When you are working full-time at a demanding job, preparing for a global finance exam seems like an impossible task. I faced the same challenge as a Scale 2 Officer at SBI Bank, where my daily schedule was already packed with branch operations, compliance targets, and customer interactions. Yet, I had a clear dream—to crack the FRM Part 1 exam within just 90 days and set a strong foundation for my career in risk management.

Table of Contents

ToggleIn the world of finance, there are countless resources and coaching institutes, but choosing the right one can completely change the outcome. While searching for the Best FRM Coaching in India, I came across RBei Classes, known for their 94% highest pass rate in India. Honestly, their reviews and teaching style gave me confidence at a time when I was unsure if I could balance my banking job with this demanding exam preparation.

At that moment, I had no idea how deeply this decision would shape my journey. Through this blog, I want to share my story, strategies, and insights on how anyone—especially working professionals like me—can pass FRM Part 1 in 90 days, while also answering some of the most common questions students often ask.

Why I Decided to Pursue FRM?

Working at SBI gave me exposure to credit risk, treasury, and compliance, but I realized that without a strong international qualification, my career growth would be limited. I wanted to move into global risk consulting or financial services, and the Financial Risk Manager (FRM) designation offered by GARP seemed like the most recognized path.

I asked myself: Can I manage FRM preparation along with my job responsibilities? That was the biggest question. And the answer came only when I discovered how to manage time effectively and how the right coaching institute could support me.

How I Found RBei Classes? – A Turning Point

When I started my research, I checked multiple options. Every institute promised results, but I needed something more practical. Unlike fresh graduates, working professionals cannot afford trial-and-error learning. We need focused, structured, and result-oriented guidance.

That is when I came across RBei Classes. What caught my attention was:

- Their 94% pass rate, the highest in India.

- The unlimited watch views for recorded lectures, allowing me to watch at my own pace.

- The validity till you pass feature, which gave me peace of mind.

- Detailed lectures that simplified difficult topics.

- Difficult mocks and the best practice set, which made the final exam feel easier.

- And most importantly, the personal mentorship from Deepak Goyal Sir.

Deepak Sir’s approach is very practical. What stood out for me was his availability—whenever I had doubts, he cleared them patiently, whether it was about conceptual clarity in Value at Risk or application-based case studies. His focus on making subjects easier for working professionals gave me hope.

My 90-Day Plan to Crack FRM Part 1

Balancing banking work and studies was not easy. I had to use every hour wisely. Here’s the strategy that worked for me:

1. Set Clear Targets

The first step was creating a 90-day calendar. I divided the four subjects of FRM Part 1—Foundations of Risk Management, Quantitative Analysis, Financial Markets & Products, and Valuation & Risk Models—into weekly chunks. Every Sunday, I reviewed my progress.

2. Daily Routine

- Morning: 1 hour of lecture revision before going to the bank.

- Evening: 2–3 hours after work, focusing on problem-solving.

- Weekends: 6–7 hours for practice sets and mock exams.

3. Using the Best Practice Set

The best practice set provided by RBei was significantly tougher than the actual exam. Initially, I felt it was too difficult, but later I realized this was their strength. When I finally appeared for the test, I found myself calm and confident because I had already practiced tougher problems.

4. Unlimited Recorded Lectures

Since recorded lectures at RBei are available with unlimited watch views, I often revised quantitative topics two to three times. For a working professional, this flexibility is priceless.

