Investing in the share market involves many choices, but two of the most critical are Long-Term Investing and Short-Term Investing. Understanding long-term investing vs short-term investing from the outset can help both novice and advanced investors decide what strategy aligns with their financial goals. In this detailed blog post, you will learn what each investing horizon entails, key benefits and risks, important facts, strategies, and how to decide which is right for you.

Table of Contents

ToggleWhat is Short-Term Investing?

Short-term investing in the share market refers to holding shares, stocks, or other equity instruments for a relatively brief period—ranging from a few days to a few months, sometimes up to a year. In short-term investing, the emphasis is on rapid gains rather than gradual growth. Because of that, investors engaging in short-term investing often respond to market trends, news events, technical indicators, and macroeconomic announcements. Moreover, they typically use tools such as swing trading, day trading, or momentum trading. Furthermore, short-term investing demands constant market monitoring, disciplined stop losses, and fast decision-making. However, the potential for higher returns comes with increased risk, increased transaction costs, and emotional pressure.

What is Long-Term Investing?

Long-term investing in the share market means buying shares or equity with a horizon of several years to decades. Commonly, long-term investors hold positions for 5, 10, 20 years or more. In long-term investing, the focus is on fundamentals: company earnings, revenue growth, business models, macro trends, management quality, and economic cycles. Moreover, long-term investing benefits from compounding returns, dividend reinvestment, and reducing the impact of short-term market fluctuations. Furthermore, long-term investing tends to incur fewer transaction costs and lower tax burdens in many jurisdictions when gains are held for longer periods. However, long-term investors must tolerate volatility, market downturns, and sometimes slow growth for periods before eventual rewards.

Key Differences Between Short-Term Investing vs Long-Term Investing

When comparing short-term investing vs long-term investing, several key differences emerge. Understanding these in depth helps you align strategy with your risk tolerance, time horizon, and financial goals. Below are primary distinctions:

| Aspect | Short-Term Investing | Long-Term Investing |

| Time Horizon | Days, weeks, months | Years to decades |

| Risk Level | High volatility, higher risk of loss | Moderate to lower risk over time (though not risk-free) |

| Return Potential | Can be large in short bursts, but also losses can be steep | Generally steady growth, cumulating over time via compounding |

| Effort & Monitoring | Requires frequent monitoring, analysis of charts, news, technical indicators | Requires occasional checking, focus on fundamentals, macro trends |

| Transaction Costs & Taxes | Many transactions; higher costs; short-term capital gains taxes (or equivalent) | Fewer trades; potential tax benefits; dividend returns contribute |

| Emotional Stress | High — quick decisions, fear of missing out (FOMO), risk of panic selling | Lower — more patience, less reactive to daily market noise |

Moreover, whereas short-term investing may respond to hype, earnings surprises, or news shocks, long-term investing tends to smooth over those events. Consequently, long-term investors can capitalize on economic cycles, structural growth sectors, and compounding of returns.

Risk and Reward Factors Volatility

For short-term investing, volatility is both friend and foe: it creates opportunity, but it also introduces uncertainty. For long-term investing, volatility can be mitigated over time as markets tend to recover from shocks—such as recessions, crashes, or geopolitical events.

Return Patterns & Compounding

In long-term investing, compounding works wonders. If you invest in a well-priced, growing company and hold for many years, dividends plus reinvestment plus share price appreciation can lead to exponential growth. On the other hand, short-term investing relies more on timing the market correctly, which is notoriously difficult. Therefore, long-term investing often results in more consistent performance for those who stay invested, compared to trying to catch every short-term swing.

Liquidity and Opportunity Costs

Short-term investing demands liquidity—you need to have cash ready to enter and exit positions quickly. That means opportunity cost: your money may be tied up in trades or waiting to be deployed. With long-term investing, although your money is committed for the long haul, you benefit from staying invested through market cycles, rather than attempting to time the market.

Emotional and Behavioural Risks

Short-term investing often triggers emotional decision-making: fear, greed, FOMO, panic, etc. Long-term investing requires patience, discipline, ability to resist reacting to every piece of market noise. Because of that, many investors underperform when trying short-term strategies because of poor behavioral discipline.

