In today’s evolving finance world, Sustainability and Climate Risk (SCR) have emerged as central themes, not just buzzwords. As more institutions, regulators, investors, and stakeholders emphasize responsible investing, sustainability and climate risk matter more than ever in finance. SCR concerns the integration of environmental sustainability and climate change considerations into financial decision-making, risk management, and capital allocation. In this blog, we’ll deeply explore: what SCR means, why it matters, how it is applied in finance, challenges, emerging trends, and what students and future finance professionals should know.

Table of Contents

ToggleBy weaving in Sustainability and Climate Risk (SCR) early and often, this blog strives to give you both conceptual clarity and practical insights.

What Is SCR? (Sustainability and Climate Risk)

Defining SCR: Sustainability and Climate Risk

“Sustainability and Climate Risk (SCR)” refers broadly to the risks, opportunities, and management practices associated with climate change, environmental degradation, and sustainable development goals as they intersect with finance and economics.

- Sustainability typically refers to meeting present needs without compromising the ability of future generations to meet their own—covering environmental, social, and governance (ESG) considerations.

- Climate risk refers to the financial risks arising from climate change—both the physical risks (storms, floods, heat waves, sea-level rise) and transition risks (policy changes, technological disruption, shifts in consumer preferences).

- Combined, Sustainability and Climate Risk (SCR) deals with embedding climate and sustainability factors into financial analysis, risk management frameworks, capital allocation, regulation, reporting, and strategy.

When we speak of “SCR in finance,” we mean how financial institutions, investors, corporations, and regulators factor in climate-related uncertainties and sustainable development into financial decisions.

SCR vs ESG: How They Relate and Differ

While SCR overlaps with ESG (Environmental, Social, Governance), it has a distinct focus:

- ESG is broader: it includes social and governance issues (labor practices, human rights, board diversity, etc.). The “E” in ESG covers environmental issues, including climate.

- SCR narrows more tightly on sustainability + climate dynamics—emphasizing climate risk, transition strategy, long-term resilience, nature risk, carbon accounting, etc.

In other words, SCR is like a focused subdomain within ESG / sustainable finance, devoted specifically to climate risk and sustainability strategies.

Institutions like GARP (Global Association of Risk Professionals) now offer a SCR Certificate to equip professionals with competencies in sustainability and climate risk.

Thus, when you see SCR, think: “the intersection of sustainability and climate risk applied in finance.”

Why Sustainability and Climate Risk Matter in Finance: Key Drivers

To answer “why SCR matters in finance,” we must explore several forces pushing the integration of sustainability and climate risk into financial systems. Here are the major drivers:

1. Escalating Physical Climate Risks

Extreme weather events (storms, floods, droughts, wildfires), sea-level rise, heat stress, shifting precipitation patterns—all pose physical risks to assets, supply chains, infrastructure, and ecosystems.

In finance, physical risks can translate into:

- Asset damage (e.g. real estate, power plants, transportation infrastructure)

- Business disruption (supply chain delays, reduced productivity)

- Insurance losses, increased claims, liability exposure

- Credit risk deterioration (borrowers affected by climate shocks may default)

Hence, financial institutions must evaluate how portfolios will fare under more frequent and severe climate events.

A recent review on financial climate risk highlights how the complexity of integrating climate science into risk frameworks is a key challenge.

2. Transition Risks and Policy Shifts

Transition risk arises from shifts in policies, regulation, technology, market preferences, and investor sentiment as economies decarbonize. Examples include:

- Carbon pricing or tax implementation

- Stricter emissions regulations

- Mandated phase-outs of fossil fuels

- Technological disruption (e.g. renewable energy, battery tech)

- Market revaluation of “stranded assets” (e.g. coal reserves, non-compliant infrastructure)

Financial firms that fail to anticipate transition risk may face sudden asset revaluations or stranded investments.

3. Regulatory and Disclosure Pressure

Globally, regulatory bodies are increasingly mandating climate-related financial disclosures. For instance:

- The Task Force on Climate-related Financial Disclosures (TCFD) laid out a framework centered on governance, strategy, risk management, metrics & targets.

- Many jurisdictions (e.g. EU, UK) are moving toward mandatory disclosures aligned with TCFD or similar frameworks.

- Supervisory authorities are pushing banks, insurers, asset managers to integrate climate risk into capital planning and stress testing.

Thus, financial firms cannot ignore SCR—compliance demands it.

4. Investor and Stakeholder Demands

Investors—especially institutional investors, sovereign wealth funds, pension funds—are demanding that capital be directed toward sustainable and resilient ventures. They are incorporating ESG screens, sustainable mandates, and climate-themed products (e.g. green bonds).

Stakeholders such as clients, regulators, civil society, millennials, and employees expect organizations to have credible sustainability and climate risk strategies.

