In short: digital banking is changing everything about how we save, spend, borrow, and manage money. Indeed, digital banking is reshaping payments, lending, customer experience, and financial inclusion — and, importantly, digital banking brings new risks alongside new conveniences. In this article we will explain how digital banking is transforming finance, why it matters, what concrete benefits it delivers, and what risks (cybersecurity, privacy, operational, regulatory and systemic) you must watch out for. Moreover, we’ll give practical guidance for students and early-career professionals who want to understand or work in the digital banking space. Above all, this long-form guide is actionable and evidence-based — and it repeats the phrase digital banking where it matters so search engines and readers both get the signal.

Table of Contents

ToggleHow Digital Banking Is Transforming Finance (and What Risks Come With It)

What we mean by “digital banking” — a short definition

First, define terms. Put simply, digital banking means delivering banking services primarily through digital channels (mobile apps, web portals, APIs, digital wallets, and automated back-end systems) rather than in-branch, paper-based processes. Consequently, digital banking includes:

- Mobile and online account access, payments, and transfers;

- Digital-first banks (nonbanks) and fintech challengers;

- Embedded finance (banking services integrated into non-bank apps);

- Open banking and API-based data sharing; and

- Automation, AI-driven personalization, and cloud-native infrastructure.

Hence, when we talk about how digital banking is transforming finance, we mean shifts in customer behaviour, business models, risk management and regulation driven by these technologies and platforms.

Why digital banking matters — quick facts and evidence

To understand the scale, consider these high-impact facts:

- Globally, account ownership and digitally enabled accounts have surged; around 79% of adults now have a formal account, and mobile/digital channels are a major driver of inclusion and usage growth.

- Digital banking adoption continues to climb rapidly in advanced and emerging markets alike; for example, in the U.S. and many other markets, the majority of adults now use digital banking regularly.

- The neobank and digital-bank market continue to expand fast: market reports show rapid valuation and market-size growth for neobanks in recent years.

- At the same time, cybersecurity and fraud risks are rising as digital adoption increases: global and national reports indicate growing cyber-enabled fraud, phishing, and domain-based attacks on banks and customers.

Those facts tell a simple story: digital banking is already big, it’s getting bigger, and its growth changes both opportunities and exposures for banks, customers, and regulators.

How digital banking is transforming finance — the key areas

Below, we explore the most important ways digital banking is changing finance. For each area, we explain the transformation, give practical examples, and show why it matters.

1) Payments: speed, convenience, and the end of cash friction

First, digital banking has accelerated the shift away from cash and toward instant, low-cost electronic payments. Mobile wallets, UPI-style rails (in some countries), real-time payments (RTGS/RT-N), and card tokenization make value transfer immediate and frictionless. As a result:

- Individuals pay and receive money instantly (peer-to-peer, payrolls, merchant payments).

- Businesses accept payments via embedded flows in apps and marketplaces.

- Cross-border payments are being reimagined through better UX, APIs, and specialized rails.

Ultimately, this reduces friction and transaction costs, increases transaction velocity, and enables new business models such as gig payments, micropayments, and subscription services.

2) Lending and credit underwriting: data + automation = faster decisions

Second, digital banking transforms lending by using alternative data, automated underwriting, and instant decision engines. Consequently:

- Lenders can evaluate credit risk using digital footprints, transaction history, and AI models rather than relying solely on traditional credit bureaus.

- Online and app-based lending platforms can deliver approvals in minutes for small loans, BNPL products, or merchant financing.

- Risk-based pricing and microcredit models become viable for previously underserved segments.

Therefore, credit becomes more accessible — but it also raises questions about model fairness, explainability, and potential over-indebtedness.

3) Financial inclusion: reaching the unbanked and underbanked

Third, digital banking reduces physical barriers to access. Mobile money and digitally enabled accounts have materially increased financial inclusion worldwide. Digital identity, simplified KYC, and agent networks help onboard customers who would otherwise face distance or cost barriers. Consequently, small businesses and low-income households gain access to savings, credit, and payments that were previously unavailable. The World Bank’s Global Findex highlights how digitally enabled accounts are transforming financial behaviour globally.

4) New players & business models: neobanks, fintechs, and embedded finance

Fourth, the market structure is changing. Fintech startups and neobanks provide native mobile experiences, targeted products, and low overhead. Moreover, non-bank firms embed financial services directly inside apps (ride-hailing, payroll platforms, e-commerce). As a result:

- Product innovation accelerates (micro-savings, goal-based accounts, instant lending, subscription features).

