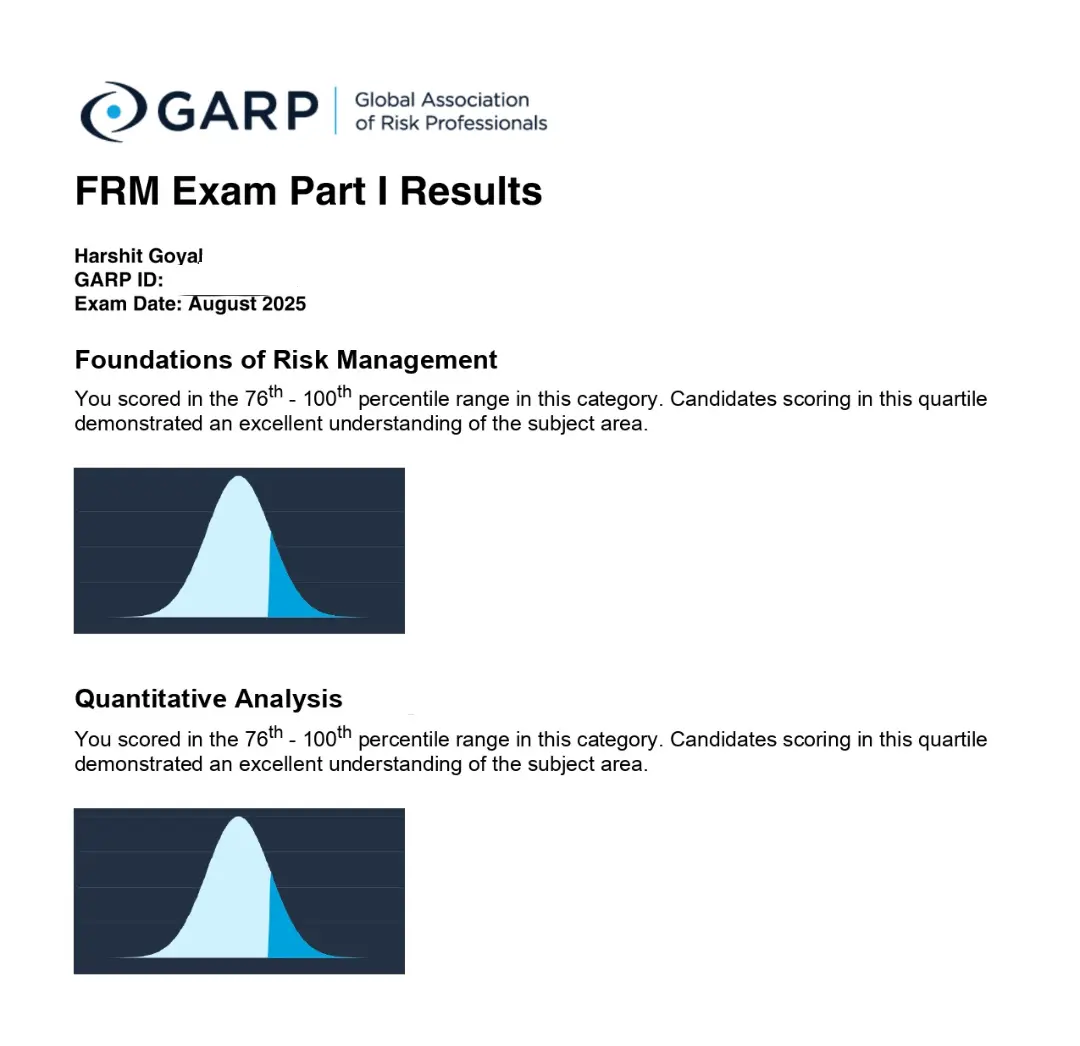

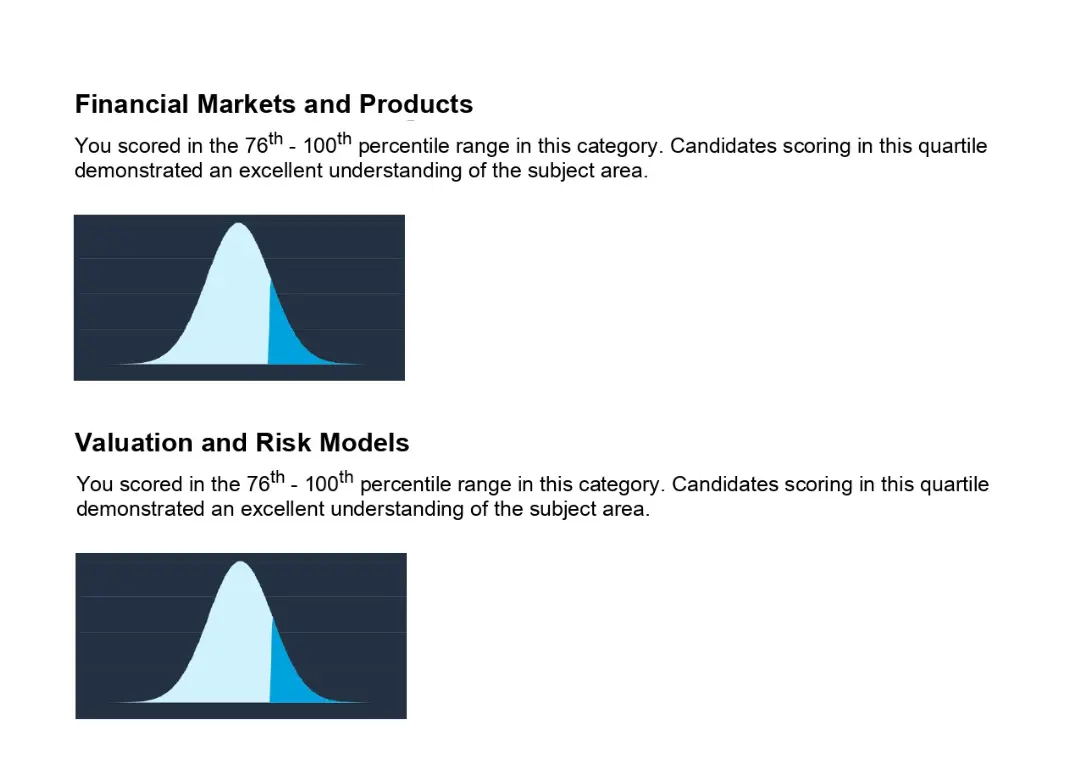

When I look back at my journey of clearing the FRM Part 1 exam in August 2025 with top quartiles in all four subjects, it still feels unreal. As a full-time college student with zero background in finance or accounts, I constantly worried about balancing my studies with a hectic academic schedule. Yet, today, I can proudly say I not only passed FRM Part 1 in my first attempt but also secured top quartiles across all the subjects.

Table of Contents

ToggleIn this blog, I want to share my detailed journey — why I chose FRM over CFA, how I discovered RBei Classes (the best FRM coaching in India), the role of Deepak Goyal Sir’s mentorship, and how I managed to study 5-6 hours a day alongside college. More importantly, I want to show you how FRM online classes, structured study material, and the right guidance transformed me from a beginner with no knowledge of finance to a confident professional with a clear career direction.

The aim of this blog is simple: if you are confused between CFA vs FRM, or wondering why choose FRM, or searching for the best FRM coaching in India, then my story will help you make an informed decision.

Why I Chose FRM Over CFA (CFA vs FRM)?

Like most finance aspirants, my first confusion was CFA vs FRM. Both are highly respected qualifications, both open great career opportunities, and both require immense dedication. However, after speaking with seniors, researching career paths, and attending a counselling session at RBei, I realized that FRM was a better fit for me.

- CFA focuses heavily on investment management, portfolio analysis, and equity valuation.

- FRM, on the other hand, is globally recognized for risk management, financial markets, quantitative techniques, and banking careers.

