Financial Modelling Course is better for your career. By the end, you will know exactly what suits your aspirations, and how RBei Classes can guide you in mastering both.

Understanding Investment Banking vs Financial Modelling

What is Investment Banking?

Investment Banking is a career path where professionals help companies raise capital, advise on mergers and acquisitions (M&A), manage IPOs, and handle large-scale financial transactions. An investment banker acts as a bridge between companies and investors.

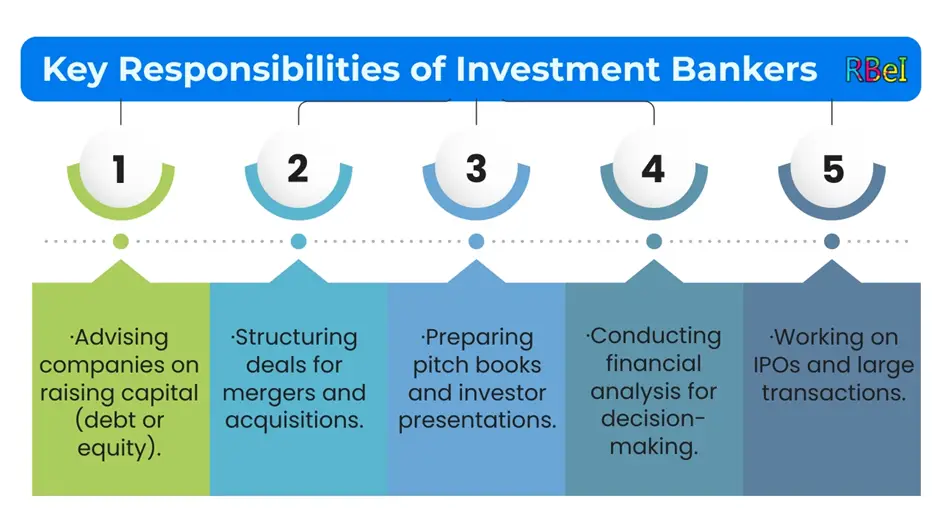

Key responsibilities of investment bankers:

- Advising companies on raising capital (debt or equity).

- Structuring deals for mergers and acquisitions.

- Preparing pitch books and investor presentations.

- Conducting financial analysis for decision-making.

- Working on IPOs and large transactions.

For a detailed beginner’s guide, check our blog: What is Investment Banking? Everything You Need to Know

What is Financial Modelling?

Financial Modelling, on the other hand, is not a career path but a practical skill. It involves building models in Excel to project a company’s financial performance, value businesses, and analyze investments.

Key uses of financial modelling:

- Creating a company’s projected financial statements.

- Building DCF models, LBO models, and M&A models.

- Conducting valuation for equity research and investment banking.

- Supporting decision-making for investors and management.

Related read: Financial Modelling vs CFA: Which is Better for Your Career?

Investment Banking vs Financial Modelling – Key Differences

Investment Banking is a Career, Financial Modelling is a Skill

- Investment Banking = Job Role (career path).

- Financial Modelling = Technical Skill used by investment bankers, equity analysts, corporate finance teams, and consultants.

Scope and Career Path

- Investment Banking → Offers roles like Analyst, Associate, VP, Director, and Managing Director in top banks.

- Financial Modelling → Used in multiple careers: investment banking, private equity, venture capital, equity research, corporate finance, and consulting.

Salary Comparison – Investment Banking vs Financial Modelling

One of the most asked questions is about salary comparison.

Investment Banking Careers:

| Role | Salary Range (INR LPA) |

|---|---|

| Analyst | ₹8 – ₹15 LPA |

| Associate | ₹15 – ₹30 LPA |

| VP | ₹35 – ₹60 LPA |

| Director/MD | ₹100 LPA – ₹1 Cr+ |

Financial Modelling Careers (as supporting skill):

| Role | Salary Range (INR LPA) |

|---|---|

| Equity Research Analyst | ₹6 – ₹12 LPA |

| Corporate Finance Analyst | ₹7 – ₹14 LPA |

| Private Equity Associate | ₹12 – ₹25 LPA |

| Valuation Consultant | ₹8 – ₹15 LPA |

Clearly, Investment Banking offers higher salaries due to the intensity of work, client exposure, and deal-making responsibilities. However, Financial Modelling is the entry gate that gives you the technical expertise needed to crack those jobs.

Investment Banking Course vs Financial Modelling Course

What You Learn in an Investment Banking Course

- Mergers & Acquisitions (M&A) process.

- IPO process and fundraising.

- Deal structuring and advisory.

- Pitch book preparation.

- Soft skills: Negotiation, communication, client management.

What You Learn in a Financial Modelling Course

- Excel mastery for finance.