- Competition intensifies, pressuring incumbents to digitally transform or partner with fintechs.

- New ecosystems form around platform businesses that integrate banking features natively.

This trend has made the financial services landscape more dynamic — but it also complicates supervision, responsibility, and consumer protection.

5) Data, personalization & experience: AI-driven banking

Fifth, banks now use data, AI, and machine learning to personalize offers, detect fraud, automate service, and boost efficiency. Chatbots, robo-advisors, spending insights, and predictive alerts improve customer experience and operational productivity. Yet, increased reliance on models introduces model risk, bias, and transparency concerns.

6) Cost structure & scale: cloud, automation, and cheaper distribution

Sixth, digital distribution plus cloud infrastructure allows banks to scale without the same physical branch costs. As a consequence:

- Unit costs of customer acquisition and servicing can fall for digital native banks.

- Pricing competition intensifies, and incumbents must invest in modernization to remain competitive.

- Lower operational costs may enable new pricing models (freemium, subscription banking).

However, migrating legacy systems to cloud-based architectures is complex and introduces its own operational risks.

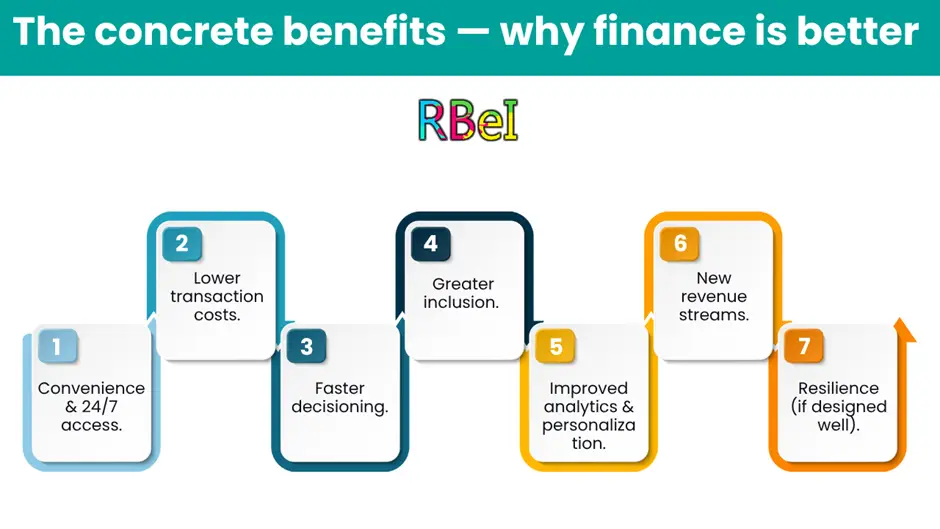

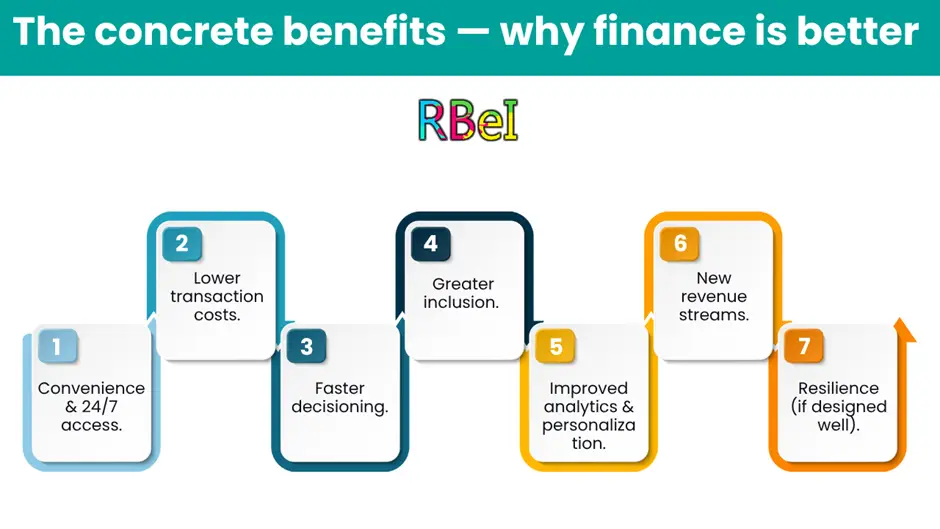

The concrete benefits — why finance is better (in many ways)

Now, let’s list the tangible benefits digital banking delivers to customers, firms, and economies.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

Clearly, the upside is substantial — which is why banks, regulators, and governments are investing heavily in digitalization.

