Table of Contents

ToggleIntroduction

How to become an Investment Banker is one of the most common questions among finance aspirants in India. With growing demand for high-paying finance careers, Investment Banking for beginners has become an exciting career choice. However, starting a journey in this field requires the right qualifications, specific skills, and a clear career roadmap. In this step-by-step guide, we will cover qualifications for investment banking, the essential skills for investment banking, and whether you should pursue an MBA or CA for investment banking in India.

By the end of this blog, you will have a complete roadmap of how to enter investment banking, what courses to pursue, and how to prepare for interviews. We will also guide you on practical skills like financial modelling that can set you apart from other candidates.

What Does an Investment Banker Do?

Before learning how to become an investment banker, it is important to understand what investment bankers actually do.

Investment bankers act as financial advisors to companies, governments, and large institutions. Their core responsibilities include:

- Raising capital through debt or equity issuance.

- Advising on mergers and acquisitions (M&A).

- Structuring deals and managing IPOs.

- Conducting valuation and financial analysis.

- Helping clients maximize wealth while minimizing risks.

To perform these tasks, they need strong analytical skills, financial modelling expertise, and business acumen.

Step-by-Step Guide on How to Become an Investment Banker in India

Step 1 – Build the Right Educational Foundation

The first step in how to become an investment banker is having the right educational background. In India, most investment bankers come from commerce, economics, finance, or business administration backgrounds.

Best Degrees for Investment Banking in India:

- Com (Hons)

- BBA in Finance

- BA Economics

- Chartered Accountant (CA)

- MBA in Finance

- CFA (Chartered Financial Analyst)

Pro Tip: Many top investment banks prefer graduates from Tier-1 institutes like IIMs, ISB, and IITs, but a strong skillset can make you stand out even if you’re from a mid-tier college.

Related read: Top 10 Skills Required to Master Financial Modelling

Step 2 – Gain Practical Skills for Investment Banking

Qualifications are important, but what differentiates a successful investment banker is practical financial skills.

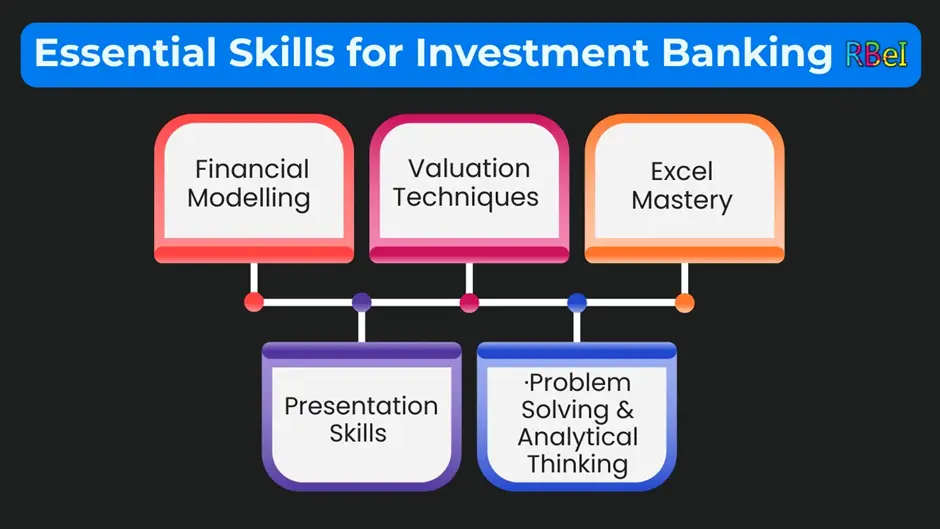

Essential Skills for Investment Banking:

- Financial Modelling (DCF, M&A, LBO models)

- Valuation Techniques (Comparable Company Analysis, Precedent Transactions, DCF)

- Excel Mastery (Advanced formulas, scenario analysis, automation)

- Presentation Skills (Pitch books, investor presentations, client decks)

- Problem Solving & Analytical Thinking

Learning financial modelling is crucial. Without this, even the best degrees will not make you job-ready.

Related read: Financial Modelling vs CFA: Which is Better for Your Career?

Step 3 – Choose Between MBA or CA for Investment Banking

A common doubt students have is whether to pursue MBA or CA for investment banking. Both paths are valuable, but they serve different purposes.