- Building 3-statement models (P&L, Balance Sheet, Cash Flow).

- Valuation methods: DCF, Comparables, Precedent Transactions.

- M&A and LBO models.

- Data analysis for financial decision-making.

In simple terms:

- Investment Banking Course = Big-picture + client-facing roles.

- Financial Modelling Course = Core technical foundation.

Both are complementary. That’s why RBei Classes offers an integrated Financial Modelling and Investment Banking course—so students gain both technical skills and real-world deal understanding.

Opportunities in Financial Modelling vs. Investment Banking

Career Scope in Investment Banking

- Work at global banks like JP Morgan, Goldman Sachs, Morgan Stanley.

- Work at Indian IB firms like Avendus Capital, ICICI Securities, Kotak IB.

- Roles: Analyst → Associate → VP → Director.

Career Scope with Financial Modelling

- Equity Research.

- Corporate Finance (Big4 firms like EY, Deloitte, PwC, KPMG).

- Private Equity & Venture Capital.

- Valuation and Consulting.

Financial Modelling gives you flexibility across multiple industries, while Investment Banking is a specialized path with very high rewards but demanding work hours.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

Salary Comparison – Which One Pays Better?

Investment Banking Salaries are among the highest in the finance industry due to deal-making exposure and client interaction. Entry-level analysts start at ₹10–15 LPA and can reach ₹1 Cr+ at senior levels.

Financial Modelling Salaries vary depending on the role. Equity research or valuation analysts earn ₹6–12 LPA initially. However, if combined with IB roles, salaries can match investment banking levels.

Conclusion: If you want faster salary growth, investment banking is the way. But if you want stability + multiple career options, financial modelling is your safety net.

Which is Better – Financial Modelling vs Investment Banking?

It depends on your goals:

- Choose Investment Banking if you want client-facing roles, high salaries, and don’t mind long hours.

- Choose Financial Modelling if you want a versatile technical skillset that opens doors to multiple careers.

Ideally, you should learn Financial Modelling first, then pursue Investment Banking, because financial modelling is the backbone of all IB work.

Why RBei Classes is the Best Coaching Institute for Both

At RBei Classes, we combine the best of both worlds:

- Job-oriented Financial Modelling Course to build strong technical skills.

- Practical Investment Banking Course to give students real-world exposure.

- Industry-focused training with live case studies, DCF models, M&A deal practice, and pitch book preparation.

- 1-on-1 mentorship to crack IB interviews and placements.

That’s why students call RBei Classes the best coaching institute for Investment Banking and Financial Modelling courses in India.

Final Take – Investment Banking vs Financial Modelling

- Investment Banking = Career path.

- Financial Modelling = Skill needed across finance roles.

- Investment Banking Salaries > Financial Modelling Salaries (but FM gives flexibility).

- Both are complementary, not competing.

If you are a beginner, start with a Financial Modelling course to build your technical foundation. Then, move towards Investment Banking courses for a complete career roadmap.

Explore our Financial Modelling and Investment Banking Course today and take your first step towards a successful finance career.

FAQs on Investment Banking vs Financial Modelling

1. Is financial modelling the same as investment banking?

No, financial modelling and investment banking are not the same.

- Investment Banking is a career path where professionals advise companies on raising capital, mergers & acquisitions, IPOs, and large financial deals.

- Financial Modelling is a technical skill that involves building Excel models to project financial performance, value companies, and support decision-making.

In short, investment banking is a job role, while financial modelling is a skillset that investment bankers (and many other finance professionals) use in their work.

2. Which is better for career growth: Investment Banking or Financial Modelling?

It depends on your career goals.

- Investment Banking offers faster salary growth, international exposure, and prestigious job titles. However, it comes with long working hours and high stress.

- Financial Modelling gives you flexibility. You can work in equity research, corporate finance, consulting, private equity, or venture capital. While initial salaries may be slightly lower than investment banking, the career paths are more diverse and stable.

Ideally, learning financial modelling first gives you the foundation to grow in investment banking later.

3. What is the salary difference between investment banking and financial modelling in India?

- Investment Banking Salaries in India:

- Analyst: ₹8–15 LPA

- Associate: ₹15–30 LPA

- VP: ₹35–60 LPA

- MD/Director: ₹1 Cr+

- Financial Modelling-Driven Careers (Equity research, corporate finance, valuations):

- Analyst: ₹6–12 LPA

- Associate: ₹12–20 LPA

- Senior roles: ₹25–40 LPA

Conclusion: Investment Banking salaries are higher, especially at senior levels. However, financial modelling salaries vary widely depending on the industry and role.

4. Should I do an Investment Banking Course or Financial Modelling Course first?

If you are a beginner, it is recommended to start with a Financial Modelling Course first because:

- It builds your technical foundation (valuations, Excel, projections).

