Table of Contents

ToggleFinancial Modelling has become one of the most in-demand skills in finance, investment banking, equity research, and corporate strategy. To succeed, you need to develop the skills required for financial modelling that go beyond just Excel formulas. In fact, mastering financial modelling skills means combining technical expertise, accounting knowledge, valuation techniques, and the ability to present complex data in a simplified manner. Without these skills, your model may look correct on the surface but fail to provide accurate insights for decision-making.

In this blog, we will dive deep into the top 10 skills required for financial modelling. By the end, you will know exactly what to learn, how to build these skills, and why they matter in real-world finance roles. If you’re a beginner, you should first read our What is Financial Modelling? Beginner’s Guide to understand the basics before jumping into advanced skills.

Why Learning Financial Modelling Skills is Essential

Before we explore the top skills, it’s important to understand why financial modelling skills are critical in today’s world. Businesses are constantly making decisions about investments, mergers, acquisitions, new projects, and risk management. Each decision requires a forecast, an evaluation, and a clear financial projection. That’s where financial modelling comes in.

- A banker uses models to advise on IPO pricing.

- A CFO uses models to assess capital structure and funding.

- An equity analyst uses models to recommend buy, hold, or sell decisions.

- A consultant uses models to suggest strategic shifts to clients.

Therefore, learning these skills required for financial modelling is not just for students or freshers; they are equally important for professionals already working in finance.

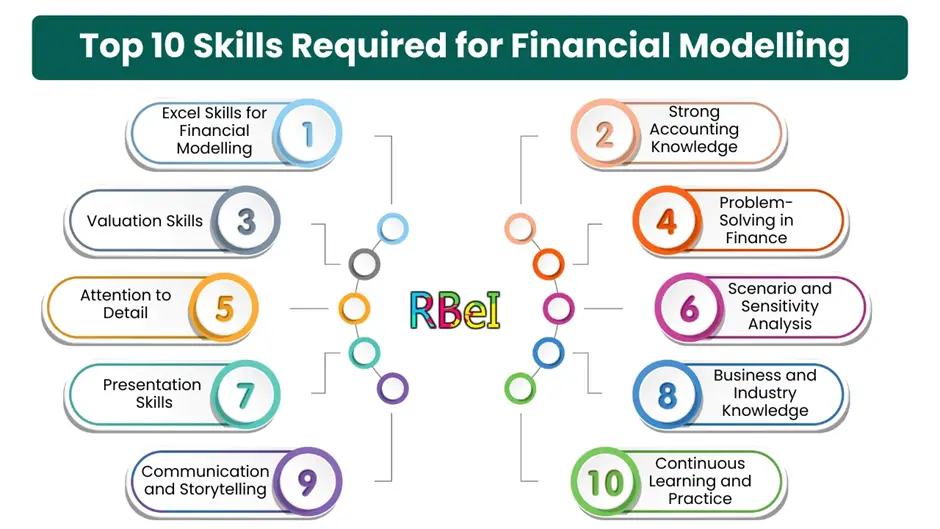

Top 10 Skills Required for Financial Modelling

Let’s now break down the essential financial modelling skills one by one, with practical examples and applications.

1. Excel Skills for Financial Modelling

When people think of financial modelling, Excel for financial modelling is the first thing that comes to mind. Excel is the backbone of every model. While basic formulas like SUM or AVERAGE are helpful, advanced Excel skills take you to the next level.

What You Need to Learn:

- Keyboard shortcuts for speed.

- Functions like VLOOKUP, INDEX-MATCH, IFERROR.

- Logical formulas for scenario building.

- Data validation and conditional formatting.

- Pivot tables for dynamic analysis.

Example: If you are projecting revenue growth for 5 years, Excel helps you create scenarios like best case, base case, and worst case, all within a single model.

Without Excel for financial modelling, you cannot build error-free, flexible, and professional models.

2. Strong Accounting Knowledge

Accounting is the language of business. If you don’t understand accounting principles, your financial model will lack credibility. In fact, one of the most important skills required for financial modelling is knowing how financial statements interact.

What You Need to Learn:

- Structure of Income Statement, Balance Sheet, and Cash Flow Statement.

- Double-entry principles.

- Deferred taxes, depreciation methods, and working capital.

- Linking all three statements into one integrated model.

Example: If you increase capital expenditure in your model, you must know how it impacts depreciation (income statement), fixed assets (balance sheet), and cash outflows (cash flow statement).

3. Valuation Skills

A big part of financial modelling is estimating what a company is worth. Valuation skills help you apply different methods depending on the industry and purpose.