Since I wanted to build a career in banking and risk management, FRM seemed more aligned with my career goals. Moreover, the fact that FRM can be completed in two levels (unlike CFA’s three) and has immense global recognition motivated me further.

The decision of CFA vs FRM wasn’t easy, but the more I explored, the more I realized that FRM was the best stepping stone for my desired career in banking, credit risk, and risk analysis.

Why I Enrolled with RBei Classes – The Best FRM Coaching in India?

Once I finalized FRM, the bigger challenge was finding the right coaching. After all, I had zero knowledge of finance and accounting. I needed a mentor who could take me from the very basics and build my foundation step by step.

That’s when I came across RBei Classes, and it turned out to be the best decision of my FRM journey. RBei has the highest pass rate in India — 94% — which immediately gave me confidence. But beyond the numbers, what attracted me most was the personal mentorship of Deepak Goyal Sir.

His teaching style is unmatched. He doesn’t just explain concepts — he breaks them into such simple steps that even someone with no prior finance background (like me) can understand. He ensures every student feels confident about the subject before moving forward.

The FRM online classes by RBei were so well-structured that I never felt lost. Lectures were easy to follow, detailed yet simple, and every topic was covered from scratch. For me, the biggest plus was that Deepak Sir was personally available for doubt resolution. Imagine having a mentor who replies to your queries late at night or guides you when you feel stuck — that’s the level of dedication he brings.

My Study Journey – From Zero Finance Knowledge to Top Quartiles

When I started, I was honestly scared. Terms like VAR, derivatives, fixed income, or quantitative analysis were completely new to me. I still remember my first class where Deepak Sir explained time value of money using simple day-to-day examples. That day I felt — yes, I can do this.

Here’s how I prepared step by step:

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

Step 1: Structured Classes and Notes

The FRM course is vast, but RBei’s structured notes and lecture flow made it manageable. Every class started from basics, built up concepts, and then connected them to exam-oriented questions.

Step 2: Daily Routine with 5-6 Hours of Study

Since I was in college, I had to manage time carefully. On most days, I studied 5–6 hours after college. It wasn’t easy, but RBei’s schedule helped me stay disciplined.

Step 3: Practice, Practice, Practice

FRM isn’t just about reading theory. It’s about solving hundreds of questions until you think like a risk manager. RBei provided thousands of practice questions and mock tests. The mocks replicated the actual exam pattern and boosted my confidence massively.

Step 4: Mentorship and Motivation

The best part of RBei was the personal mentorship by Deepak Sir. Whenever I felt overwhelmed, he guided me patiently. He often said, “Don’t run behind shortcuts, build concepts. Once you know concepts, passing FRM becomes natural.”

Career Opportunities After FRM – Why It Was Worth It

One of the biggest reasons I chose FRM was the career opportunities. During my preparation, I interacted with RBei alumni who are now working in top banks, Big 4 consulting firms, and global financial institutions.

Some of the most popular roles after FRM include:

- Risk Analyst

- Credit Risk Manager

- Investment Banking Associate

- Quantitative Analyst

- Treasury and Risk Consultant

FRM holds high value in banking and financial risk management, and I aim to build a long-term career in this field.

Why FRM Online Classes Made the Difference?

Since I was managing college, offline coaching was not possible. The FRM online classes by RBei made my journey possible. The recordings were available 24/7, so I could revisit concepts anytime. If I missed a class, I didn’t panic — I simply watched the recording.

The flexibility of online learning, combined with structured mentorship, was the perfect balance for my situation. Without FRM online classes, I don’t think I could have cleared with such strong results.

How RBei Classes Helped Me Secure Top Quartiles in All Subjects?

This is something I’m truly proud of. Out of thousands of students who attempt FRM Part 1, very few manage to score top quartiles in all four subjects. Here’s how RBei helped me achieve that:

- Foundational Teaching – Even with zero background, I never felt left behind.

- Exam-Focused Study Material – Every concept was backed with practice questions.

- Regular Mocks – The mocks were the game-changer. By exam day, I had already attempted 5 full-length mocks.

