Table of Contents

ToggleWhen students step into the world of finance, one question often dominates their mind: Financial Modelling vs CFA, which is better for my career? Both Financial Modelling and CFA (Chartered Financial Analyst) are highly respected pathways, but they serve different purposes. If you want to understand which option fits your goals, you must compare CFA vs Financial Modelling not just in terms of course structure, but also in terms of career opportunities, industry relevance, and long-term growth. At RBei Classes, widely recognized as the best coaching classes for Financial Modelling and Investment Banking courses, we guide students through this exact confusion every single day.

In this blog, we will break down the differences between CFA and Financial Modelling, explain their scope, highlight their relevance in India and abroad, and help you decide the right career path.

Understanding Financial Modelling vs CFA

Before comparing CFA vs Financial Modelling, you must understand what each path actually means.

- CFA (Chartered Financial Analyst): This is a globally recognized professional qualification focused on investment management, equity research, portfolio management, and corporate finance. The CFA course is theory-driven, rigorous, and requires students to clear three levels. It is ideal for those aiming to build a career in asset management, equity research, or corporate finance.

- Financial Modelling: This is a practical skill that involves building models in Excel (or other tools) to evaluate businesses, forecast financial performance, analyze investments, and make corporate finance decisions. Financial Modelling is not a degree or certification by itself; instead, it is a job-ready skill that is highly valued in investment banking, private equity, consulting, and corporate finance.

Thus, Financial Modelling vs CFA is essentially a comparison of practical skills vs professional qualification. Both have strong advantages, but their career impact depends on your goals.

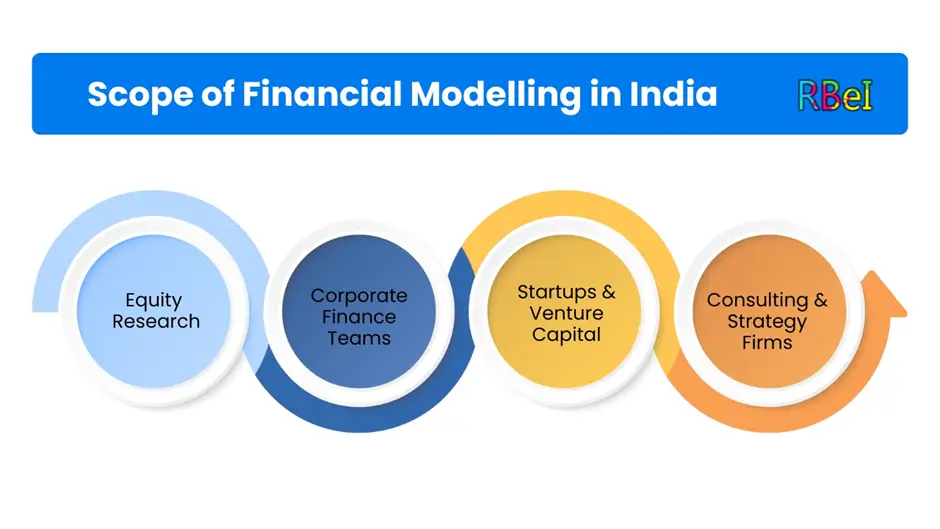

Scope of Financial Modelling in India

When considering CFA vs Financial Modelling, you must also look at industry demand. In India, the scope of Financial Modelling has expanded rapidly because companies are relying on data-driven decision-making. Financial Modelling is no longer limited to investment bankers; it is now widely used in:

- Equity Research: Analysts create valuation models for listed companies.

- Corporate Finance Teams: Professionals prepare budgeting and forecasting models.

- Startups & Venture Capital: Entrepreneurs and investors rely on models to evaluate funding rounds.

- Consulting & Strategy Firms: Models are used to assess M&A and restructuring.

The benefit of Financial Modelling is that it offers immediate job readiness. Unlike CFA, which takes years to complete, Financial Modelling can be mastered in a few months, especially with guidance from expert-led platforms like RBei Classes.

Career in CFA – A Global Qualification

On the other hand, if you pursue a career in CFA, you are choosing a globally respected designation. CFA is highly valued in:

- Asset Management Firms: To manage investment portfolios.

- Hedge Funds and Private Equity: To perform deep valuation analysis.

- Equity Research Houses: To publish industry and company-specific research reports.

- Corporate Finance Roles: Especially in multinational companies with global operations.

