Table of Contents

ToggleIf you are curious about what is financial modelling and how a financial modelling course can shape your career, you are in the right place. In today’s corporate and finance-driven world, every decision – from investing in startups to acquiring billion-dollar companies – is backed by models that project numbers into the future. By learning how to build and analyze financial models, beginners and professionals alike can make smarter business and investment decisions. This blog will give you a complete beginner’s guide to financial modelling, explain its importance, outline the types of financial models, and even connect how these models are used in business valuation, DCF analysis, and M&A models. Whether you want to learn financial modelling online or through a structured classroom program, this guide will prepare you for your journey.

Introduction to Financial Modelling

Before diving deep, let us clearly define financial modelling. In simple terms, financial modelling is the process of creating a mathematical representation of a real-world financial situation. It is usually done in Excel or advanced tools, where inputs like revenue, costs, investments, and financing are linked together to project financial performance.

Think of a financial model as a decision-making tool if you change one variable, you can immediately see how it affects profits, cash flows, or valuations. That’s why investment bankers, equity analysts, corporate finance professionals, and even entrepreneurs rely heavily on it.

Transitioning from theory to practice, the models you build are not just numbers. They are stories about businesses, expressed in financial terms.

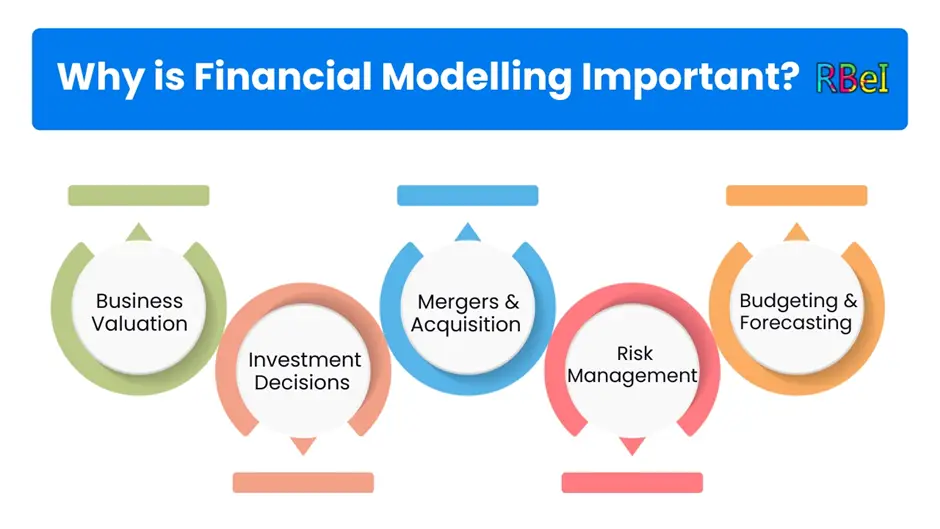

Why is Financial Modelling Important?

The importance of financial modelling cannot be overstated. Companies and investors depend on it for

- Business Valuation Determining the worth of a company through models like DCF (Discounted Cash Flow).

- Investment Decisions Evaluating whether to invest in stocks, bonds, or startups.

- Mergers & Acquisitions (M&A Models) Analyzing whether acquiring another company will be profitable.

- Budgeting & Forecasting Helping management plan ahead.

- Risk Management Testing scenarios such as downturns or interest rate hikes.

For beginners, this highlights why learning financial modelling online or through a structured program is not just about Excel skills but about understanding how businesses work.

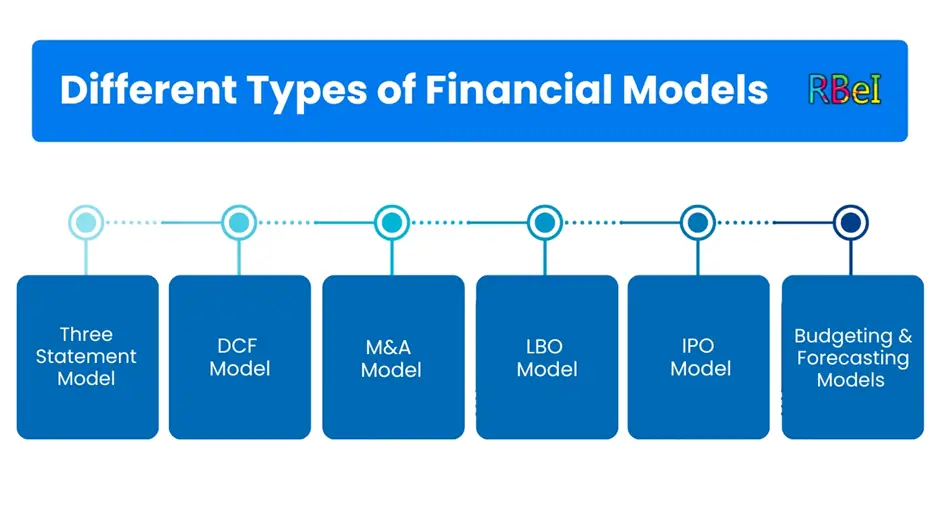

Types of Financial Models

There is no one-size-fits-all approach. Depending on the situation, professionals use different models. Some common types of financial models include

1. Three-Statement Model

This is the foundation of financial modelling. It connects the Income Statement, Balance Sheet, and Cash Flow Statement into one dynamic model.

2. Discounted Cash Flow (DCF) Model

DCF is one of the most powerful valuation tools. By projecting free cash flows and discounting them back at a cost of capital, you estimate the company’s intrinsic value.

3. Merger & Acquisition (M&A) Model

This model evaluates whether acquiring a target company will create or destroy shareholder value.