MBA for Investment Banking

- Provides international exposure and networking.

- Focuses on management + finance skills.

- Preferred for global banks like Goldman Sachs, JP Morgan, Morgan Stanley.

- Costly but highly rewarding.

CA for Investment Banking

- Provides strong accounting and taxation knowledge.

- Preferred for domestic banks, Big4 consulting, and boutique IB firms.

- Cost-effective compared to MBA.

If you want global exposure, MBA is preferred. If you want strong technical expertise at a lower cost, CA is a good option.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

Step 4 – Build Relevant Work Experience

Investment banking is not an entry-level friendly career. You need internships or prior work experience.

Ways to Gain IB Experience in India:

- Internship with Big4 firms (EY, KPMG, Deloitte, PwC).

- Internship with boutique investment banks.

- Equity research roles at brokerage houses.

- Analyst roles in corporate finance teams.

Pro tip: Even if you don’t land a direct IB internship, roles in equity research or corporate finance give you transferable skills.

Step 5 – Build a Strong Resume and Network

Your resume should showcase skills for investment banking like financial modelling, Excel, and valuation. Additionally, networking plays a huge role in securing interviews.

Tips:

- Attend finance seminars, webinars, and alumni meets.

- Build LinkedIn connections with bankers.

- Join online finance communities.

Step 6 – Crack the Interview for Investment Banking Roles

Interviews for IB roles are rigorous. Expect both technical questions and behavioral questions.

Technical Topics:

- DCF Valuation

- LBO Models

- Financial Ratios & Analysis

- M&A Case Studies

Behavioral Questions:

- Why do you want to become an investment banker?

- Tell me about a deal you admire.

- How do you handle high-pressure situations?

Qualifications Required for Investment Banking in India

Undergraduate Degrees

You can start with B.Com, BBA, or Economics. These give you basic financial knowledge.

Postgraduate Qualifications

- MBA in Finance

- CFA Program

- Master’s in Finance / Economics

Professional Certifications

- Chartered Accountant (CA)

- Chartered Financial Analyst (CFA)

- Financial Modelling & Valuation Courses

Our Financial Modelling and Investment Banking Course is designed to provide these practical skills.

Skills for Investment Banking – What You Must Master

Core Technical Skills

- Financial Modelling

- Valuation

- Excel & PowerPoint

Soft Skills

- Negotiation

- Communication

- Teamwork

For a detailed guide, check Top 10 Skills Required to Master Financial Modelling

Salary of Investment Bankers in India

- Analyst: ₹8–15 LPA

- Associate: ₹15–30 LPA

- VP: ₹35–60 LPA

- MD / Director: ₹1 Cr+

Factors affecting salary: College pedigree, work experience, networking, and technical skills.

Challenges in Investment Banking

- Long working hours (80–100 hours/week).

- High-pressure environment.

- Constant client demands.

Yet, the rewards—both financial and professional—make it worthwhile.

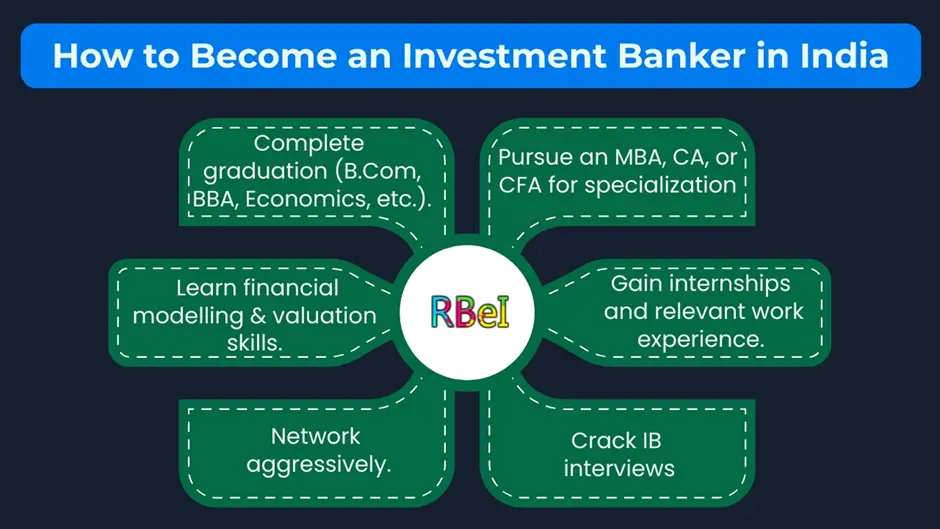

Final Roadmap – How to Become an Investment Banker in India

- Complete graduation (B.Com, BBA, Economics, etc.).