5. Mock Tests and Mentorship

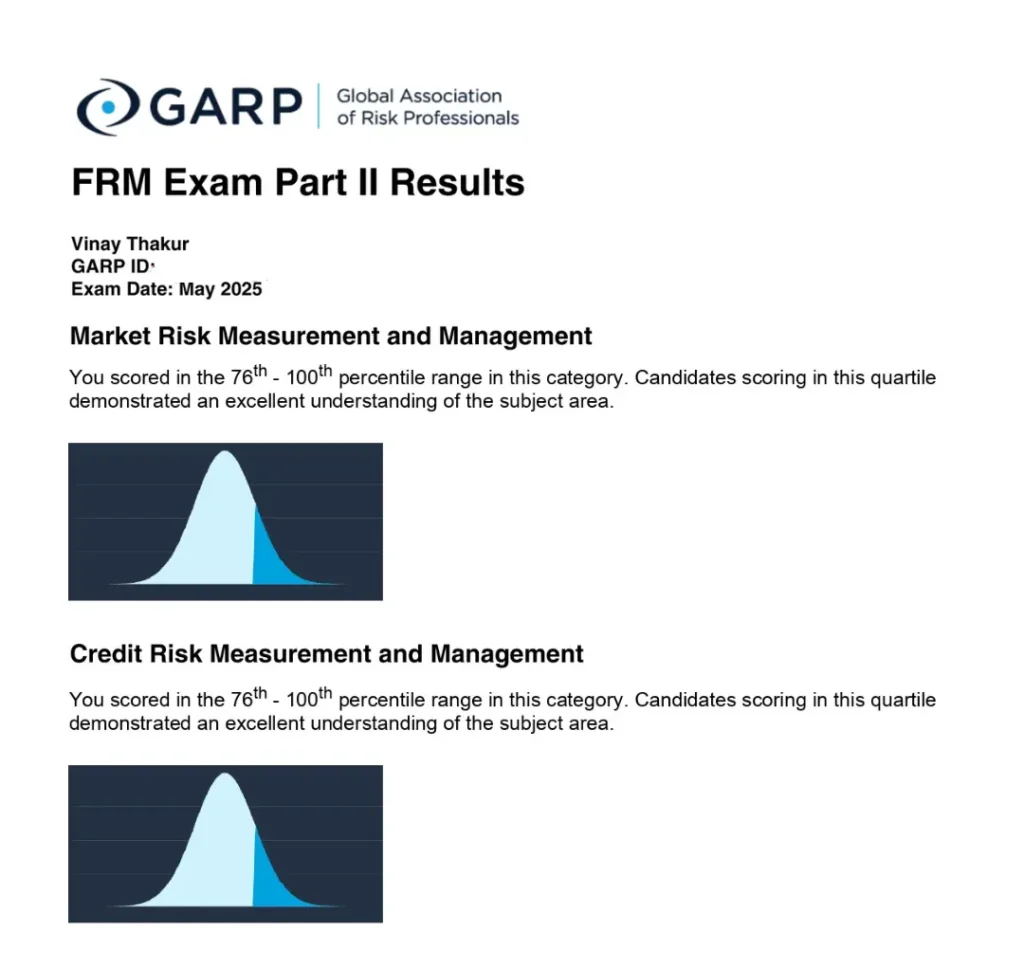

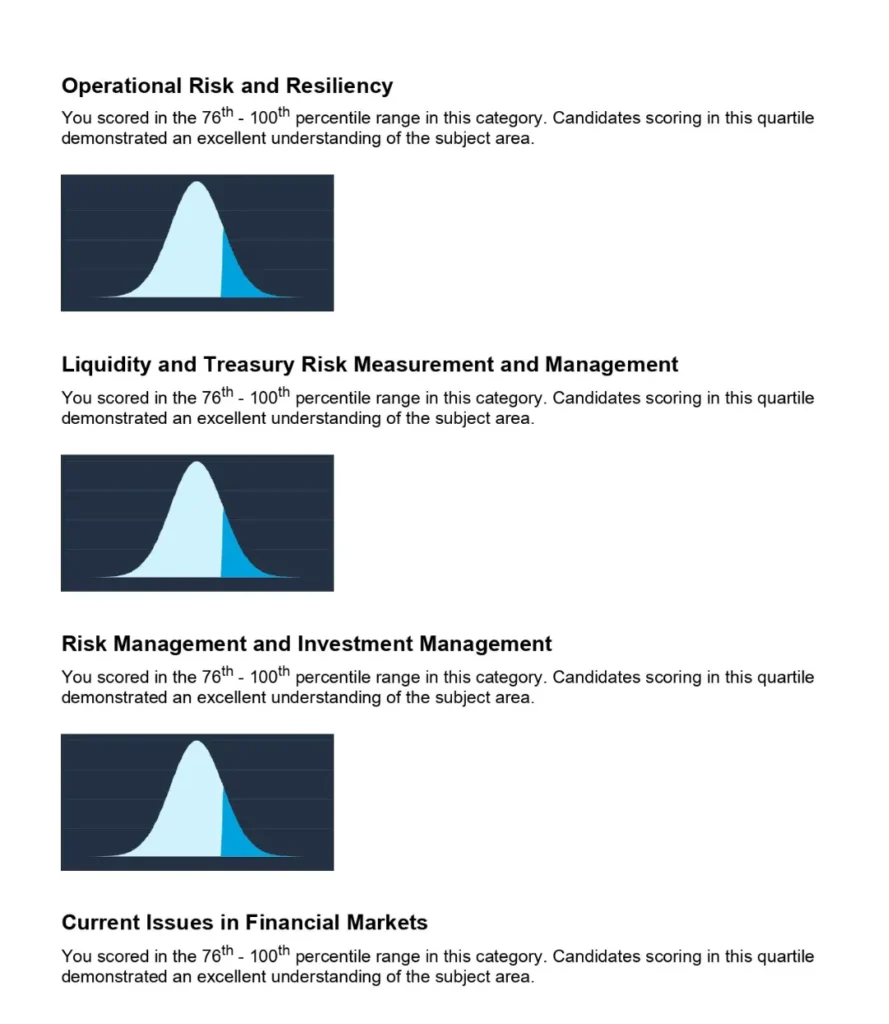

The personalized mentorship by Deepak Sir helped me identify weak areas. He guided me to focus on concepts rather than blindly memorizing formulas. This strategic approach brought me into the top quartile in all subject areas.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

The Roadblocks I Faced

Life never goes smoothly in banking. During my preparation:

- There were audits at the branch, leaving me too tired some nights.

- Unexpected family functions disturbed my schedule.

- Sometimes, I simply felt demotivated.

But every time I fell behind, I reminded myself why I started this journey—to open doors to global opportunities. And with support from RBei and my own discipline, I kept going.

Why RBei Classes Felt Different?

I compared notes with friends studying at other coaching institutes, and here’s why I felt RBei Classes is the Best FRM Coaching in India:

- Clarity of Concepts – Topics like probability distributions, derivatives, and VaR felt simpler.

- Accessibility – Deepak Sir was always approachable for doubts.

- Structured Learning – Recorded videos + live doubt sessions made learning organized.

- Unlimited Views and Extended Validity – Perfect for someone juggling work and studies.

- Community Support – Fellow aspirants shared tips and kept the motivation alive.

Unlike other institutes that only provide videos, RBei provides a study ecosystem.

The Result – FRM Part 1 and Beyond

With this plan, I cleared FRM Part 1 in just 90 days. Later, I also attempted FRM Part 2 and achieved top quartiles in all six subjects, again with the guidance of RBei Classes. Eventually, this global qualification and my banking experience helped me secure an opportunity with PwC in Risk Consulting. This was a huge milestone in my career, which all started with the right decision at the right time.

Why Recorded Lectures Are the Best for Working Professionals

Recorded lectures fit into my unpredictable banking schedule. On late evenings when I was free, or early mornings when the branch was yet to open, I could revisit topics at my own pace. Since lectures at RBei come with validity till you pass, I never feared losing access. This made it a far better option than classroom-based programs with limited schedules.

Key Takeaways for Aspirants

- Plan Strategically – 90 days is possible with discipline and structured targets.

- Choose the Right Institute – The best FRM coaching in India is not just about notes but mentorship and support.

- Practice Difficult Questions – By solving the best practice set, the real exam feels easier.

- Flexibility Matters – Unlimited watch views and recorded lectures give working professionals an edge.

- Mentorship is Everything – Guidance from experienced mentors like Deepak Sir shortens the learning curve.