Costs and Taxes

- Transaction costs: Every trade typically incurs brokerage, commissions, bid-ask spread, and sometimes platform fees. In short-term investing, since trades are frequent, these costs accumulate significantly.

- Taxes: Many tax regimes impose higher tax rates on short-term capital gains than long-term gains. Hence, long-term investing often offers better net returns after tax.

- Opportunity costs also include inflation, alternative investment returns, and the cost of not reinvesting dividends.

Market Behaviour, Volatility, and Time Horizons

Cycles and Mean Reversion

Markets move in cycles: bull markets, bear markets, corrections, consolidations. Long-term investing allows an investor to ride several cycles; over years or decades, negative periods often reverse. However, in short-term investing, a single negative event can wipe out gains, especially if leverage is involved.

Black Swan Events

Events like financial crashes, pandemics, regulatory shocks, political instability—these are unpredictable. In short-term investing, such events create significant downside risk. Conversely, long-term investors may experience such events, but their impact is often diluted over time. Turnaround and recovery can help regain ground.

Compound Growth vs Volatility Smoothing

Because long-term investing involves being in the market over long durations, growth tends to smooth out. Meanwhile, short-term investing yields are more jagged; highs may be higher but lows can be painful.

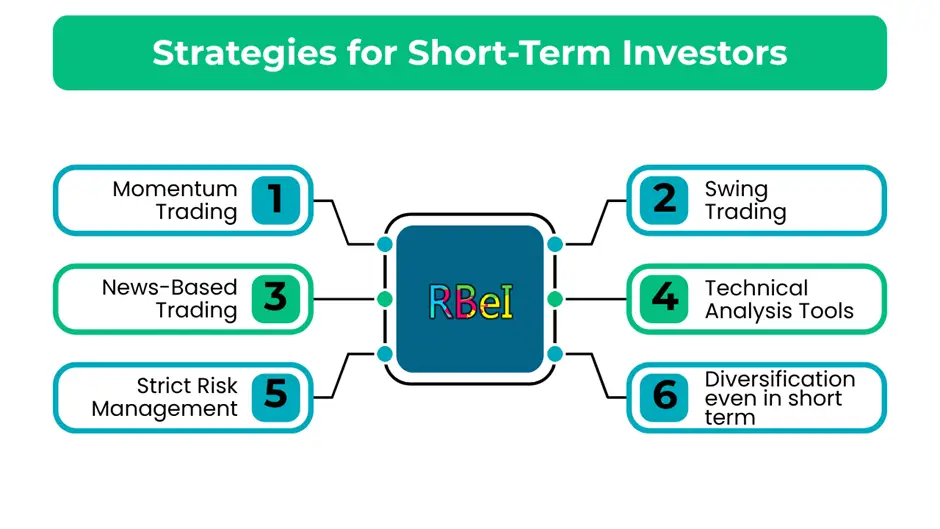

Strategies for Short-Term Investors

If you lean toward short-term investing, following disciplined strategies is essential. Below are some useful approaches:

However, no matter how good the strategy, short-term investing is highly competitive and often requires full-time attention and experience.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

