If you’re planning to build a career in finance, FRM Coaching is one of the smartest investments you can make. The Best FRM Course prepares you for a globally recognized qualification that opens doors to high-paying and prestigious roles in risk management, investment banking, corporate finance, and more. Understanding FRM Exam Cost, FRM Exam Dates, FRM Salary, FRM Job Opportunity, and FRM Course Duration is crucial before you begin your journey. At RBei Classes, we guide students step-by-step to clear FRM exams efficiently and confidently — even if they are starting from scratch.

Table of Contents

ToggleWhat is FRM and Why is it Important?

The Financial Risk Manager (FRM) designation, offered by the Global Association of Risk Professionals (GARP), is the gold standard in risk management education. Whether you are a finance student, a working professional, or someone planning a career switch, FRM equips you with skills in market risk, credit risk, operational risk, and investment risk management.

Employers across top banks, asset management companies, hedge funds, and consulting firms actively seek FRM-certified professionals because they bring specialized expertise in identifying, assessing, and mitigating financial risks. In today’s volatile market environment, this skill set is not just valuable — it’s essential.

Areas of Study in the FRM Course

The FRM curriculum is comprehensive and designed to ensure you have both theoretical knowledge and practical application skills.

FRM Part 1 covers:

- Foundations of Risk Management

- Quantitative Analysis

- Financial Markets and Products

- Valuation and Risk Models

FRM Part 2 covers:

- Market Risk Measurement and Management

- Credit Risk Measurement and Management

- Operational Risk and Resiliency

- Liquidity and Treasury Risk Management

- Risk Management and Investment Management

- Current Issues in Financial Markets

At RBei Classes, we simplify these complex topics using real-life case studies, practical examples, and exam-focused notes so that students not only pass but also understand how to apply the concepts in real-world finance.

Job Opportunities after FRM

An FRM certification opens doors to multiple industries and positions. Here are some common roles FRM holders take up:

- Risk Analyst or Risk Manager

- Investment Banking Associate

- Credit Risk Analyst

- Market Risk Analyst

- Treasury Manager

- Portfolio Manager

- Quantitative Analyst

Top recruiters include JP Morgan, Goldman Sachs, HSBC, KPMG, Deloitte, PwC, and Citibank.

With the growing demand for risk management professionals, FRM-certified candidates often enjoy faster promotions, better job security, and global career mobility.

Best FRM Coaching – Why RBei Classes Leads the Way

While self-study is possible, the FRM syllabus is vast and can feel overwhelming without proper guidance. This is why choosing the Best FRM Coaching is crucial.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

Why RBei Classes?

