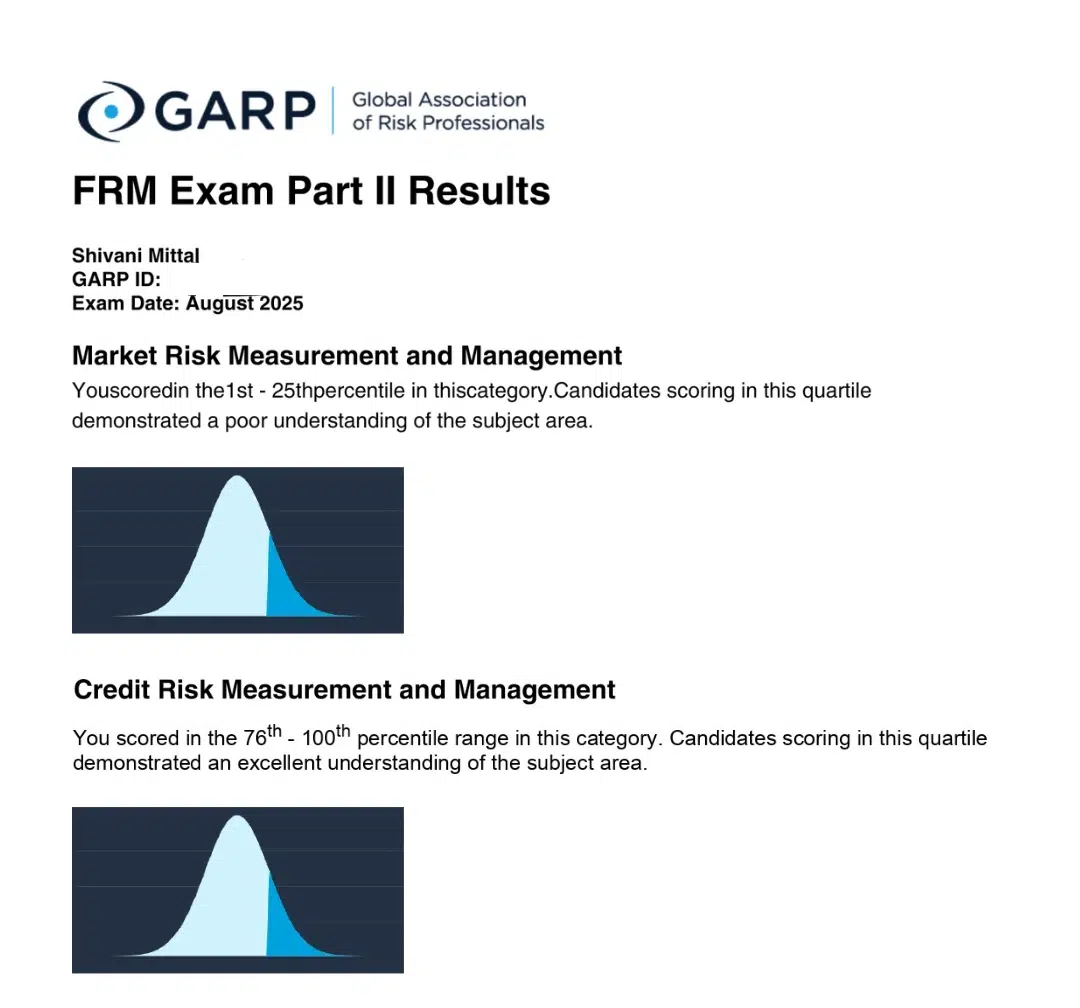

When I started preparing for the FRM Part 2 exam, I had absolutely zero knowledge of finance. Coming from an engineering background and working full-time at JP Morgan in Kolkata, the thought of attempting a globally recognized exam like the FRM (Financial Risk Manager) seemed impossible. However, with determination, proper guidance, and the right mentorship, I cleared my FRM Part 2 in August 2025 on the very first attempt, securing top quartiles in all subjects.

Table of Contents

ToggleWhat made this journey even more special is that I managed everything while working a full-time job, studying just 5–6 hours daily for four months. The biggest factor behind my success was choosing RBei Classes, the best FRM coaching for working professionals in India, guided by the incredible mentorship of Deepak Goyal Sir.