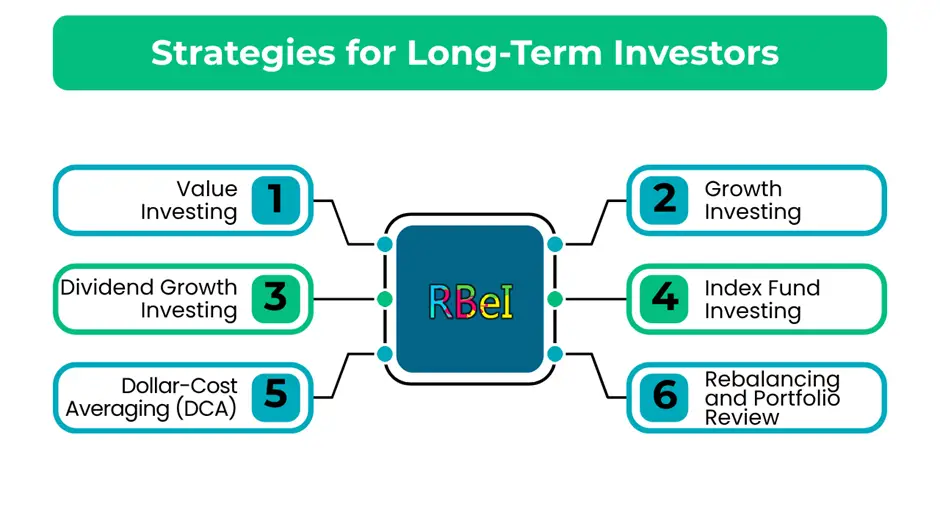

Strategies for Long-Term Investors

For those preferring long-term investing, here are strategies that tend to produce healthy returns over years:

Long-term investing rests heavily upon patience, consistency, and a clear understanding of financial goals.

Taxation, Costs, and Other Practical Considerations

Costs

- Brokerage fees for every trade: frequent traders incur more.

- Bid-ask spread: especially in less liquid stocks, the spread can eat into returns.

- Slippage: when your order executes at a worse price due to volatility, more relevant for short-term.

Taxes

- Short-term capital gains tax: Many tax systems treat gains from sales held less than a threshold (say 1 year) as short-term, taxed at higher rates.

- Long-term capital gains tax: Often lower rates; plus, some jurisdictions offer exemptions, benefits for long holdings.

Time and Effort

Short-term investors must spend substantial time reading charts, monitoring news, making trades. Long-term investors can set up automatic contributions, occasional reviews, less stress.

Behavioural Factors

Patience, discipline, controlling emotions matter more in long-term investing. Impulse decisions hurt in both, but short-term investing tends to magnify mistakes.

Inflation and Compounding

Over long periods, inflation erodes purchasing power. Therefore, long-term investors must aim for returns above inflation. Also, compounding (especially via dividends, reinvestment) is a powerful force.

Which is Better for Students and Young Investors?

For students or young adults, there are particular advantages and disadvantages to both long-term and short-term investing in the share market. Deciding which fits best depends on personal goals, risk tolerance, time available, capital, and level of knowledge.

Advantages of Long-Term Investing for Students

- Small amounts invested early can grow significantly over many years via compounding.

- More time to recover from market downturns.

- Less stress, fewer trades, lower costs.

- Learning about business fundamentals, economics, finance, which builds lasting skills.

Advantages of Short-Term Investing for Students

- Potential for quick gains (which can be motivating).

- Learning market mechanics, technical analysis, trading psychology.

- Flexibility: ability to exit easily; more cash flow if successful.

Disadvantages for Students

- Short-term investing can be risky without sufficient capital; mistakes more costly proportionally.

- Distraction: too much time monitoring markets can distract from studies or other priorities.

- Long-term investing demands patience; sometimes young investors get bored or anxious to realize gains.

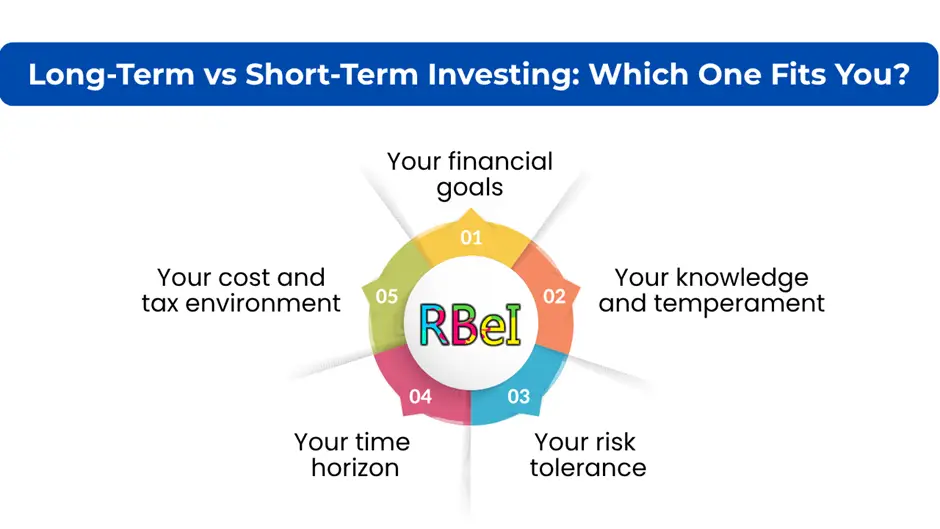

How to Choose Between Long-Term and Short-Term Investing <a name=”how-to-choose”></a>