However, CFA is not an easy journey. It requires 3-4 years of dedication, clearing three levels, and gaining relevant work experience. That said, once you become a CFA charterholder, it opens doors to international opportunities, something Financial Modelling alone may not achieve.

CFA vs Financial Modelling – Which One Should You Choose?

The big question: Financial Modelling vs CFA – which is better? The answer lies in your career stage and professional goals.

- If you are a fresher or college student: Start with Financial Modelling to gain practical, job-ready skills. This will help you secure internships and entry-level roles in finance. Later, you can pursue CFA for deeper theoretical knowledge.

- If you are a working professional in finance: Adding Financial Modelling to your skill set will make you efficient in real-world projects. If you aspire for leadership or global recognition, combine it with CFA.

- If you want international mobility: CFA is the right choice since it is globally accepted. Financial Modelling complements it, but CFA is the recognized qualification worldwide.

- If you are aiming for Investment Banking: Both are useful, but recruiters expect Financial Modelling skills first. Once you establish yourself, CFA can add credibility. (You can also read our detailed blog on How to Become an Investment Banker for a clear roadmap.)

In short, it is not about Financial Modelling vs CFA as rivals, but about understanding how they complement each other.

CFA Course vs Practical Skills – The Real Difference

A key aspect of CFA vs Financial Modelling is the nature of learning:

- CFA is a structured, exam-driven course. It builds strong conceptual understanding of finance, ethics, and investment principles.

- Financial Modelling is a hands-on skill. You learn by building valuation models, running sensitivity analysis, and projecting cash flows.

Many students at RBei Classes start with Financial Modelling and later pursue CFA. This combination works best because you gain practical job skills first and then add the prestige of a CFA qualification.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

Salary Comparison – CFA vs Financial Modelling

Another factor in choosing Financial Modelling vs CFA is salary potential.

- Financial Modelling: Freshers can expect ₹6–10 LPA in investment banking or equity research roles. With experience, this can go up to ₹25–30 LPA in India.

- CFA: After clearing Level 3 and gaining experience, professionals can earn anywhere between ₹12–40 LPA in India, with even higher potential abroad.

This shows that both CFA and Financial Modelling have strong earning potential, but CFA has the edge in international markets.

Combining Financial Modelling and CFA for Maximum Impact

Rather than choosing CFA vs Financial Modelling as a strict either-or, many successful professionals combine both. The CFA qualification gives credibility, while Financial Modelling provides job readiness. Together, they make you highly competitive in finance careers.

For instance, an equity research analyst who knows Financial Modelling can prepare detailed valuation models, while CFA knowledge allows them to interpret market trends and apply ethical principles. This dual strength makes you stand out in the industry.

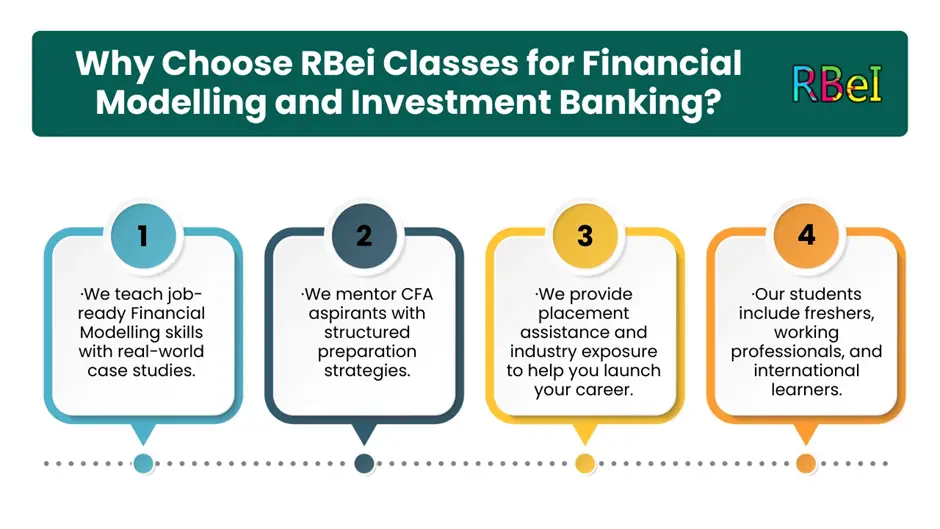

Why Choose RBei Classes for Financial Modelling and Investment Banking?