5. Opportunity and Innovation

SCR is not just about risk mitigation. It opens doors to:

- Sustainable financial products (green bonds, sustainability-linked loans, climate derivatives)

- Investment in climate solutions—renewables, energy efficiency, carbon capture, climate adaptation infrastructure

- Competitive advantage: firms with better SCR frameworks can win capital, reputation, regulatory favor

- Resilience: better positioning in a low-carbon, climate-resilient future

Thus, SCR matters as both a defensive necessity and a proactive growth lever.

6. Systemic Risk and Financial Stability

Climate change is not just an idiosyncratic risk—it is systemic. Because climate impacts are correlated (affecting multiple sectors, geographies, assets), they can threaten broader financial stability.

Financial regulators and central banks are increasingly treating climate risk as a macroprudential concern.

Deloitte emphasizes that sustainable finance and integration of climate risk must become engrained in day-to-day operations across financial services.

Key Dimensions of SCR in Finance

Understanding SCR in finance requires decomposing the subject into manageable dimensions. Below are essential building blocks.

Physical Risk, Transition Risk & Liability Risk

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

- Physical Risk: Risks from climate hazards (floods, storms, drought). These risks may damage property, infrastructure, operations.

- Transition Risk: Risks from the shift to a low-carbon economy—policy, technology, market, legal shifts.

- Liability Risk: Potential for legal claims—companies may be held accountable for contributing to climate change, or for failing to mitigate risks.

These three are core categories of climate risk in financial analysis.

Scenario Analysis & Stress Testing

To manage SCR, institutions use scenario analysis—projecting various climate futures (e.g. 1.5 °C, 2 °C, 3 °C warming) and assessing impacts on portfolios.

Stress testing can simulate severe climate shocks, transition pressures, and model asset losses under adverse conditions.

This helps in capital allocation, resilience planning, capital buffers, and strategic adjustments.

Metrics, Targets & Reporting

To operationalize SCR, firms must measure exposures and set targets. Key metrics include:

- Carbon emissions (Scope 1, 2, 3)

- Carbon intensity (e.g. emissions per unit revenue or per asset)

- Green revenues / sustainable investment share

- Alignment with climate pathways (like net-zero)

- ESG scores and ratings (though imperfect)

Reporting frameworks such as TCFD, SASB, or local sustainability disclosure regimes translate metrics into public reports.

Governance & Strategy Integration

SCR must be embedded into governance structures. That means:

- Board oversight of climate risk

- Climate risk committees

- Integration into risk management frameworks (credit, market, operational risk)

- Incentive systems (executive compensation linked to sustainability goals)

- Capital budgeting that considers climate costs

Sustainable Finance & Investment Products

SCR spurs growth of financial instruments like:

- Green bonds: debt issued to finance climate or environmental projects

- Sustainability bonds: combining green + social goals

- Sustainability-linked loans / bonds: interest terms linked to ESG outcomes

- Climate derivatives: hedges tied to weather, carbon prices

- Impact investing, carbon markets, and climate funds

These instruments channel capital toward sustainable and adaptable solutions.

How SCR Is Adopted in Practice: Use Cases & Examples

Use Case: Banks & Credit Risk

Banks must evaluate how climate stress impacts borrowers. For example:

- A lending portfolio heavy in fossil fuel companies may face transition losses

- Mortgage portfolios in flood-prone zones may suffer default risk

- Agricultural loan portfolios may be vulnerable to droughts

Thus, risk scoring models and credit underwriting now often include climate stress factors.

Use Case: Asset Management & Portfolio Allocation

Asset managers are increasingly screening portfolios for climate exposures, reallocating capital to climate-aligned assets, divesting from high-carbon sectors, and applying climate scenario overlays.

They also design thematic funds (e.g. clean energy, climate tech) and integrate ESG/climate metrics into alpha generation strategies.

Use Case: Insurance & Reinsurance

Insurers bear direct financial losses from climate events. They must:

- Price premiums to reflect increased risk

- Manage capital reserves under climate stress

- Model catastrophe scenarios more aggressively

- Offer products that encourage resilience (e.g. green building discounts)

Use Case: Corporate Strategy & Capital Budgeting

Non-financial firms also use SCR in:

- Evaluating investments (e.g. whether to upgrade infrastructure to withstand climate stress)

- Adjusting business models (e.g. shifting away from carbon-intensive lines)

- Disclosing climate risk to investors

- Managing supply chain climate risks (e.g. sourcing from climate-vulnerable geographies)

Example: UBS’s SCR Policy Framework

UBS applies an institutional SCR policy framework across business divisions to identify and manage adverse impacts on climate, nature, and environment, influencing product development, investments, and financing decisions.

