Table of Contents

ToggleWhen it comes to Excel for Financial Modelling, beginners often feel overwhelmed by the endless formulas, shortcuts, and functions available. Yet, mastering Excel for financial modelling is the most essential skill for any aspiring financial analyst, investment banker, or corporate finance professional. From valuation models to M&A deals, Excel forms the backbone of financial decision-making. The right Excel formulas for financial modelling and structured use of shortcuts can drastically improve efficiency, accuracy, and confidence while building models.

In this blog, we will cover everything a beginner needs: the best Excel formulas for financial modelling, powerful Excel shortcuts for finance, practical modelling with Excel functions, common mistakes to avoid, and advanced tips used by real analysts. By the end, you’ll have a solid toolkit to make your models faster, cleaner, and more professional.

At RBei Classes, we train students with real-world case studies and industry-level projects to ensure you not only learn Excel but also apply it in the context of financial modelling. Let’s dive into this step-by-step guide.

Why Excel is Essential for Financial Modelling Beginners

Financial modelling involves forecasting, analyzing, and valuing companies using structured frameworks. While tools like Python, R, and Power BI are rising in popularity, Excel for financial modelling continues to dominate the finance world.

Here’s why Excel is a must-learn:

- Universality – Every company uses Excel, making it a global financial language.

- Flexibility – Whether it’s building a discounted cash flow (DCF) model, M&A model, or leveraged buyout (LBO), Excel adapts to your needs.

- Speed – With the right Excel shortcuts for finance, you can build and audit models 2x faster.

- Transparency – Unlike black-box tools, Excel allows full visibility of every assumption and calculation.

Before you aim to become an investment banker, equity analyst, or corporate finance professional, mastering Excel formulas for financial modelling is your first step.

Also read: Top 10 Skills Required to Master Financial Modelling

Best Excel Formulas for Financial Modelling Beginners

Core Formulas Every Financial Analyst Must Know

When you start with modelling using Excel functions, it’s important to focus on practical, finance-relevant formulas rather than learning everything. Below are the best Excel formulas for financial modelling every beginner should know:

- SUM / AVERAGE / COUNT

- Used for basic aggregations (revenues, expenses, headcount).

- Shortcut-friendly and widely used in every sheet.

- IF / Nested IF

- Helps build scenarios and conditions in models.

- Example: IF sales growth < 10%, reduce marketing spend by 5%.

- VLOOKUP / HLOOKUP / XLOOKUP

- Used to fetch specific data from large sheets.

- Essential when linking assumptions to calculations.

- INDEX + MATCH

- More flexible than VLOOKUP; can search across rows and columns.

- Common in advanced financial analyst Excel skills.

- PMT, IPMT, PPMT

- Critical for loan repayment and interest schedule modelling.

- NPV / IRR / XNPV / XIRR

- Used for valuation and investment decision-making.

- Example: Calculating NPV of a project cash flow.

- TEXT / DATE Functions (EOMONTH, YEAR, MONTH)

- Perfect for time-based forecasting in financial models.

- ROUND / ROUNDUP / ROUNDDOWN

- Avoids messy decimal outputs in reports.

These are not just random functions. They are the backbone of valuation, M&A, and corporate finance models.

