Why Gold Prices Keep Rising is the question on every investor’s, student’s, and market-watcher’s mind today, and for good reason: gold has surged to new records, attracting headline-making forecasts and intense investor interest. Consequently, many want a clear, student-friendly explanation of the forces pushing prices higher. Therefore, in this deep-dive we explain why gold prices keep rising, step-by-step, with real-world data, charts of causes, and practical takeaways so you can understand the mechanics — and not just the headlines.

Table of Contents

ToggleQuick preview — the short answer (TL;DR)

- Why gold prices keep rising: because a mix of monetary factors (lower expected real interest rates and rate-cut bets), heavy institutional demand (central banks and ETFs), a weaker U.S. dollar, strong physical demand pockets (India & China), and geopolitical/market uncertainty have all combined to push prices upward.

- Key near-term drivers: expectations of U.S. rate cuts and central bank buying.

- What students should remember: gold is a non-yielding real asset whose attractiveness rises when real yields fall, currency risk increases, or safe-haven demand spikes.

Why Gold Prices Keep Rising — A Complete Market Breakdown

Why Gold Prices Keep Rising: The Big Picture (Macro + Market)

First, consider the big picture: gold is priced in U.S. dollars and competes with cash, bonds, and other assets for investor attention. Therefore, three macro threads usually explain extended gold rallies:

- Monetary policy expectations — when central banks move toward easing or when real interest rates fall, gold becomes more attractive.

- Institutional demand — sustained central bank purchases and record ETF inflows create structural upward pressure.

- Safe-haven and physical demand — geopolitical risk, trade tensions, and seasonal demand (e.g., India weddings/festivals) increase physical buying.

Thus, the present rally isn’t usually a single-factor story; instead, multiple forces have converged to support rising prices.

Why Gold Prices Keep Rising: Monetary Policy & Real Rates

1. Expected rate cuts vs. real yields

- Mechanics: gold pays no interest, so its opportunity cost equals the real yield on government bonds (nominal yield minus inflation). Therefore, if inflation remains elevated but nominal yields fall or are expected to fall, real yields decline, and gold becomes relatively more attractive.

- Recent context: markets have been pricing in U.S. Federal Reserve rate cuts, which reduces expected interest income on cash/bonds and supports gold. Reuters reports that gold surged on bets of U.S. Fed rate cuts, helping push prices to record highs.

2. Inflation uncertainty

- Why it matters: high or uncertain inflation increases the appeal of real assets and inflation hedges — among them, gold. Investors use gold as a long-term store of value when the purchasing power of paper money is questioned.

- Net effect: if inflation expectations remain sticky but policy appears to ease, gold typically rallies.

Why Gold Prices Keep Rising: U.S. Dollar Moves

Because gold is dollar-priced, the U.S. dollar’s strength or weakness has a direct effect:

- Dollar down → gold up: a weaker USD makes gold cheaper for foreign buyers, increasing global demand and supporting prices.

- Recent situation: a softening dollar (driven partly by Fed-cut expectations) has been one of the catalysts for increased gold buying this year. Analysts and coverage have repeatedly tied the 2025 rally to a weakening USD.

Why Gold Prices Keep Rising: Central Bank Buying (Structural Demand)

1. Central banks are net buyers

- What’s happening: central banks — notably emerging-market & some European central banks — have been adding to gold reserves in recent years to diversify foreign reserves away from dollar assets.

- Evidence: World Gold Council and related reporting show a rebound and continued central bank purchases in 2024–2025, with monthly and quarterly additions that are meaningful in aggregate.

2. Why central banks buy gold

- Diversification: gold lowers portfolio correlation with USD-denominated assets.

- Risk management: political/geopolitical concerns and desire to hedge currency concentration.

- Outcome: when sovereign buyers accumulate, they can create a multi-year structural bid under prices — not just short-term flows.