Challenges, Limitations & Criticisms of SCR

Despite its growth, SCR faces important hurdles:

1. Uncertainty & Modeling Complexity

Climate systems are complex, long-horizon, nonlinear, and uncertain. Coupling climate science with financial models is inherently challenging. Scenario definitions, parameter assumptions, feedback loops are fraught with uncertainty.

2. Data Gaps & Inconsistency

- Many firms lack historical climate exposure data

- Scope 3 emissions (indirect upstream/downstream) are hard to measure

- ESG / climate rating agencies often lack alignment; different providers yield divergent scores

- Data quality and consistency remain weak in many markets

3. Short-Term Incentives vs Long-Term Horizons

Financial markets and corporate governance often emphasize short-term results (quarterly performance), while climate risk and sustainability are long-term issues. This misalignment creates friction in adopting SCR strategies aggressively.

4. Greenwashing & Credibility Risk

There is growing concern that companies may make superficial sustainability claims without substantive action. SCR efforts must avoid greenwashing. Transparent metrics, auditing, and credible third-party verification are essential.

5. Cost & Resource Intensity

Implementing SCR frameworks—hiring expertise, developing modeling capacity, auditing, reporting—requires capital, time, and organizational reconfiguration, which may deter smaller institutions or those in emerging markets.

6. Regulatory Fragmentation

Different jurisdictions adopt varying rules and disclosure regimes, creating compliance complexity for global firms. The lack of standardized global frameworks is a barrier.

7. Capital Stranding vs Transition Dilemma

How aggressively should firms divest from carbon-intensive assets? Too fast, and they may lose returns; too slow, and they may incur transition losses. Striking the right balance is not trivial.

Why Students and Future Finance Professionals Should Care

Given the trends, here is why SCR is especially relevant for students and future finance careers:

1. Skill Demand & Employability

Finance, risk, and sustainability roles increasingly require SCR knowledge. Earning credentials like the SCR Certificate can differentiate you.

The SCR Certificate from GARP is an entry point into climate risk roles—covering sustainability, climate models, transition planning, carbon reporting.

2. Future-Proofing Your Career

As financial markets evolve toward sustainable finance, professionals who lack SCR understanding risk becoming irrelevant. Knowing SCR equips you for work in banking, asset management, ESG, climate policy, consulting, and more.

3. Enhancing Analytical Skills

Studying SCR deepens your quantitative, scenario analysis, modeling, risk management, and strategic thinking skills. These skills are broadly applicable across finance.

4. Thought Leadership & Impact

You can meaningfully contribute to climate solutions via capital allocation, advisory roles, sustainable investment products, climate strategy for firms, and influencing policy.

5. Bridging the Gap between Science & Finance

SCR is inherently interdisciplinary. As someone versed in finance and SCR, you become a translator between climate scientists, policymakers, engineers, and financial decision makers.

6. Competitive Advantage

In interviews, proposals, job applications, having a solid understanding of SCR signals future readiness and adaptability. It helps you stand out in competitive finance jobs.

How to Learn and Prepare for SCR

If you’re interested in mastering SCR, here are steps and resources:

1. Formal Certifications & Courses

- GARP’s SCR Certificate: a globally recognized exam covering sustainability and climate risk.

- Many prep courses and workshops exist (e.g. Udemy, customized SCR bootcamps)

- University programs or electives in climate finance, sustainable finance

2. Self-Study & Reading

- The TCFD framework and reports

- IPCC (Intergovernmental Panel on Climate Change) assessments

- Research papers on financial climate risk (e.g. recent review papers)

- Reports by institutions (e.g. central banks, BIS, UNEP, World Bank)

- ESG / climate rating methodologies

3. Practical Projects & Case Studies

- Perform scenario analysis on a small portfolio

- Build climate risk stress tests

- Assess carbon footprint for a sample company

- Use public data (e.g. climate maps, emissions data) to analyze physical risk

4. Internships / Projects

Seek roles or internships in banks, asset managers, ESG teams, sustainability consultancies, or risk departments where SCR is relevant.

5. Networking & Community Engagement

Join sustainability, climate, and ESG communities (GARP, PRI, CFA Climate, local chapters) to discuss trends, share knowledge, and stay current.

6. Stay Updated

Climate science, regulation, and finance evolve rapidly. Regularly read journals, news, regulatory updates, climate policy developments.