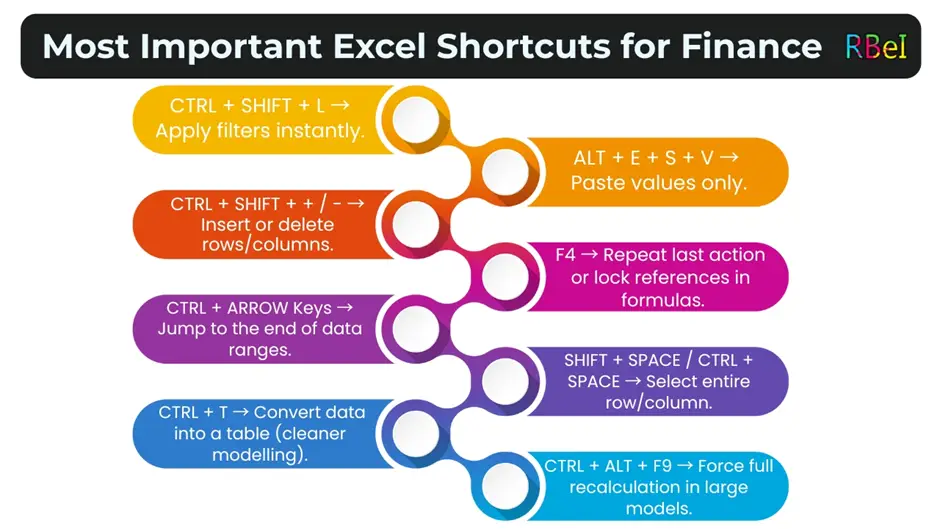

Why Shortcuts Matter in Financial Modelling

When you’re working on large valuation models, speed is everything. Professionals can’t afford to waste time clicking menus when a shortcut saves seconds on every step. Over a 200-sheet M&A model, those seconds add up to hours.

Here are the most important Excel shortcuts for finance:

- CTRL + SHIFT + L → Apply filters instantly.

- ALT + E + S + V → Paste values only.

- CTRL + SHIFT + + / – → Insert or delete rows/columns.

- F4 → Repeat last action or lock references in formulas.

- CTRL + ARROW Keys → Jump to the end of data ranges.

- SHIFT + SPACE / CTRL + SPACE → Select entire row/column.

- CTRL + T → Convert data into a table (cleaner modelling).

- CTRL + ALT + F9 → Force full recalculation in large models.

Memorizing these shortcuts can make you 2x faster, which is why every top analyst swears by them.

Practical Tips for Modelling with Excel Functions

Structuring Your Model

- Always separate assumptions, calculations, and outputs into different sheets.

- Use consistent color coding: Blue (inputs), Black (formulas), Green (links).

- Apply named ranges for key assumptions like growth, discount rate, etc.

Building Scenarios

Use IF formulas or scenario managers to test multiple cases:

- Base Case: Normal growth.

- Upside Case: Aggressive growth.

- Downside Case: Recession scenario.

Linking Sheets Efficiently

- Always link assumptions instead of hardcoding numbers.

- Use INDEX-MATCH for dynamic referencing instead of static cell links.

These habits make your model professional and audit-proof.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

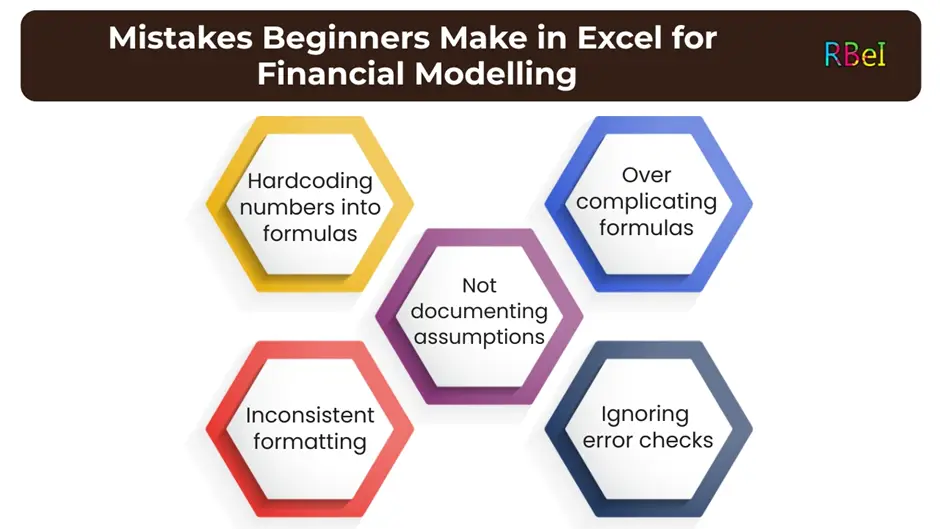

Mistakes Beginners Make in Excel for Financial Modelling

Even with the best formulas and shortcuts, beginners often make errors that cost them job interviews or credibility. Here are the most common mistakes:

- Hardcoding numbers into formulas

- Example: =100 instead of linking to assumptions.

- Overcomplicating formulas

- Long nested IFs make auditing impossible.

- Inconsistent formatting

- Different colors, no naming convention.

- Ignoring error checks

- Professional models always have error checks like balance sheet balancing.

- Not documenting assumptions

- Future analysts must know why a certain rate was chosen.