- Personal Mentorship – Deepak Sir guided me not just academically, but also mentally, keeping my stress levels low.

- Doubt Resolution – Whenever I got stuck, my queries were resolved quickly, so I never carried confusion forward.

Thanks to this approach, I walked into the exam hall with confidence — and walked out with top quartiles across all subjects.

Why RBei is the Best FRM Coaching in India?

If someone asks me today, “What’s the best FRM coaching in India?” — my answer will be RBei Classes without hesitation. Here’s why:

- 94% Pass Rate — Highest in India

- Comprehensive FRM Course Material

- FRM Online Classes with Flexibility

- Personal Mentorship by Deepak Goyal Sir

- Best Guidance for College Students

- Proven Track Record of Top Quartile Results

RBei doesn’t just prepare you for exams, they prepare you for a career in risk management.

Frequently Asked Questions (FAQs)

1. Which is better: CFA vs FRM?

The debate of CFA vs FRM is one of the most common among finance students. Both certifications hold global recognition and open doors to very different career paths.

- CFA (Chartered Financial Analyst): Best suited for careers in investment banking, equity research, asset management, and portfolio management.

- FRM (Financial Risk Manager): Focused on risk management, credit analysis, derivatives, treasury, and banking.

If your dream career is in banking, credit risk, market risk, or financial consulting, then FRM is the better choice. On the other hand, if you want to pursue roles like portfolio manager or equity analyst, CFA might be more aligned. Many professionals also pursue both CFA and FRM for a competitive edge.

2. What are the career opportunities after FRM?

FRM is considered one of the most rewarding certifications in finance. After completing the FRM course, you can explore opportunities in:

- Banks and Financial Institutions – Risk Analyst, Credit Risk Manager, Treasury Analyst

- Big 4 Consulting Firms – Risk Advisory, Financial Risk Consulting

- Investment Banks – Quantitative Analyst, Risk Controller

- FinTech & Insurance – Risk Modeling, Compliance

Globally, FRM holders work in organizations like JP Morgan, Goldman Sachs, HSBC, BlackRock, PwC, and Deloitte. Since banks and regulators value strong risk management, FRM-certified professionals are in very high demand.

3. Which is the best FRM coaching in India?

When students ask about the best FRM coaching in India, one name stands out consistently — RBei Classes. Here’s why:

- 94% Highest Pass Rate in India for FRM exams.

- Structured FRM Online Classes with recordings available 24/7.

- Deepak Goyal Sir personally mentored me and simplified finance so that even beginners could understand easily.

- Best preparation material covering every topic from basics to advanced levels.

- Proven success stories where students with zero finance background cleared FRM in their first attempt with top quartiles.

With its student-focused mentorship and consistent results, RBei Classes is undoubtedly the best choice for FRM aspirants in India.

4. Can I prepare for FRM Part 1 with a full-time job or college?

Yes, absolutely. Thousands of students clear FRM while balancing jobs or college. The key is structured planning and consistent study hours. Most successful candidates dedicate 2–3 hours daily on weekdays and 5–6 hours on weekends.

With FRM online classes, it has become even easier to manage. Students can attend live classes or watch recorded sessions at their convenience. At RBei, many students, just like me, have cracked FRM Part 1 by studying 5–6 hours a day alongside college. The mentorship ensures you stay motivated and disciplined throughout.

5. Is FRM worth it in India?

Yes, FRM is absolutely worth it in India, especially if you aim to build a career in banking, financial services, or consulting. With the increasing focus on risk management, compliance, and financial regulations, demand for FRM-certified professionals is growing rapidly.

In India, FRM opens doors to:

- Jobs in private and government banks

- Risk and compliance roles in NBFCs and insurance companies

- Consulting opportunities with Big 4 firms (PwC, Deloitte, KPMG, EY)

- Risk roles in MNCs and FinTech companies

Moreover, FRM is recognized in more than 190 countries, so it also gives you global mobility. With salaries ranging from ₹8 LPA for freshers to ₹30+ LPA for experienced professionals, FRM is one of the most high ROI courses in finance.