The risks of digital banking — what to watch for

Yet, for all its virtues, digital banking carries important risks. Below we unpack the most critical ones: cybersecurity, privacy, operational concentration, model risk, regulatory gaps, financial crime, and systemic considerations.

1) Cybersecurity & fraud (the most visible short-term risk)

Digital channels increase the attack surface. Phishing, account takeover, ransomware, API abuse, and look-alike domain attacks are all increasing threats. Indeed, global cybersecurity reports show rising cyber-enabled fraud and that firms consider cyber risk a top concern.

Implications:

- Financial loss for banks and customers; reputational damage; regulatory penalties.

- Need for stronger authentication (multi-factor), anomaly detection, and proactive domain monitoring.

- Increased cost of cyber insurance and incident response.

Practical mitigation: layered security, customer education, rapid response playbooks, and continuous threat intelligence.

2) Data privacy and misuse of personal data

Digital banking collects huge amounts of personal and behavioral data. Misusing or mishandling this data — whether through a breach or through opaque monetization — damages trust and violates regulation (GDPR, data-protection rules, etc.). Therefore:

- Banks must implement strict data governance, encryption, consent mechanisms, and explainable data uses.

- Open banking and API sharing increase data flows; consequently, consent and liability frameworks are crucial.

3) Operational risk & cloud dependency

Moving to cloud and API architectures centralizes operations and dependencies. While cloud offers scalability, it also means outages, misconfigurations, or third-party failures can have broad impacts. Hence:

- Banks must manage third-party risk, SLAs, and redundancy.

- Regulatory bodies expect resilience planning and third-party oversight.

4) Model risk, bias, and lack of explainability

AI/ML models power personalization and credit decisions but can embed bias or produce non-intuitive outcomes. Model failures can lead to discriminatory lending, regulatory scrutiny, or unexpected losses. Therefore:

- Banks need governance around model development, testing, explainability, and monitoring.

- Regulators increasingly require auditability and fairness checks.

5) Financial crime and compliance scaling challenges

As digital banks scale fast, anti-money-laundering (AML) and Know Your Customer (KYC) processes must scale too. New account volumes can outpace firms’ AML controls, creating regulatory and legal risk. Indeed, some regulators have called out rising digital payments fraud and urged stronger measures.

6) Concentration risk & systemic implications

If many banks rely on the same cloud providers, Software-as-a-Service (SaaS) vendors, or third-party services, a single outage can affect wide swaths of the financial system. Regulators now pay close attention to concentration risk and third-party dependencies.

7) Consumer protection & over-extension (behavioral risks)

Faster credit (BNPL, instant loans) can lead to over-borrowing. Without proper safeguards — affordability checks, clear disclosures — consumers can accumulate unsustainable debts. Regulators are increasingly focused on BNPL and new credit products.

Regulatory responses & the evolving rule-book

Regulators are adapting to digital banking’s reality. Key themes include:

- Open banking / API rules. Jurisdictions differ, but many encourage data portability and competition via open APIs, while emphasizing consent and security.

- Cloud and third-party oversight. Authorities demand stronger vendor risk management, contingency plans, and incident reporting.

- Cyber incident reporting and resilience frameworks. Regions are introducing mandatory cyber incident disclosures and resilience testing.

- Consumer protection for digital credit and BNPL. Increased scrutiny on disclosures and affordability assessments is emerging.

- Domain and identity protections. Some regulators (e.g., India’s RBI) are taking steps to protect consumers against look-alike domains and fraud by introducing secure domain registries and measures to prevent spoofing.

Therefore, regulation is moving from lagging to catching up; banks must be proactive in compliance, not reactive.

Real-world examples — successes and cautionary tales

Concrete cases show both promise and peril.

Success stories

- Monzo (UK): A large digital-first bank that reached profitability after years of growth and product expansion, demonstrating that disciplined digital models can become sustainable. However, Monzo also faced compliance pressures and operational challenges during rapid growth.