At RBei Classes, we emphasize avoiding these mistakes by teaching structured modelling practices.

Also read: Financial Modelling Case Studies: Real-World Examples You Must Learn

Advanced Excel Tips for Aspiring Financial Analysts

Once you’ve mastered the basics, step into advanced techniques to stand out:

- Dynamic Charts with Named Ranges – To present financial data clearly.

- Macros & VBA Basics – Automating repetitive tasks.

- Sensitivity Analysis with Data Tables – Testing how assumptions affect valuation.

- Power Query & Pivot Tables – Cleaning and analyzing large datasets.

- Error Traps (IFERROR) – Keeping outputs clean and presentation-ready.

These advanced techniques give you a competitive edge in finance job interviews.

How RBei Classes Helps You Master Excel for Financial Modelling

At RBei Classes, we don’t just teach theory — we focus on practical exposure to Excel in real financial modelling projects. Our students build live case studies on valuation, M&A, and IPO modelling. Here’s why students prefer us:

- Faculty with industry expertise: Real investment bankers & analysts.

- Placement support: Resume workshops, mock interviews, and job referrals.

- Doubt-solving sessions: Every student gets one-on-one mentorship.

- Practical focus: You’ll work on DCF, LBO, and M&A models, not just Excel basics.

If you are serious about a career in finance, joining our Financial Modelling and Investment Banking course is the best step you can take.

Conclusion

Excel for financial modelling is not just a skill; it’s the foundation of your finance career. By learning the best Excel formulas for financial modelling, mastering Excel shortcuts for finance, and practicing modelling with Excel functions, you can work like a professional analyst. Avoiding common mistakes and gradually upgrading to advanced skills will ensure you stand out in job interviews and practical roles.

Whether you’re a beginner or preparing for investment banking, the journey always starts with Excel. At RBei Classes, we guide you step by step so you can confidently build, audit, and present financial models.

FAQs on Excel Tips & Tricks for Financial Modelling

1. Which Excel formulas are most important for financial modelling beginners?

The most important Excel formulas for financial modelling beginners include:

- SUM & AVERAGE → for basic aggregations.

- IF / Nested IF → for building scenarios.

- VLOOKUP / XLOOKUP → for fetching data.

- INDEX + MATCH → flexible lookups across rows & columns.

- NPV / IRR → for valuation and investment analysis.

- PMT / IPMT → for loan and interest calculations.

- ROUND → to clean up messy outputs.

These formulas form the backbone of DCF models, M&A projections, and financial planning models, which is why every analyst must master them.

2. How do Excel shortcuts help in financial modelling?

Excel shortcuts for finance help analysts save time, increase accuracy, and build models faster. For example:

- ALT + E + S + V → paste values without formulas.

- CTRL + SHIFT + + / – → insert or delete rows/columns instantly.

- F4 → lock references in formulas or repeat last action.

- CTRL + ARROW Keys → jump across data tables quickly.

When you work on 200+ sheet models in investment banking or equity research, shortcuts can save hours. In fact, professionals say shortcuts double your efficiency compared to using the mouse.

3. What are the common mistakes beginners make in Excel for financial modelling?

The most common mistakes are:

- Hardcoding numbers into formulas instead of linking to assumption sheets.

- Overcomplicating formulas with long nested IFs that are hard to audit.

- Inconsistent formatting, making models look messy and unprofessional.

- Not using error checks like balance sheet balancing.

- Ignoring documentation of assumptions, making models hard to understand later.

At RBei Classes, students are trained to avoid these errors by following structured modelling practices used by professionals.

4. Do I need advanced Excel (like VBA) to start financial modelling?

No, beginners don’t need VBA or advanced macros to start financial modelling. You only need a solid understanding of core Excel formulas and shortcuts first. Once you’re comfortable building DCF, M&A, or LBO models, you can explore advanced tools like VBA, Power Query, and Pivot Tables to automate processes.

Think of VBA as a bonus skill. But without mastering basic Excel formulas, advanced tools won’t help.

5. How long does it take to master Excel for financial modelling?

On average, it takes:

- 1–2 months to learn core Excel formulas and shortcuts (if practiced daily).

- 3–4 months to become comfortable building full models like DCF or M&A.

- 6+ months to reach professional-level efficiency where you can handle complex projects.