Why Gold Prices Keep Rising: ETF & Institutional Investment Flows

1. ETFs as leverage on sentiment

- How ETFs matter: physically-backed gold ETFs and exchange-traded products allow institutions and retail investors to gain gold exposure without holding physical bullion. Therefore, large inflows to ETFs translate into substantial physical purchases.

- Recent data: reports show record ETF inflows in Q3 2025, including the largest monthly inflow in September and the strongest quarter on record for gold ETFs, generating huge demand into physical gold holdings.

2. Why flows accelerate

- Momentum & fear: rising prices attract momentum buying and fear-driven hedging (portfolio insurance).

- Low alternatives: when returns elsewhere look uncertain, allocation to gold via ETFs becomes more attractive.

Why Gold Prices Keep Rising: Physical Demand — India & China

1. India — cultural and investment demand

- Why India matters: India is one of the world’s largest gold markets; weddings and festivals usually drive large jewelry purchases annually. Although record prices sometimes temper volume demand, investment demand (bars & coins) can surge when buyers expect further price rises.

- Recent note: festive seasons can boost demand, and reports in 2025 show both investment led buying and mixed jewelry demand due to high prices.

2. China — industrial, jewelry, and investment demand

- China’s role: China is another major buyer (jewelry + investment). Economic and policy shifts there influence physical demand cycles and, therefore, net demand.

Why Gold Prices Keep Rising: Supply Side Constraints

1. Mining production & supply lag

- Long lead times: new mine capacity takes years and substantial capital investment. Consequently, supply cannot quickly respond to price spikes.

- Mine output: while miners may increase output when prices rise, immediate shocks are primarily absorbed by inventories and secondary supply (recycling), not by quick production jumps.

2. Recycling & secondary flows

- Recycling helps, but slowly: when prices are high, recycling increases, but it is not always enough to offset demand surges quickly.

Why Gold Prices Keep Rising: Geopolitical & Risk Events

1. Safe-haven flows

- How it works: in times of geopolitical conflict, trade wars, or macro shocks, investors often allocate to hard assets like gold to preserve capital.

- Current drivers: trade tensions and geopolitical headlines in 2025 have contributed to the safe-haven narrative supporting gold.

2. Market psychology

- Momentum & narrative: as prices climb and headlines appear, momentum traders and retail investors pile in, reinforcing the trend — sometimes creating self-fulfilling rallies.

Why Gold Prices Keep Rising: Forecasts & Market Expectations

1. Upgraded analyst forecasts

- Recent forecasts: major banks have revised gold targets upward amid the rally — for instance, Bank of America raised its forecast to $5,000/oz for 2026, reflecting stronger investor demand and potential tighter physical supply. Such forecasts feed investor expectations and can accelerate flows.

2. Beware the bandwagon

- Critical point: while bullish forecasts matter, markets can correct violently if sentiment shifts (e.g., unexpectedly hawkish central bank action or a sudden rise in real yields). Analysts warn corrections are possible even amid structural demand.