In this blog, I want to share my complete journey — why I chose FRM, how I managed studies with a full-time job, why I trusted RBei Classes, and how they helped me crack FRM Part 2 in one go.

Why I Chose FRM While Working in JP Morgan?

Being an engineer, I never thought my career would take me into finance. However, while working at JP Morgan, I explored the world of risk management, derivatives, and global financial markets. I realized that to grow in the banking and finance domain, I needed a strong credential that could validate my expertise. That’s when I came across the FRM certification.

I was inspired by three main reasons:

- FRM is globally recognized – It is considered the gold standard in risk management.

- Career growth in banking and finance – I saw many of my seniors with FRM moving into leadership roles.

- Future-proof skillset – Risk management is becoming increasingly important with global market volatility, climate risks, and cyber risks.

However, my biggest challenge was my background — I had zero knowledge of finance or accounting. The thought of learning everything from scratch while handling a demanding job was overwhelming.

Why I Chose RBei Classes for FRM Coaching?

When I started researching for FRM coaching institutes in India, I came across many options. But after interacting with a few students and attending demo sessions, I realized that RBei Classes was different.

Here’s why I chose them:

- Highest pass rates in FRM in India – Their track record is unmatched.

- Specialized for working professionals – Their teaching style suits people like me who have limited time.

- Personal mentorship by Deepak Goyal Sir – Unlike many coaching institutes where you never get to interact with the main faculty, here Deepak Sir is always available for doubts and guidance.

- Structured and easy-to-understand lectures – They teach from the very basics, which was crucial for someone like me with no finance background.

- Comprehensive preparation material – Their notes, question banks, and mock tests were sufficient. I didn’t need to look for anything else.

On 25th April 2025, I joined RBei Classes and started my preparation. Looking back, it was the best decision I made for my FRM journey.

How I Managed FRM Preparation with a Full-Time Job?

Balancing work at JP Morgan and studying for FRM Part 2 was not easy. My typical day was packed, but I created a disciplined routine:

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

- Daily study hours: 5–6 hours (early mornings + evenings after work).

- Weekly planning: Every Sunday, I created a study timetable based on RBei’s guidance.

- Topic-wise approach: I focused on completing one topic thoroughly before moving to the next.

- Active revision: I revised previous concepts daily so that nothing slipped away.

- Mock tests: I took full-length mock exams to build speed and accuracy.

Transitioning from engineering to finance was tough initially. Concepts like credit risk, operational risk, and derivatives valuation felt like a completely new language. However, RBei Classes simplified everything. Deepak Sir has a unique way of explaining even the most complex topics in simple words, often using real-world examples from banking.

The Role of RBei Classes in My Success

Honestly, I wouldn’t have cleared FRM Part 2 without RBei Classes. Here’s how they helped me crack the exam in one go:

1. Simplified Learning for Non-Finance Background

Coming from engineering, finance felt alien to me. But RBei made it approachable. They taught from the very basics, ensuring I understood the “why” behind every concept.

2. Mentorship of Deepak Goyal Sir

The biggest differentiator of RBei is the personal mentorship by Deepak Sir. He was always available to clear doubts — whether it was a small concept or an exam strategy. His constant motivation kept me going during tough days.

3. Comprehensive Study Material

I didn’t waste time looking for multiple resources. Their lectures, notes, and practice questions were more than enough. Each topic was explained with clarity, and the mock exams were very close to the actual exam.

4. Flexible Learning for Working Professionals

The classes were structured keeping in mind the challenges of working professionals. The recorded lectures gave me flexibility, while live sessions helped me stay connected and disciplined.

5. Highest Pass Rates in India

Knowing that RBei has the highest FRM pass rates in India gave me the confidence that I was in the right place.

Benefits of Clearing FRM for My Career in Banking

After passing FRM Part 2, I realized how much this certification has added to my professional profile. Some key benefits I experienced include:

- Global recognition – FRM is valued across top banks, consulting firms, and financial institutions worldwide.

- Stronger career prospects – Within JP Morgan itself, I have seen my career opportunities expand.

- Deeper understanding of risk management – From market risk to operational risk, I now understand real-world challenges in banking more deeply.

- Networking opportunities – FRM connects you with a global community of risk professionals.

- Long-term growth – With FRM, I know I have a solid foundation for future leadership roles in finance.