- Pursue an MBA, CA, or CFA for specialization.

- Learn financial modelling & valuation skills.

- Gain internships and relevant work experience.

- Network aggressively.

- Crack IB interviews.

Conclusion

Becoming an investment banker in India is challenging but highly rewarding. The right mix of qualifications for investment banking, strong skills for investment banking, and smart career choices can help you break into this field. Whether you choose MBA for investment banking or CA vs MBA for IB, remember that practical skills like financial modelling make you stand out.

If you are serious about building a career in investment banking, now is the time to start preparing. At RBei Classes, we specialize in Financial Modelling and Investment Banking courses that are 100% job-oriented and industry-relevant.

Explore our Financial Modelling and Investment Banking Course today and start your journey towards becoming an investment banker.

FAQs on How to Become an Investment Banker in India

1. What qualifications do I need to become an investment banker in India?

To become an investment banker in India, you need a strong academic background in finance, economics, or business. The most common routes are:

- Undergraduate Degree: B.Com (Hons), BBA Finance, BA Economics.

- Postgraduate Degree: MBA in Finance from IIMs, ISB, or other reputed B-Schools.

- Professional Certifications: Chartered Accountant (CA), CFA (Chartered Financial Analyst), or Financial Modelling courses.

While top-tier MBAs often have an edge, boutique firms and domestic IB roles also hire Chartered Accountants and CFA candidates. Additionally, recruiters look for practical skills like financial modelling, valuation, and Excel mastery, which you can learn through specialized training.

2. Is MBA mandatory for investment banking in India?

No, MBA is not mandatory to become an investment banker in India, but it is the most common pathway. An MBA in Finance from a top institute provides exposure, networking opportunities, and direct campus placements into global firms like JP Morgan, Goldman Sachs, and Morgan Stanley.

However, there are alternative routes:

- CA + Financial Modelling → Many CAs work in corporate finance and boutique IB firms.

- CFA Charterholders → CFA is globally recognized and can help you enter equity research and investment banking roles.

- Direct Entry via Skills → With expertise in financial modelling, valuation, and pitchbook preparation, you can land analyst roles in mid-tier banks or advisory firms even without an MBA.

So, while MBA makes the process smoother, it is not the only way.

3. What skills are most important for investment banking jobs in India?

The most important skills for investment banking can be divided into two categories:

Technical Skills:

- Financial Modelling (DCF, M&A, LBO models)

- Valuation (Comparable Company Analysis, Precedent Transactions)

- Advanced Excel & PowerPoint

- Accounting and Financial Statement Analysis

Soft Skills:

- Communication and Presentation (for client interactions)

- Negotiation (for deal structuring)

- Analytical & Problem-Solving Ability

- Time Management (working under pressure with tight deadlines)

Recruiters often say, “Degrees get you shortlisted, but skills get you hired.”

4. How much salary does an investment banker earn in India?

The salary of an investment banker in India depends on your level, skills, and firm.

- Analyst (Entry-level): ₹8–15 LPA (at boutique or mid-sized IB firms).

- Associate (2–3 years of experience): ₹15–30 LPA.

- Vice President: ₹35–60 LPA.

- Director/Managing Director: ₹1 Cr+ annually in top firms.

Apart from salary, investment bankers also receive performance bonuses, which can sometimes be higher than the base pay. That’s why investment banking is considered one of the most lucrative finance careers in India.

5. Is investment banking a good career option in India for beginners?

Yes, investment banking is an excellent career option in India, especially for beginners who want a high-paying, fast-growing career in finance. However, it is not easy to enter—it requires dedication, long working hours, and continuous learning.

Pros:

- High salary packages.

- Opportunity to work on big deals (IPOs, M&A, funding rounds).

- Global exposure and growth opportunities.

Cons:

- Very long working hours (often 80–100 hours per week).

- High-pressure environment.

- Intense competition for entry-level roles.

If you are passionate about finance, analytical by nature, and willing to work hard, investment banking for beginners can be a rewarding career choice.