4. Leveraged Buyout (LBO) Model

Used by private equity firms, it assesses if a company can be bought with mostly debt and sold later for profit.

5. IPO Model

When companies go public, analysts prepare IPO models to forecast valuations and issue prices.

6. Budgeting and Forecasting Models

Companies rely on these to track expenses and revenues against plans.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

Transition words like firstly, secondly, moreover, and finally are often used here because each model builds upon the other in practice.

Skills Required for Financial Modelling

To master financial modelling, you need both technical and analytical skills. While this blog focuses on the beginner’s guide, you can check our detailed write-up on Skills Required for Financial Modelling.

Some must-have skills include:

- Excel Proficiency

- Accounting and Finance Knowledge

- Analytical Thinking

- Attention to Detail

- Understanding Valuation Techniques

Financial Modelling for Beginners – Step by Step

Here’s a roadmap if you are just starting

- Learn Accounting Basics – Understand how financial statements connect.

- Master Excel Shortcuts – Speed is critical for modelling.

- Understand Valuation Techniques – DCF, comparables, precedent transactions.

- Build a Simple Three-Statement Model – Link statements correctly.

- Move to Complex Models – Such as M&A or LBO.

- Practice Case Studies – Use real companies to test your skills.

- Get Feedback and Refine – Join communities or take professional training.

Common Mistakes Beginners Make

Even though financial modelling is powerful, beginners often make mistakes such as

- Overcomplicating models with unnecessary details.

- Ignoring accounting integrity (statements not balancing).

- Not testing scenarios.

- Relying only on templates without understanding logic.

By avoiding these, you will become more confident

Applications of Financial Modelling in the Real World

Let’s make this practical. Financial modelling is not limited to investment banks. It is widely used across industries

- Startups To raise funding from investors.

- Corporates For budgeting and capital allocation.

- Banks To assess loan viability.

- Investors For portfolio analysis.

- Governments For infrastructure projects.

How to Learn Financial Modelling Online?

The most convenient way today is through financial modelling courses online. At RBei Classes, we have designed a job-oriented financial modelling and investment banking course where students learn step by step, from basics to advanced case studies.

You can start learning at your own pace, build live models, and get guidance from mentors who have worked in investment banking. If you’re curious, check out our Financial Modelling Course Page → https://rbeiset.com/financial-modelling.

Financial Modelling vs Investment Banking

Many students confuse the two. Financial modelling is a skill, while investment banking is a career field where financial models are applied daily. If you want to see how financial modelling connects to the world of banking, you should read our What is Investment Banking?.

Future of Financial Modelling

With AI and automation, the tools might change, but the fundamentals of modelling will remain the same. Financial decisions will always require human judgment supported by robust models.

That is why building this skill today ensures long-term career growth.

Conclusion

To summarize, financial modelling is the art and science of representing a company’s future in numbers. By learning it, you not only improve your career prospects but also gain a skill that is highly valued across industries.

Whether you are a student, a working professional, or an entrepreneur, the right financial modelling course can make you job-ready and open doors in fields like investment banking, equity research, and corporate finance.

If you are serious about your career, start your journey today with our structured training at RBei Classes.

What is financial modelling in simple words?

Answer: Financial modelling is like creating a roadmap of a company’s future using numbers. Imagine you want to know how a business will perform in the next 5 years. Instead of guessing, you put together data such as revenue, expenses, loans, and investments in an Excel sheet or software. Then, you connect these numbers to project profits, cash flows, and overall valuation.

In simple words, a financial model helps you predict financial performance and make better decisions. That’s why people preparing for careers in finance, investment banking, or equity research often start by learning financial modelling online.

Why is financial modelling important for beginners?

Answer: For beginners, financial modelling is important because it teaches you how real businesses operate financially. Instead of just reading theory, you actually build models that show:

- How a change in sales affects profits.

- How companies are valued using methods like DCF (Discounted Cash Flow).

- How mergers or acquisitions are analyzed using M&A models.

This skill is not just for experts—it’s a foundation that helps students, entrepreneurs, and professionals make smarter decisions. If you’re starting your career in finance, learning financial modelling early will give you a competitive advantage in placements and job interviews.

What are the different types of financial models I should know?

Answer: There are several types of financial models, and each serves a different purpose. The most common ones include:

- Three-Statement Model – Connects income statement, balance sheet, and cash flow.

- DCF Model – Estimates the true value of a business based on future cash flows.

- M&A Model – Used in mergers and acquisitions to test profitability.

- LBO Model – Popular in private equity, where a company is bought mostly with debt.

- IPO Model – Helps in pricing a company going public.

- Budgeting & Forecasting Models – Used internally by companies for planning.

As a beginner, you should start with the three-statement model, and then gradually move to DCF and M&A models.

How can I learn financial modelling online?

Answer: Today, the most effective way to learn is through a structured financial modelling course online. A good program should include:

- Step-by-step guidance on building models from scratch.

- Case studies of real companies.

- Training on Excel and financial statement analysis.

- Hands-on practice with valuation methods like DCF and comparables.

At RBei Classes, we offer a job-oriented Financial Modelling and Investment Banking course that covers all of these areas with practical projects. You can check the https://rbeiset.com/financial-modelling for details and start your journey toward a finance career.

Is financial modelling the same as investment banking?

Answer: No, they are not the same. Financial modelling is a skill, while investment banking is a career field.

- Financial Modelling → Focuses on building tools (Excel models, valuation frameworks, projections).

- Investment Banking → Uses these models to advise clients on mergers, acquisitions, IPOs, and fundraising.

In short, financial modelling is one of the core skills required in investment banking. If you want to see the connection, you can read our detailed blog on What is Investment Banking?.