My FRM Part 2 Exam Day Experience

On the day of the exam in August 2025, I felt confident. The preparation strategy from RBei had already exposed me to all types of questions. Even though FRM Part 2 is challenging, the exam felt manageable because of the conceptual clarity I gained during preparation.

When the results came out, I felt overjoyed to secure top quartiles in all subjects. That moment made me realize the power of consistent hard work and the right mentorship.

Final Thoughts: Why RBei Classes Are the Best FRM Coaching in India

If you are a working professional like me and dream of clearing the FRM exam, I cannot recommend RBei Classes enough. They are truly the best FRM coaching for working professionals in India.

- They don’t just teach; they mentor.

- They don’t just provide content; they provide strategy.

- They don’t just prepare you for the exam; they prepare you for a successful career in finance.

To any student who is from a non-finance background, trust me — if I could do it, so can you. With the guidance of Deepak Goyal Sir and the structured approach of RBei Classes, even the toughest exam like FRM Part 2 becomes achievable.

Key Takeaways from My Journey

- Discipline matters more than background – Even with zero knowledge of finance, you can succeed with consistent effort.

- Right coaching is a game changer – RBei Classes made the impossible possible for me.

- Work-life-study balance is tough but achievable – With proper planning, working professionals can crack FRM in the first attempt.

- Mentorship is priceless – Having a mentor like Deepak Sir can transform your journey.

FAQs on FRM, Opportunities, and Coaching

1. What is the FRM exam and why is it important for a career in finance?

The FRM (Financial Risk Manager) exam is a globally recognized certification offered by GARP (Global Association of Risk Professionals). It focuses on areas such as market risk, credit risk, operational risk, liquidity risk, and investment management. FRM is important because it validates your expertise in risk management and financial analysis, which are highly valued skills in banks, hedge funds, consulting firms, and regulatory bodies. For professionals working in finance, especially in risk or treasury roles, FRM gives a clear competitive edge and opens doors to international opportunities.

2. What are the career opportunities after completing FRM?

After clearing FRM, professionals can explore a wide range of high-paying career opportunities across banking, consulting, and financial services. Popular roles include:

- Risk Analyst / Risk Manager in top banks like JP Morgan, Goldman Sachs, HSBC.

- Credit Risk Specialist in credit rating agencies and NBFCs.

- Market Risk Professional in investment banking and trading desks.

- Consulting and Advisory Roles in Big 4 firms like Deloitte, PwC, KPMG, EY.

- Portfolio and Investment Management in asset management companies.

Additionally, FRM professionals often move into leadership roles in risk management, given the rising demand for experts who can handle global financial challenges.

3. Which is the best FRM coaching for working professionals in India?

For working professionals, RBei Classes stand out as the best FRM coaching in India. They consistently achieve the highest FRM pass rates and follow a student-friendly learning approach. The biggest advantage is the personal mentorship from Deepak Goyal Sir, who explains every concept from scratch and simplifies even the toughest topics. Their structured study plan, detailed notes, practice exams, and doubt-solving sessions help students balance a full-time job with FRM preparation. With this support, many students, including me, cleared FRM in the first attempt with top quartiles.

4. Can FRM be done along with other courses like CFA or MBA?

Yes, many professionals pursue FRM along with CFA or MBA depending on their career goals.

- FRM + CFA: Ideal for those who want to specialize in investment banking, asset management, and risk management. CFA focuses on investment analysis, while FRM focuses on risk — together, they provide a powerful combination.

- FRM + MBA: Perfect for professionals who want both business leadership and technical finance expertise. While MBA builds management skills, FRM builds subject matter expertise in risk.

For working professionals, it is recommended to start with FRM, as it can be completed faster (Part 1 and Part 2) and adds significant value in banking and finance jobs.

5. Is FRM worth it for non-finance background students like engineers?

Absolutely yes! FRM allows students from engineering, science, or non-commerce backgrounds to pursue it successfully. While the initial learning curve may seem steep, with the right coaching and structured preparation, it becomes very manageable. Many engineers have transitioned into high-paying finance roles after completing FRM.

In my personal journey, I started with zero knowledge of finance, but under the guidance of RBei Classes and Deepak Goyal Sir, I built strong fundamentals and cleared FRM Part 2 in my first attempt. FRM not only bridges the knowledge gap but also opens doors to global banking and financial careers for non-finance graduates.