- These skills are required in every finance role, not just investment banking.

- It helps you prepare for interviews in equity research, corporate finance, and IB analyst roles.

After mastering financial modelling, you can pursue an Investment Banking Course to learn deal-making, M&A structuring, IPO processes, and client management.

At RBei Classes, we offer a combined Financial Modelling and Investment Banking course that prepares students for both technical and practical aspects.

5. Can I get a job in investment banking if I only know financial modelling?

Yes, but only up to a point. Knowing financial modelling alone can help you land entry-level roles like:

- Equity Research Analyst

- Valuation Analyst

- Corporate Finance Analyst

However, to move into core investment banking roles, you also need:

- Knowledge of M&A and IPO processes.

- Strong presentation & communication skills.

- Networking and industry connections.

- Possibly an MBA or CA/CFA background.

In short, financial modelling is the entry ticket, but investment banking requires a bigger toolkit of technical + soft skills.

Student Reviews for RBei Classes – Financial Modelling & Investment Banking Course

1. Rohit Sharma – Working Professional, Mumbai (JP Morgan India)

“I joined RBei Classes while working as an analyst at JP Morgan in Mumbai. The lectures were highly structured, and Deepak Sir’s focus on practical exposure made a huge difference. The doubt-solving sessions were prompt, and the placement support team even helped me prepare for interviews internally. I could immediately apply the concepts of valuation and modelling in my job.”

2. Sneha Iyer – College Student, Bengaluru (Christ University)

“As a final-year B.Com student at Christ University, I was looking for a career in investment banking. The step-by-step teaching style at RBei Classes made difficult concepts like LBO and DCF very easy to understand. The mock interviews and placement guidance gave me confidence, and the faculty’s personal mentorship stood out. Best decision for my career!”

3. Amit Verma – Working Professional, Delhi (EY – Ernst & Young)

“I work at EY Delhi, and I can confidently say this course gave me an edge over my colleagues. The live case studies on M&A and IPO structuring were extremely useful. The placement team’s resume workshops and LinkedIn guidance were game changers. Highly recommend RBei Classes for professionals wanting to upskill in finance.”

4. Riya Mehta – College Student, Ahmedabad (IIM Ahmedabad – MBA Student)

“I was pursuing MBA at IIM Ahmedabad when I enrolled in RBei Classes. The course was very practically oriented, with assignments that felt like actual IB projects. The faculty’s industry knowledge was outstanding, and I especially liked the one-on-one doubt solving. It helped me secure my summer internship in corporate finance.”

5. Arjun Nair – Working Professional, Kochi (Federal Bank)

“I was working in Federal Bank’s credit team in Kochi. The course gave me the investment banking perspective that I was missing. I loved how the lectures balanced theory and real-world application. Placement support was excellent, and I even got interview opportunities at boutique IB firms in Mumbai. Truly worth every penny.”

6. Priya Kapoor – College Student, Delhi (SRCC – Shri Ram College of Commerce)

“Being a finance student at SRCC, Delhi, I always wanted to specialize in financial modelling. RBei Classes gave me the perfect mix of classroom learning and real case studies. The Excel-based modelling exercises were the highlight. Faculty always encouraged us to ask questions, and the doubt-solving sessions were quick and detailed.”

7. Siddharth Jain – Working Professional, Gurugram (KPMG India)

“At KPMG Gurugram, financial modelling is a day-to-day requirement. This course from RBei Classes helped me refine my technical skills to the next level. The focus on practical assignments and industry tools gave me confidence in client projects. Also, the faculty’s constant career guidance and mentorship were priceless.”

8. Ananya Rao – College Student, Hyderabad (Osmania University)

“I was from a non-IIT, non-IIM background (Osmania University), and I wanted to build a career in IB. RBei Classes really helped bridge the gap. The lectures were interactive, placement support was very personalized, and Deepak Sir constantly motivated us. I now feel well-prepared to target top firms.”

9. Karan Malhotra – Working Professional, Pune (Cognizant – Finance Division)

“Coming from an IT-finance background at Cognizant, Pune, I was hesitant about switching to investment banking. The course gave me clarity, confidence, and skills like advanced Excel, DCF modelling, and pitchbook preparation. The mock interviews and doubt-solving sessions gave me the confidence to target IB analyst roles. Strongly recommend to anyone planning a career transition.”

10. Simran Kaur – College Student, Chandigarh (Punjab University)

“As a BBA student at Punjab University, I didn’t have much exposure to advanced finance. This course made everything crystal clear. The faculty explained every concept with real-world examples, and the practical exposure to models was unmatched. Placement guidance and career counselling sessions gave me direction about what roles I should apply for.”