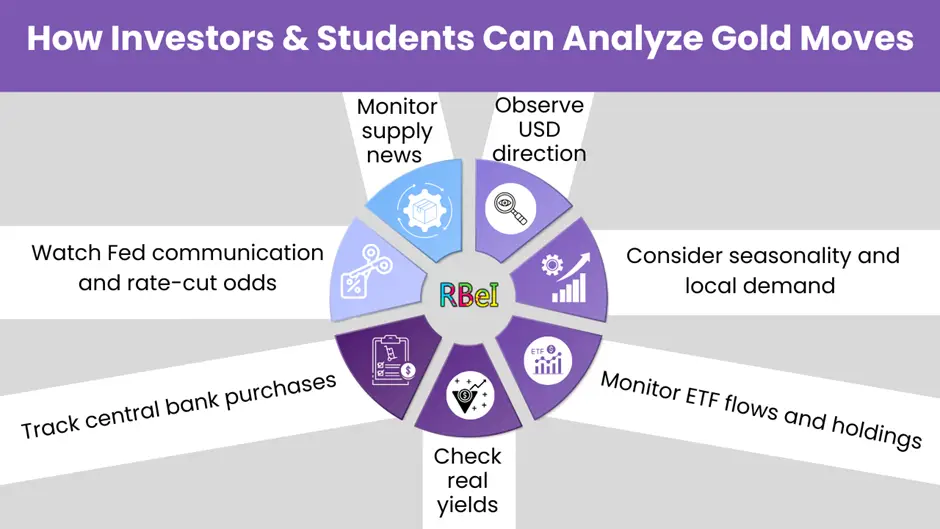

How Students Should Frame the Economics of Gold (Simple Models)

If you’re studying for exams or trying to internalize the logic, use this simple decomposition:

Gold price = f(real yields, dollar strength, central bank demand, ETF/investor flows, physical demand, supply constraints, geopolitical risk, market sentiment).

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

- Real yields ↓ → gold ↑ (most important macro link).

- Dollar ↓ → gold ↑ (strong second link).

- Central bank purchases & ETF inflows → sustained structural demand → gold ↑.

- Physical demand spikes (India/China) → adds seasonal/structural demand → gold ↑.

Use this functional view to analyze any gold move: ask which inputs changed and by how much.

Practical Examples & Data Points (2025 context)

- Record highs: gold hit record levels above $4,000/oz in October 2025 amid Fed-cut bets and trade tensions.

- ETF flows: global physically-backed gold ETFs recorded their largest monthly inflow in September 2025, forming part of the strongest quarter on record.

- Central banks: central banks continued to purchase gold in 2025, with monthly rebounds in August and strategic accumulation over 2024–2025.

These data points show that the rally is underpinned by both investment and sovereign demand.

Common Myths & Misconceptions

- “Gold always goes up in inflation.” Not always; gold’s relationship with inflation is mediated by real yields and policy responses. If central banks hike nominal rates far above inflation, real yields may rise and gold can fall.

- “Gold is a perfect hedge.” Gold reduces some risks, but it’s not a perfect hedge for every scenario and can be volatile.

- “Physical demand alone moves the market.” Physical demand matters, but large moves often require institutional flows (ETFs, central banks, funds).

Risk Factors That Could Reverse the Rally

- Sharper-than-expected Fed hawkishness: if central banks tighten more than markets expect, real yields could rise and dampen gold.

- Stronger USD: a sudden dollar rally (e.g., due to safe-asset flows to the dollar) can reduce gold demand.

- Profit-taking & technical corrections: momentum-driven rallies often have sharp pullbacks. Reuters and other analysts warn that despite strong fundamentals, corrections are possible.

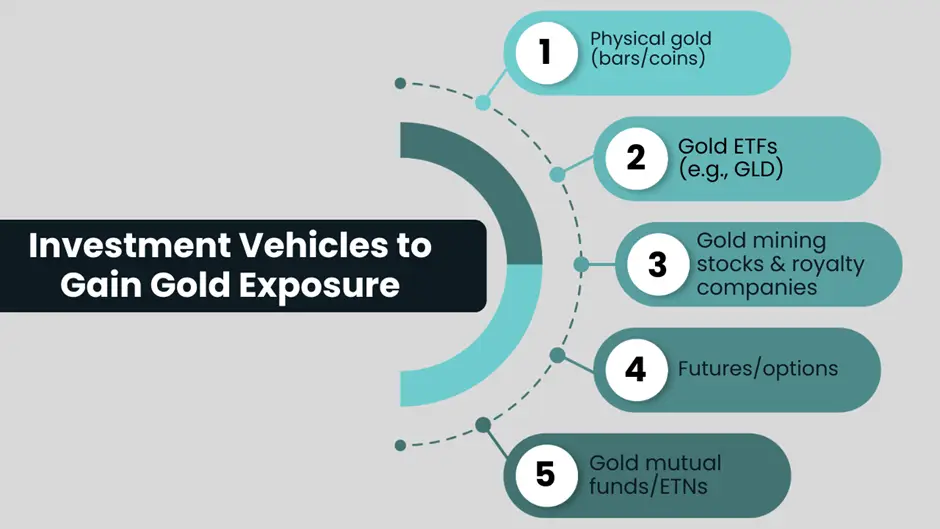

How Different Market Participants Use Gold

- Central banks: strategic reserve diversification and risk management. Institutional investors: portfolio diversification, inflation hedging, tactical allocation via ETFs and futures.