With guided mentorship and case studies (like those taught at RBei Classes), students typically become job-ready in 4–5 months, since they practice real-world examples instead of just theory.

Student Reviews for RBei Classes

1. Rahul Mehta – Working Professional (Analyst, Deloitte, Mumbai)

“The Financial Modelling and Investment Banking course at RBei Classes completely transformed my understanding of finance. The lectures were very clear and industry-oriented. Placement support was excellent; I received guidance on resume building and mock interviews that helped me crack Deloitte. What stood out was the focus on practical exposure – building real DCF and M&A models made me feel confident at work. Faculty are approachable and doubt-solving sessions ensured I never felt stuck.”

2. Ananya Sharma – College Student (Final Year, SRCC, Delhi)

“As a finance student at SRCC, I was looking for a course that bridges the gap between theory and practice. RBei Classes did exactly that. The lectures were interactive, and concepts like valuation and IPO processes became easy to understand. Faculty were patient in doubt-solving, and the course had a strong hands-on focus on Excel and modelling. I now feel much more prepared for my placements.”

3. Amit Reddy – Working Professional (Finance Executive, Infosys, Bangalore)

“Coming from an IT company’s finance team, I wanted to sharpen my investment banking knowledge. The RBei Classes faculty explained complex topics with real examples from Indian markets. Doubt-solving was personalized, and the placement guidance gave me confidence in interviews. What impressed me most was the practical case studies we worked on, which I could immediately apply in my role at Infosys.”

4. Priya Nair – College Student (MBA, IIM Bangalore)

“During my MBA at IIM Bangalore, I realized I needed strong financial modelling skills for summer internships. This course gave me exactly that. From Excel tips to advanced valuation models, everything was explained step by step. Faculty shared insights from their IB careers, and that exposure was priceless. The doubt-clearing sessions were flexible, which made learning smooth. I strongly recommend this to every MBA student.”

5. Kunal Gupta – Working Professional (Equity Research, HDFC Securities, Delhi)

“After joining RBei Classes, my productivity at work improved drastically. The Excel shortcuts and modelling techniques I learned save me hours daily. Placement support is very strong, especially for those looking to transition into IB or equity research. Faculty not only focus on concepts but also on how they are applied in the industry. The balance between lectures, assignments, and real projects makes this course stand out.”

6. Megha Kapoor – College Student (B.Com, St. Xavier’s College, Mumbai)

“As an undergraduate at St. Xavier’s, I always feared Excel and finance models. This course changed that. The lectures were simple yet comprehensive, and practice assignments helped me master concepts. Faculty were always available for doubt-solving, even beyond class hours. I loved the emphasis on practical exposure, which made me more confident in handling internships.”

7. Rohit Singh – Working Professional (Senior Associate, PwC, Gurgaon)

“I had some prior exposure to financial statements, but modelling was new to me. The step-by-step teaching style at RBei Classes made it very easy. The placement preparation sessions helped me get interview-ready. Faculty brought in real corporate examples, and the focus on core concepts like DCF and M&A was extremely useful for my work at PwC. This course is worth every minute.”

8. Sneha Iyer – College Student (Economics Hons, Christ University, Bangalore)

“The best part of RBei Classes is the practical learning approach. Instead of only slides, we built full models in Excel from scratch. Doubt-solving sessions were super helpful, and faculty always encouraged questions. I especially liked the placement workshops that guided us on how to present financial skills in resumes. As a college student, this course gave me a clear edge in campus placements.”

9. Arjun Malhotra – Working Professional (Corporate Banking, ICICI Bank, Pune)

“As a corporate banker, I wanted to understand investment banking models better. RBei Classes provided exactly that. The lectures were structured and detailed, faculty had deep knowledge, and practical exercises were highly relevant. Doubt sessions were always on time, and placement support helped me explore new opportunities. The hands-on exposure to valuation models gave me confidence in discussions with clients.”

10. Simran Kaur – College Student (MBA, Punjab University, Chandigarh)

“The course exceeded my expectations. The faculty are highly experienced, and their teaching style makes even the toughest concepts easy. I loved the practical Excel training and case studies we solved. Placement support gave me a clear roadmap to target investment banking roles. Doubt-solving sessions were very personalized. Overall, the course made me industry-ready even before graduating.”