If you are confused about Financial Modelling vs CFA, the right coaching guidance can make all the difference. At RBei Classes, we are known as the best coaching classes for Financial Modelling and Investment Banking because:

- We teach job-ready Financial Modelling skills with real-world case studies.

- We mentor CFA aspirants with structured preparation strategies.

- We provide placement assistance and industry exposure to help you launch your career.

- Our students include freshers, working professionals, and international learners.

With 10,000+ students trained across 25+ countries, RBei Classes ensures that you don’t just learn, but actually build a career in finance.

Conclusion – Financial Modelling vs CFA, the Right Choice for You

To sum up, the Financial Modelling vs CFA debate is not about choosing one over the other. Instead, it is about aligning your choice with your career stage, professional goals, and desired opportunities.

- Start with Financial Modelling if you want immediate, practical skills.

- Pursue CFA if you want global recognition and a long-term career in investment management.

- Combine both for the strongest profile in finance careers.

At RBei Classes, we help you make the right decision and equip you with both skill and knowledge. Whether you dream of becoming an investment banker, equity analyst, or finance leader, our courses ensure you get there.

Check out our Financial Modelling and Investment Banking Course here to start your journey today.

Which is better for a fresher – Financial Modelling or CFA?

For freshers, Financial Modelling is usually the better starting point. The reason is simple: it is a practical, skill-based course that allows you to build models, analyze companies, and prepare valuation reports right from the beginning. Employers value this skill because it makes you job-ready quickly.

On the other hand, CFA is a long-term commitment with three levels and requires years of preparation. While CFA adds global recognition, freshers may find it difficult to secure entry-level roles based only on CFA knowledge without practical skills.

👉 Best strategy for freshers: Learn Financial Modelling first to secure internships or analyst roles. Later, pursue CFA to add a professional qualification and boost career growth.

Can I do both Financial Modelling and CFA together?

Yes, many students and professionals pursue Financial Modelling and CFA together, and in fact, this combination is highly recommended. Financial Modelling provides hands-on job skills, while CFA offers deep conceptual and theoretical knowledge.

Doing both ensures you are not only able to build financial models but also interpret results using frameworks taught in CFA. For example:

- In equity research, Financial Modelling helps you prepare valuation models, while CFA helps you analyze industries and markets.

- In investment banking, modelling skills get you shortlisted, but CFA boosts credibility with clients and employers.

👉 If you are a student with enough time, start with Financial Modelling and simultaneously prepare for CFA Level 1. This dual approach gives you an edge in placements and interviews.

What is the salary difference between CFA and Financial Modelling careers?

The salary difference depends on role, industry, and experience. Here’s a realistic comparison for India:

- Financial Modelling Careers: Freshers in investment banking, equity research, or corporate finance can expect salaries around ₹6–10 LPA. With 4–6 years of experience, this can rise to ₹20–30 LPA.

- CFA Careers: A CFA Level 3 candidate or charterholder with relevant experience can earn anywhere between ₹12–40 LPA in India. In global markets like the US, UK, or Singapore, salaries can go beyond $100,000 annually.

👉 Key takeaway: Financial Modelling ensures quick entry into finance jobs, while CFA ensures long-term growth and higher international salaries.

Is CFA necessary if I already know Financial Modelling?

No, CFA is not mandatory if you know Financial Modelling. Many professionals build strong careers in investment banking, corporate finance, or consulting purely with Financial Modelling skills. In fact, recruiters often prioritize modelling skills during hiring since they are directly applied in real work.

However, CFA adds credibility and opens international doors. If your goal is to work abroad, move into portfolio management, or climb into leadership roles, CFA gives you that recognition.

👉 So, Financial Modelling gets you the job, CFA helps you build a career. Doing both together is always an advantage.

What is the scope of Financial Modelling in India compared to CFA?

The scope of Financial Modelling in India is huge because the financial ecosystem is expanding rapidly. Startups, investment banks, private equity firms, and consulting companies are all hiring candidates who can build and analyze models. Since Financial Modelling is a short-term, practical skill, it is highly valuable for quick employability.

The scope of CFA is broader globally. In India, CFA demand is rising too, especially in investment research, asset management, and corporate finance roles. However, it is a long-term commitment and not as “job-ready” as Financial Modelling in the early stages.

👉 If you are focused on India and immediate career opportunities, Financial Modelling gives faster results. If you are focused on global recognition and long-term growth, CFA is the better bet.