- Mobile money in emerging markets: Mobile money platforms have dramatically increased financial access for millions, enabling remittances, savings and merchant payments — a clear win for inclusion.

Cautionary tales

- Phishing and look-alike domain fraud: Firms and customers have lost significant sums due to deceptive domains and social engineering. This underscores the need for domain monitoring and customer education.

- Rapid scaling without AML controls: Some digital lenders and neobanks have been flagged by regulators for inadequate AML controls as they grew user bases faster than compliance teams could manage. This highlights the operational risks of growth without robust control frameworks.

These examples show that success is possible if growth is matched by governance, controls, and resilience.

Practical risk mitigation — what banks and customers should do

Below are practical actions for banks, fintechs, regulators, and customers.

For banks & fintechs

- Adopt defense-in-depth cybersecurity: MFA, behavioral fraud detection, domain monitoring, incident response playbooks, red/blue team testing.

- Strengthen data governance: Minimize data collection, encrypt data at rest/in transit, maintain auditable consent logs for open banking.

- Scale AML/KYC with automation: Use analytics to detect suspicious flows, and combine automated screening with human oversight to reduce false negatives/positives.

- Third-party risk management: Vet cloud vendors, enforce SLAs, replicate critical workloads across providers, and test recovery.

- Model governance: Introduce explainability, bias testing, backtesting, and continuous monitoring for AI models.

- Customer education: Launch campaigns on phishing hygiene, scam reporting, and safe digital habits.

- Regulatory engagement: Work with regulators on pilot programs, incident reporting, and sandboxing for new products.

For customers and students

- Enable multi-factor authentication (MFA) and never reuse passwords across important accounts.

- Verify domains and links before entering credentials — scammers use look-alike URLs.

- Monitor accounts frequently and set transaction alerts for unusual activity.

- Understand product terms for BNPL and instant credit — read fees and repayment schedules.

- If you’re studying finance or tech, learn both the business and the security/regulatory side — employers need people who understand product, data, and risk together.

How to prepare:

- Build technical skills (SQL, Python, cloud basics) and domain knowledge (payments, lending basics).

- Do projects: build a mini-digital banking app prototype, analyze transactional datasets for fraud patterns, or implement a simple credit scoring model.

- Learn regulations (GDPR, local data protection rules, open banking frameworks) and practice documenting controls.

- Understand privacy, ethics, and fairness — these are increasingly central in hiring decisions.

Thus, digital banking is fertile ground for multidisciplinary talent.

The future — what’s next in digital banking?

Looking ahead, these trends will shape the next phase of digital banking:

- Embedded and contextual finance everywhere. Financial services will continue to be embedded into apps and commerce flows.

- More regulated open finance. Open banking will grow into broader open finance, connecting pensions, investments, and insurance via APIs — with clearer rules and standards.

- AI for both experience and risk. Generative AI will create new customer experiences and operational efficiencies — but regulators will focus on model risk and explainability.

- Stronger focus on resilience & concentration risk. As cloud and third-party dependency grows, regulators will increase oversight and expect contingency planning.

- Financial inclusion at scale. Mobile accounts and digital rails will continue to bring more adults into the formal financial system, with implications for savings, credit, and economic participation.

In short, the direction is clear: more integration, more intelligence, more reach — and more regulatory and technical complexity.

Quick checklist — for students, product teams and regulators

A short checklist you can carry away:

For students / job seekers:

- Learn SQL + Python; do a payments or fraud detection project.

- Understand basic regulations and privacy principles.

- Build a security-aware mindset (MFA, secure coding basics).

Product teams / fintechs:

- Incorporate AML and cyber controls earlier in product design.

- Design explainable models and track performance post-deployment.

- Plan for vendor outages: test recovery.

For regulators / policymakers:

- Encourage interoperable API standards and clear liability rules for open banking.

- Monitor concentration in cloud and critical third-party providers.

- Mandate incident reporting and strengthen consumer protection for digital credit.

Final thoughts — balancing opportunity and responsibility

To conclude, digital banking is transforming finance by making payments faster, credit more accessible, and banking more personalized and inclusive. Nonetheless, these advances come with material risks: cyber threats, data privacy concerns, operational concentration, and regulatory challenges. Therefore, stakeholders — banks, fintech’s, regulators, and customers — must treat digital banking as a joint project: embrace innovation, but invest equally in security, governance, and consumer protection.