- Retail investors: savings, jewelry, and speculative positions often bought via ETFs or physical bullion.

Classroom Example: Build a Simple Gold Price Model (for students)

Model inputs (monthly):

- Real 10-yr yield (Δ)

- USD index (Δ)

- ETF net flows (monthly USD)

- Central bank net purchases (tons/month)

- Seasonal demand (India/China indicators)

- Supply shocks (dummy variable)

Interpretation: coefficients a–d show sensitivity. In practice, researchers find negative coefficients on real yields and USD (i.e., when yields/USD fall, gold rises) and positive coefficients on ETF and central bank flows. Use actual monthly data from WGC and central bank reports to calibrate for coursework.

Frequently Asked Questions (Students’ Edition)

Q1: Is gold a good hedge against inflation?

A1: It can be, but its effectiveness depends on real yields and central bank policy responses. If nominal yields outpace inflation and real yields rise, gold can underperform.

Q2: Will gold keep rising forever?

A2: No asset rises forever. Structural demands and flows can support long trends, but corrections and reversals happen when macro inputs change (e.g., real yields rise).

Q3: Should I buy gold now?

A3: That depends on your risk profile, investment horizon, and portfolio objectives. Consider diversification, not speculation. Use ETFs for liquidity and lower transaction costs if you’re a retail investor.

Q4: How much does central bank buying matter?

A4: A lot — sovereign purchases are large, persistent, and can create a structural bid under prices. 2023–2025 saw record purchases.

Classroom Assignment Idea (for teachers)

Assignment: Collect monthly time series data for gold price, 10-yr nominal yield, CPI inflation, USD index, ETF holdings (monthly change), and central bank gold purchases for the past 5 years. Run a multiple regression to explain gold price changes. Interpret coefficients and discuss structural breaks (e.g., 2020 pandemic, 2022 inflation spike, 2025 rally). Use World Gold Council and central bank reports for primary inputs.

Policy & Macro Implications (why it matters beyond investors)

- Reserve management: more central bank gold accumulation signals shifting reserve strategies globally and affects currency/geopolitical dynamics.

- Currency policy: countries with weaker currencies can be pushed into buying hard assets as a hedge, reinforcing the trend.

- Commodity markets interplay: high gold prices can influence mining investment and resource allocation across metals.

A Balanced View: Bull Case vs. Bear Case

Bull case (reasons gold could continue rising)

- Continued Fed easing or rate cuts → lower real yields.

- Sustained ETF inflows and central bank purchases create structural demand.

- Ongoing geopolitical risks and trade tensions keep safe-haven demand elevated.

Bear case (reasons for correction)

- Renewed hawkish policy and rising real yields.

- Sudden USD strength.

- Heavy profit-taking or a shift from gold to risk assets if global growth reaccelerates.

Conclusion — Putting It All Together

Why gold prices keep rising is not a simple story of one single variable. Instead, it’s the convergence of monetary easing expectations, falling real yields, a weaker U.S. dollar, record ETF inflows, renewed central bank buying, pockets of strong physical demand (notably India and China), and heightened geopolitical risk. These factors combine to create both immediate buying pressure and longer-term structural demand — and together they explain the strong upward move we’ve seen in 2025.

For students: memorize the causal chain linking real yields → dollar → demand and keep an eye on ETF flows and central bank purchases for tangible evidence of investor intent. For investors: gold can have a place in diversified portfolios, but understand the risks and mechanics outlined above.