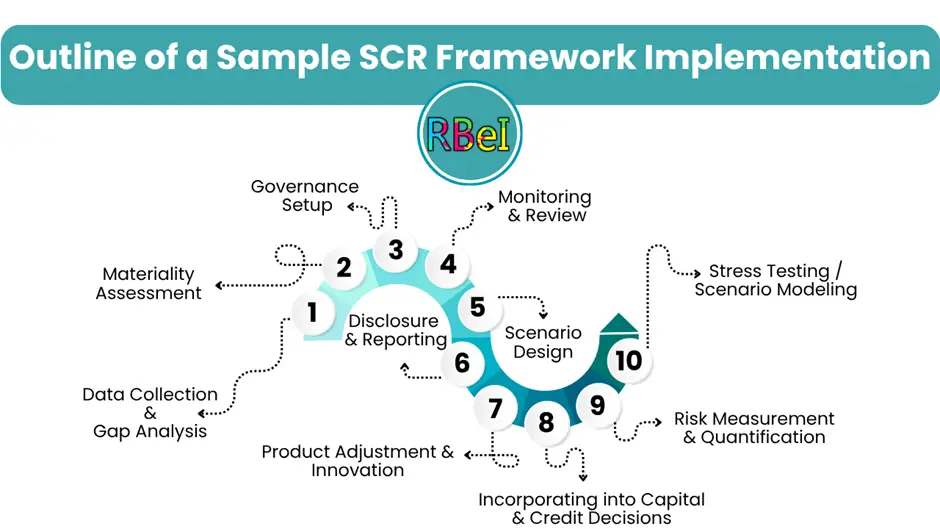

Outline of a Sample SCR Framework Implementation (For a Bank)

Below is a hypothetical step-by-step approach showing how a bank might integrate SCR into its existing risk framework:

Such a framework helps align the bank with emerging regulation, investor expectations, and climate resilience.

Emerging Trends & Future Directions in SCR

As SCR evolves, here are some cutting-edge directions you should watch:

1. Nature Risk & Biodiversity

Beyond carbon and climate, financial risk from nature loss, land-use change, biodiversity loss are gaining attention. SCR will increasingly incorporate nature-based risks (e.g. ecosystem services, deforestation, soil degradation).

2. Climate-Linked Credit Ratings & Scoring

Credit rating agencies are beginning to embed climate risk into credit ratings. SCR may converge with credit analysis more tightly.

3. AI / Machine Learning & Big Data

Using satellite data, climate models, remote sensing, geospatial analytics, and machine learning to assess physical risk with finer granularity.

4. Carbon Markets, Offsets & Pricing

Growth in voluntary and regulated carbon markets, carbon pricing schemes, and integration of offsets into corporate finance.

5. Scenario Standardization & Global Convergence

Efforts are ongoing to standardize scenario definitions, regulatory frameworks, stress testing methodologies, and disclosure rules across jurisdictions.

6. Climate Litigation & Liability Risk Escalation

As regulations and litigation increase, firms may face liability risk from claims tied to climate harm or misrepresentation.

7. Integration with Social & Equity Dimensions

As climate impacts often hit vulnerable communities harder, SCR will increasingly integrate social equity dimensions, justice, resilience, and inclusion.

8. Dynamic Capital Allocation & Real-Time Monitoring

Fintech and climate APIs may enable dynamic real-time monitoring of climate exposures and adaptive capital allocation.

Tips for Writing Papers, Projects or Assignments on SCR

Here are some tips if you, as a student, plan to write essays or assignments on Sustainability and Climate Risk / SCR:

- Start with clear definitions and situate SCR relative to ESG and sustainable finance.

- Use real-world examples or case studies (e.g. UBS’s SCR framework, bank climate stress tests, asset manager climate integration).

- Incorporate data: e.g. climate models, geospatial exposure, emissions data, rating agency reports.

- Perform scenario exercises or simple stress test models to show quantitative thinking.

- Critically examine limitations: modeling uncertainty, data gaps, regulatory fragmentation.

- Address both risks and opportunities (not merely doom and gloom).

- Be forward-looking: propose possible improvements or future research areas.

- Cite credible sources (IPCC, GARP, central bank reports, academic papers).

- Use visuals (graphs of temperature trends, scenario maps, risk exposure charts).

- Maintain a balance: theoretical foundations + applied relevance.

Summary & Take-Home Messages

| Theme | Key Insight |

| SCR = Sustainability + Climate Risk | SCR focuses specifically on embedding climate risk and sustainability into finance. |

| Why it matters | Physical risk, transition risk, regulatory & investor demand, systemic risk, and opportunity all drive SCR adoption. |

| Core components | Scenario analysis, metrics, governance, capital allocation, product innovation, reporting. |

| Applications | In banking, asset management, insurance, corporate strategy, sustainable finance products. |

| Challenges | Uncertainty, data gaps, short-term incentives, greenwashing, resource constraints. |

| Career relevance | SCR skills and credentials are increasingly essential for future finance professionals. |

| Trends ahead | Nature risk, AI, carbon markets, litigation, standardization, real-time risk monitoring. |

In conclusion, Sustainability and Climate Risk (SCR) matters profoundly in contemporary finance. It is no longer optional or niche—it is a strategic imperative. For students, professionals, and organizations, mastering SCR means understanding the interplay between climate science, economic systems, and financial outcomes, and crafting resilient strategies for a changing world.