What You Need to Learn:

- Discounted Cash Flow (DCF) Valuation.

- Comparable Company Analysis.

- Precedent Transaction Analysis.

- Leveraged Buyout (LBO) models.

Example: In M&A deals, a banker may build a DCF model to estimate the intrinsic value of the company, and then compare it with market multiples.

This makes valuation skills one of the most critical aspects of financial modelling.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

4. Problem-Solving in Finance

Financial modelling is not just about numbers; it’s about solving real-world business problems. Employers look for candidates who can analyze a situation, build assumptions, and use financial models to provide solutions.

What You Need to Develop:

- Ability to question assumptions.

- Critical thinking for scenario analysis.

- Creativity in structuring data.

Example: A company facing declining margins may want to know whether to cut costs, raise prices, or diversify. Your model should help solve this by quantifying the impact of each choice.

5. Attention to Detail

A small mistake in financial modelling can cost millions. That’s why attention to detail is a must-have skill. Models often involve hundreds of rows, multiple sheets, and linked formulas. A single error can spread throughout.

Example: Accidentally linking revenue growth to the wrong cell can misrepresent the entire company valuation.

To avoid this, always cross-check formulas, reconcile balances, and use error checks.

6. Scenario and Sensitivity Analysis

Markets are uncertain. That’s why financial models must account for different situations. Scenario analysis and sensitivity analysis allow you to test assumptions and see how results change.

What You Need to Learn:

- Data Tables for sensitivity analysis.

- Building “Best Case, Base Case, Worst Case” scenarios.

- Tornado diagrams for visualization.

Example: A DCF valuation can show a company worth ₹500 crores at 10% WACC, but if the WACC changes to 12%, the value may fall sharply. Sensitivity analysis highlights this risk.

7. Presentation Skills

A great financial model is useless if you cannot explain it. Presentation skills ensure you can communicate your findings to non-finance people.

What You Need to Learn:

- Designing clear charts and graphs.

- Using PowerPoint for financial storytelling.

- Writing concise executive summaries.

Example: A CEO may not look at your entire Excel sheet. But a one-slide summary with key insights and recommendations can drive decisions.

8. Business and Industry Knowledge

Numbers don’t exist in isolation. You must understand the industry before making assumptions. Strong business acumen is one of the hidden but powerful skills required for financial modelling.

What You Need to Focus On:

- Industry-specific drivers (e.g., same-store sales for retail, occupancy rates for hotels).

- Economic factors like inflation, interest rates, and currency risks.

- Company strategies and market competition.

Example: A retail model should not assume the same growth rate as a tech startup. Context matters.

9. Communication and Storytelling

Models are technical, but finance is about people. You must communicate assumptions, risks, and results effectively. Storytelling in financial modelling means turning numbers into a business narrative.

Example: Instead of just saying “EBITDA margin is 22%,” you can present it as:

“Due to improved supply chain efficiency and cost savings, the company’s EBITDA margin is projected to improve from 18% to 22% over the next three years.”

10. Continuous Learning and Practice

Finally, the most underrated financial modelling skill is continuous learning. Financial markets, valuation methods, and Excel tools keep evolving. To stay ahead, you must practice regularly and update your knowledge.

How to Keep Learning:

- Enroll in a structured Financial Modelling Course.

- Follow case studies of real companies.

- Practice building models from scratch.

Example: Start with a simple 3-statement model of a listed company, then gradually move to DCF, M&A, and LBO models.