Conclusion – My Advice to You

If you are a working professional struggling to balance your job with studies, my story should give you confidence. It is absolutely possible to pass FRM Part 1 in 90 days, provided you stay disciplined and choose the right guidance. For me, that guidance was RBei Classes, where practical learning, mentorship, and structured materials made all the difference.

Today, as I work in risk consulting at PwC after clearing both parts with top quartiles, I look back and realize—those 90 days were a turning point in my life. If I, as an SBI Scale 2 Officer with limited time, could do it, you can too.

Remember, success in FRM is not about how much time you have, but how effectively you use it with the right support.

1. Which is the Best FRM Coaching in India?

Honestly, when I was searching for the best FRM coaching in India, I was completely confused. Every institute claimed to be the best, but I realized later that results speak louder than words. For me, the turning point came when I joined RBei Classes, who consistently maintain a 94% pass rate in India. That statistic alone gave me confidence because I didn’t want to waste even a single attempt.

What makes RBei different is not just the lectures but the overall ecosystem—recorded classes with unlimited watch views, validity till you pass, difficult mock tests, and personal mentorship from Deepak Goyal Sir. Many of my colleagues went with other institutes, but most of them either struggled with conceptual clarity or complained about outdated material. My personal take? If you want the right mix of conceptual strength and exam preparation, RBei Classes truly live up to the name of being the best coaching for FRM in India.

2. Can I Prepare for FRM Along with a Full-Time Job?

This is the most common doubt I hear from working professionals. Being a Scale 2 Officer at SBI, I know the pain of managing bank audits, monthly closing, and customer pressures. At first, I doubted if it was even possible. But with the right plan and flexible coaching, it is absolutely doable.

The trick is to choose recorded lectures because live sessions often clash with office hours. At RBei, I used to watch lectures early in the morning and again late at night, depending on my shift. The ability to watch at my pace (and multiple times) made life much easier. Trust me, with 2–3 hours on weekdays and some long weekend study sessions, you can crack FRM Part 1 in just 90 days.

3. How Important Are Practice Sets for FRM Success?

From my experience, practice sets are the real game changers. Reading theory gives you confidence during preparation, but the actual exam tests your application. The Best Practice Set I got with RBei was tougher than the actual FRM exam paper. Initially, it was demotivating because I scored lower marks, but with each attempt, my confidence grew.

By the time I sat for the final FRM exam, the real questions seemed easier because I had already trained at a higher difficulty level. This is one major advantage I noticed compared to other institutes, where practice papers are often too easy. If you aim for success in the first attempt, invest your time where the practice material challenges you.

4. Is FRM Math Heavy and Do I Need a Strong Background in Quant?

This is one question I also asked before starting my journey. I come from a banking background and was slightly out of touch with advanced mathematics. Many of my colleagues said FRM is math heavy, especially in topics like regression, probability distributions, and Value at Risk models.

But after learning through detailed, step-by-step lectures from Deepak Sir, I realized it is not “too heavy” if explained in a simple way. Practical application examples made it easier, and I never felt lost. In fact, the toughest-looking topics became my strengths later because I practiced them repeatedly from the mocks and the best practice set. So yes, FRM involves math, but no, it is not beyond your capacity if you have the right mentor.

5. Why Did I Choose Coaching Instead of Self-Study?

Initially, I was tempted to go for self-study because the thought of saving money felt appealing. But reality hit me during the first two weeks when I got stuck in quantitative analysis. Google and books could only take me so far. That’s when I realized that without structured guidance, I would waste precious time.

Once I joined RBei Classes, things changed. Their step-by-step teaching, unlimited recorded lectures, and conceptual clarity made my preparation smooth. I could actually study smart instead of blindly reading. Also, having a mentor like Deepak Sir kept me motivated—it was like having a personal coach ensuring I did not give up midway. So my advice—if you are a working professional or someone aiming for a one-shot success, go for proper coaching. It is an investment, not an expense.

Also Read:

Best FRM Part 2 Coaching in Dubai