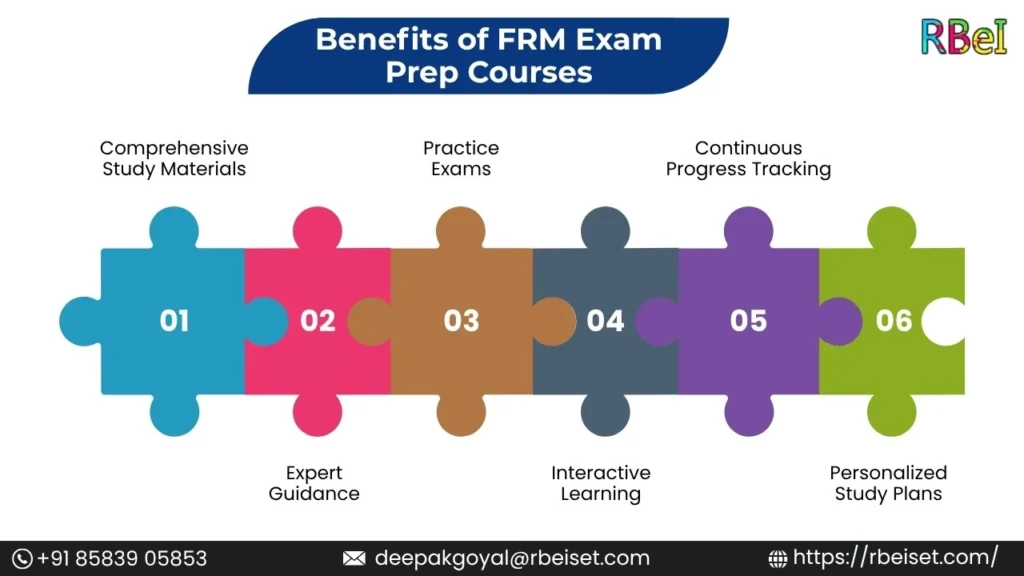

- Expert faculty with years of FRM teaching experience

- Concept clarity through simple, real-world examples

- Flexible learning — live online classes, recorded sessions, and doubt-solving support

- Structured study plans to cover the syllabus in time for the exam

- Mock tests and performance tracking

- Affordable fee structure compared to other institutes

We have trained hundreds of successful FRM candidates across India, and our results speak for themselves.

FRM Exam Cost and Important Dates

Before you enroll, it’s important to understand the FRM Exam Cost:

- Enrollment Fee – One-time payment of USD 400 (around ₹33,000) when you first register.

2. Part 1 Exam Fee – USD 600 to USD 1,000 (₹50,000 to ₹83,000) depending on when you register (early, standard, or late).

3. Part 2 Exam Fee – Same as Part 1.

FRM Exam Dates 2025 (Tentative):

- FRM Part 1: May, August, November windows

- FRM Part 2: May and November windows

Booking early saves you money and gives more time to prepare.

FRM Salary in India and Abroad

FRM-certified professionals enjoy lucrative salaries.

- In India – Average salary ranges from ₹8 lakh to ₹20 lakh per annum depending on experience.

- Abroad – Salaries often exceed USD 90,000 annually, with bonuses for top performers.

Salaries also vary based on the role, location, and industry, but one thing is clear — the ROI on FRM Coaching is very high.

FRM Course Duration

Most students take 1.5 to 2 years to complete both FRM levels. However, with the right coaching and disciplined preparation, it is possible to clear faster.

Can I Clear FRM Level 1 in 3 Months?

Yes, it’s possible — but it requires focused study, proper guidance, and a disciplined schedule. At RBei Classes, we have helped students achieve this by providing:

- Concise study notes

- Chapter-wise video lectures

- Weekly revision tests

- Time management strategies for the exam

If you can dedicate 3–4 hours daily and follow a structured plan, clearing FRM Level 1 in 3 months is achievable.

What if I Fail FRM?

Failing FRM is not the end — many successful professionals didn’t pass on their first attempt. You can retake the exam in the next available window. The key is to:

- Analyze your weak areas

- Change your preparation strategy

- Seek expert guidance (if not already doing so)

RBei Classes offers personalized doubt-solving and customized study plans for repeat candidates to ensure they pass the next time.

Is FRM Easier than ACCA?

Yes, FRM is generally considered easier than ACCA in terms of content volume and exam duration.

- FRM has two levels, while ACCA has 13 papers.

- FRM focuses specifically on risk management, while ACCA covers a broader accounting and finance syllabus.

If your goal is a specialized career in risk management, FRM is the faster and more targeted option.

Final Thoughts – Choosing the Right Path with FRM Coaching

Pursuing the FRM certification is a career-changing decision. With the Best FRM Coaching like RBei Classes, you get the knowledge, strategies, and confidence to succeed. Whether you’re aiming for high-paying FRM job opportunities, preparing for FRM Exam Dates in the coming year, or calculating the FRM Exam Cost for your budget, planning ahead is essential.

At RBei Classes, our mission is simple — help you clear the FRM exams in the shortest time with maximum clarity and confidence. With expert mentoring, proven strategies, and continuous support, your FRM journey will not just be a qualification — it will be the launchpad for your dream finance career.