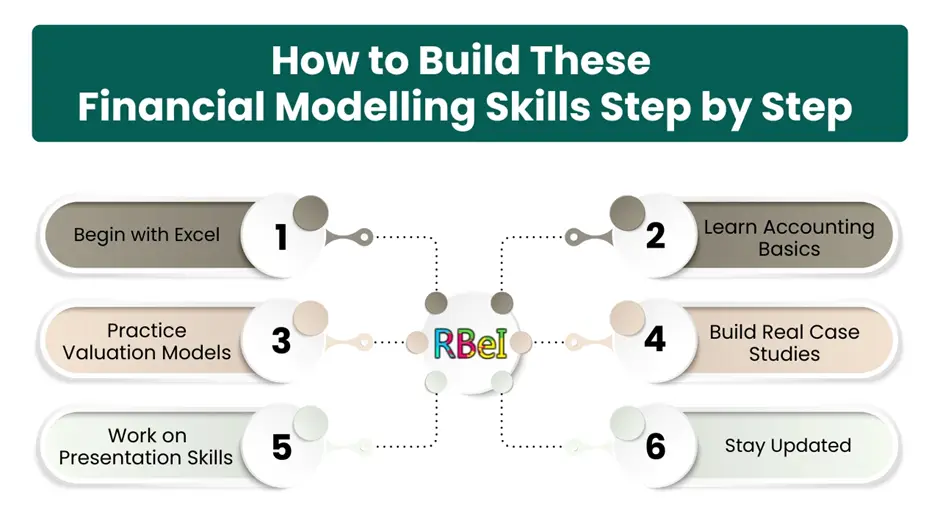

How to Build These Financial Modelling Skills Step by Step

Now that you know the top 10 skills required for financial modelling, let’s map out a practical roadmap.

- Begin with Excel – Get comfortable with advanced functions and keyboard shortcuts.

- Learn Accounting Basics – Understand financial statements and linkages.

- Practice Valuation Models – Start with DCF, then move to comparables.

- Build Real Case Studies – Apply problem-solving to real-world situations.

- Work on Presentation Skills – Summarize results in reports and PowerPoints.

- Stay Updated – Regularly revise your models and learn new tools.

If you want a structured approach, our Financial Modelling and Investment Banking Course covers these skills step by step with practical projects.

Conclusion

Mastering financial modelling is not about memorizing formulas; it’s about combining technical, analytical, and communication abilities to solve real business problems. From Excel for financial modelling to valuation skills, from problem-solving in finance to presentation skills, each ability plays a vital role.

The good news is that anyone can build these financial modelling skills with practice and the right guidance. Start small, be consistent, and gradually advance toward complex models.

If you’re serious about a career in finance, now is the time to take action. Explore our What is Financial Modelling? Beginner’s Guide and enroll in our Financial Modelling and Investment Banking Course to start your journey.

FAQs on Skills Required for Financial Modelling

1. What are the most important skills required for financial modelling?

The most important skills required for financial modelling include advanced Excel knowledge, strong accounting fundamentals, valuation techniques, problem-solving abilities, and presentation skills. Excel allows you to structure and calculate efficiently, while accounting ensures you understand the flow of financial statements. Valuation skills help in estimating company worth, problem-solving makes your model practical, and presentation skills help in communicating results effectively. Together, these financial modelling skills enable professionals to build reliable, decision-making tools for businesses and investors.

2. Do I need to be very good at Excel for financial modelling?

Yes, Excel proficiency is essential for financial modelling. While you don’t need to memorize every formula, you must be comfortable with advanced functions such as INDEX-MATCH, VLOOKUP, IFERROR, and pivot tables. Additionally, using keyboard shortcuts and dynamic formulas will make you faster and more accurate. In fact, without Excel for financial modelling, you cannot efficiently build scenarios, test assumptions, or present clean financial models. Beginners can start with basic formulas and gradually move toward advanced Excel features with practice.

3. Is accounting knowledge necessary for financial modelling?

Absolutely. Accounting knowledge is one of the core skills required for financial modelling. Financial models are built on the three financial statements—Income Statement, Balance Sheet, and Cash Flow Statement. Without understanding how they are connected, your model will lack credibility. For example, if you model higher capital expenditure, you should know how it affects depreciation (income statement), fixed assets (balance sheet), and cash flows. Therefore, even if you’re not from an accounting background, learning the basics of financial statements is crucial before mastering financial modelling.

4. How can I improve my financial modelling skills if I am a beginner?

If you are a beginner, the best way to improve your financial modelling skills is by following a structured approach:

- Start with Excel – Learn shortcuts, formulas, and formatting.

- Understand accounting basics – Focus on the 3 financial statements.

- Learn valuation methods – Begin with DCF, then move to comparables.

- Practice regularly – Pick a company’s annual report and build models.

- Seek feedback – Share your models with mentors or peers for corrections.

Joining a professional Financial Modelling Course can also help you practice case studies and gain hands-on exposure to industry-level models.

5. What career opportunities can I get after learning financial modelling skills?

Learning financial modelling skills opens doors to multiple finance careers. The most common roles include:

- Investment Banking Analyst – Building IPO, M&A, and LBO models.

- Equity Research Analyst – Creating valuation models for listed companies.

- Corporate Finance Professional – Forecasting and budgeting for businesses.

- Financial Planning & Analysis (FP&A) – Supporting CFOs with strategic decisions.

- Consultant – Advising clients using scenario-based models.

In today’s job market, professionals with strong financial modelling skills are highly valued, as companies want data-driven decision-making.