Choosing between long-term investing vs short-term investing requires honest assessment of several factors. Below are questions and criteria to guide that decision:

1. What is your time horizon?

If you are young, saving for retirement or a major future goal, long-term investing often makes more sense. If you need cash in 6-12 months, short-term may suit better.

2. What is your risk tolerance?

Can you stomach big drawdowns? If not, long-term investing with diversified assets may offer more comfort.

3. How much time and effort can you dedicate?

Short-term investing demands ongoing attention. Long-term can be more hands-off.

4. What is your knowledge and experience level?

If you understand fundamental analysis, macro trends, and have patience, long-term investing can serve well. If you also know technical analysis and trading, can take risk, short-term might be appealing—but start small.

5. What are your goals?

Are you seeking rapid income, or steady wealth building? Are dividends or compounding important? Do you need liquidity? Goals shape strategy.

6. Cost and taxation context in your country matters. Understand brokerage fees, tax on gains. A strategy good on paper may falter after costs.

7. Hybrid approach possibility: You might combine both—hold core long-term investments and take some short-term trades with a small portion of your capital. That can balance risk and opportunity.

Real-Life Examples and Case Studies <a name=”case-studies”></a>

Case Study 1: Long-Term Investment in a Growth Company

Suppose an investor bought shares of a tech company in 2005, held them through 2008 crash, through cyclic dips, reinvested dividends, and sold in 2020. Over 15 years, such investment may have grown 10-20x. Because of long-term investing, short-term volatility was overcome.

Case Study 2: Short-Term Trading on Earnings Announcements

Another investor trades around quarterly earnings of companies. They buy before earnings release, hoping for positive surprise; sometimes profit, sometimes loss. Over many such trades, profits are inconsistent; costs eat into gains; emotional stress high.

Case Study 3: Hybrid Portfolio

An investor allocates 80% of portfolio to long-term holdings: index funds, dividend growth stocks; and 20% to short-term trades. The long-term portion gives stability; the short-term allows occasional profit from market swings. Over 10 years, the hybrid portfolio grew steadily with fewer drawdowns.

Important Facts and Statistics

- Historically, over long enough periods (20-30 years), broad stock market indices deliver average annual returns of 7-10% (after inflation in many developed markets).

- Short-term returns fluctuate wildly: one year may give +40%, another –30% or worse.

- Transaction costs: frequent trading can reduce net returns by 1-2% or more annually.

- Taxes: In many countries, long-term capital gains are taxed at lower rates; short-term gains taxed at regular income tax rates.

Transitioning Between Strategies

Sometimes, market conditions or life circumstances shift, making it wise to transition from short-term investing focus to long-term, or vice versa. For example:

- If you have built up capital and knowledge, you might shift to long-term investing to preserve wealth.

- If nearing financial goal (marriage, down payment, college fee), your horizon shortens—thus move toward more short-term or conservative investments.

- Economic outlook changing: if high volatility is expected, long-term investors may reduce exposure or hedge; short-term investors may be cautious.

Pros and Cons Summarized

Pros of Short-Term Investing

- Potential for quick profits

- Flexibility

- Opportunity to capitalize on market inefficiencies

Cons of Short-Term Investing

- High risk and emotional stress

- High transaction and tax costs

- Hard to consistently beat market

Pros of Long-Term Investing

- Potential for compounding growth

- Lower cost and tax benefits

- Greater likelihood of riding out downturns

Cons of Long-Term Investing

- Patience required; sometimes slow growth

- Risk of company underperformance over long run

- Opportunity cost if you miss short-term chances

Practical Tips for Students or First-Time Investors

- Start with a small capital you can afford to lose if using short-term strategies.

- Learn the basics: read financial statements, understand fundamental analysis.

- Use virtual or simulated trading to practice short-term without real money.

- Diversify: don’t put all into one stock.

- Keep costs in mind: choose low-fee brokers, avoid over-trading.

- Keep emergency fund in place—don’t need to liquidate investments suddenly.

- Be disciplined: set stop-loss, profit goals.

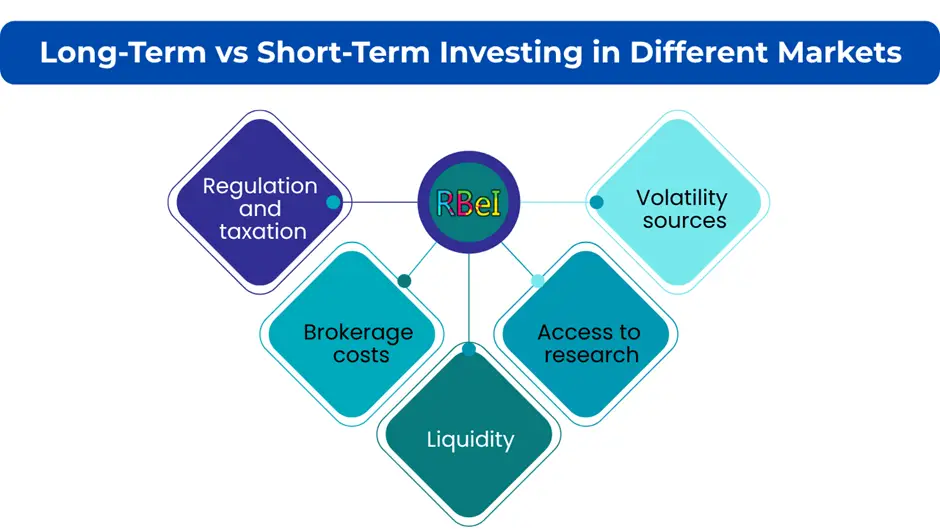

Long-Term vs Short-Term Investing in Different Markets (India Perspective)

Considering the share market in India, there are unique facets:

How Long Is Long Enough? Defining Your Time Horizon

It’s essential to define what “long-term” means for you. For one person, 3-5 years might be long; for another, 20 years. Key is that longer horizons reduce risk of permanent loss, and increase chance to benefit from growth and compounding. Short-term periods are usually less than 1 year, sometimes up to 2 years in certain strategies.

Common Mistakes in Each Approach

Mistakes in Short-Term Investing

- Overtrading

- Ignoring costs and fees

- Letting emotions rule decisions

- Over-leverage

- Chasing fads without analyzing fundamentals or risk

Mistakes in Long-Term Investing

- Buying because something is “popular” rather than fundamentally strong

- Failing to diversify

- Panic selling during downturns

- Neglecting to rebalance portfolio occasionally

- Ignoring macro risks or company deterioration over time

Tools and Resources to Help

- Financial news portals and stock analysis services

- Charting tools, technical indicators (for short-term)

- Fundamental analysis software, annual reports, balance sheets (for long-term)

- Financial calculators for compounding, CAGR (compound annual growth rate)

- Simulated trading platforms

- Peer learning: investing clubs, forums, mentorship

Long-Term vs Short-Term Investing: Which One Fits You?

To sum up, choosing between long-term investing vs short-term investing depends on:

Often, many successful investors adopt a blend—keeping a core of long-term holdings and allocating a smaller portion for occasional short-term trades. That way, one harnesses stability and compounding of long-term investing, while also having flexibility and opportunity in short-term-based moves.

Conclusion

In conclusion, long-term investing vs short-term investing each has its strong suits and drawbacks. Long-term investing excels in compounding growth, lower costs, tax efficiency, and less emotional pressure. Short-term investing may offer quicker returns, but at higher risk, greater costs, and more mental stress. For many, especially students and young investors, long-term investing is the safer and more reliable path for building wealth over time. Nevertheless, if you are intrigued by markets, have time, and can commit to learning and discipline, incorporating some short-term trades can be beneficial.