Table of Contents

ToggleInvestment Banking is one of the most prestigious and rewarding career paths in finance. If you are exploring a career in investment banking, then understanding what this field is, what roles investment bankers play, and how you can break into it is essential. Today, many students and professionals want to pursue an Investment Banking Course because it not only opens doors to high-paying opportunities but also helps them develop skills in valuation, mergers and acquisitions, equity research, and financial modelling. At RBei Classes, we provide the best coaching classes for financial modelling and investment banking course, guiding students step by step to achieve their career goals.

In this blog, you will get a complete beginner-to-advanced guide on investment banking—from its meaning, role, services, and career scope, to how you can prepare and land your dream job in investment banking in India. By the end, you will have everything you need in one place to start your journey confidently.

What is Investment Banking?

At its core, investment banking is the division of banking that helps large corporations, governments, and institutions raise capital, execute mergers and acquisitions (M&A), manage risks, and provide advisory services. Unlike commercial banks, which deal with savings accounts and loans for individuals, investment banks focus on big-ticket financial transactions.

Investment banks act as intermediaries between companies that need funds and investors who want to deploy capital. This requires deep expertise in equity research, valuation, and financial modelling, which is why pursuing an investment banking course is often the first step for aspiring professionals.

Some of the most well-known global investment banks include Goldman Sachs, Morgan Stanley, J.P. Morgan, Barclays, and Credit Suisse. In India, firms like Kotak Investment Banking, ICICI Securities, and Axis Capital play a crucial role in shaping the corporate finance landscape.

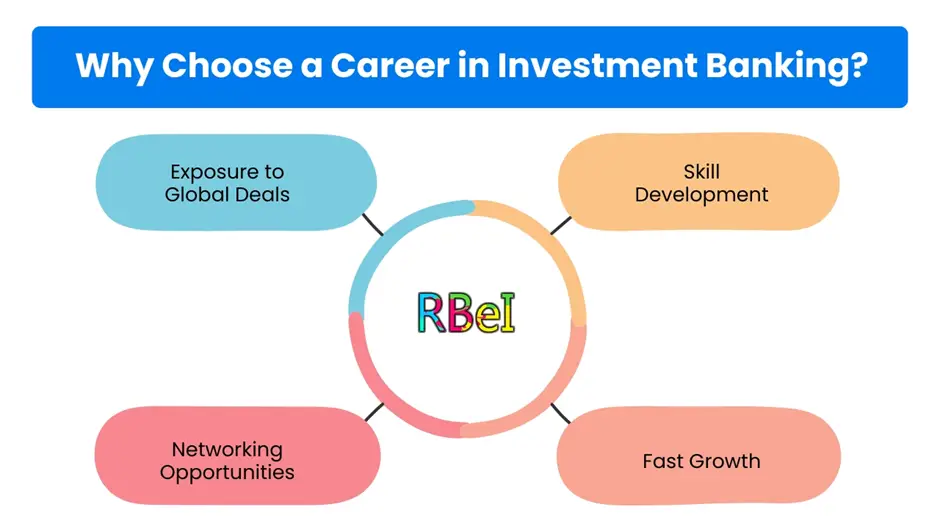

Why Choose a Career in Investment Banking?

A career in investment banking is considered one of the most lucrative in the finance world. But beyond the attractive paychecks, this career offers:

- Exposure to Global Deals: Investment bankers work on billion-dollar mergers, acquisitions, and IPOs.

- Skill Development: The role demands expertise in valuation, financial modelling, and risk assessment.

- Networking Opportunities: You work closely with top executives, investors, and policymakers.

- Fast Growth: Clear progression from Analyst → Associate → Vice President → Director → Managing Director.

However, breaking into this field is challenging because it demands not just technical skills but also strong communication, problem-solving, and analytical abilities. That’s where a structured investment banking course from trusted institutions like RBei Classes comes in, bridging the gap between academics and industry practice.

Role of an Investment Banker

The role of an investment banker varies depending on the division they work in. Broadly, their responsibilities include:

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

- Capital Raising – Helping companies issue stocks and bonds to raise money.

- Mergers and Acquisitions (M&A) – Advising clients on buying, selling, or merging businesses.

- Equity Research – Providing insights on market trends, stock valuations, and investment strategies.

- Restructuring – Assisting distressed companies in reorganizing their finances.

- Advisory Services – Guiding firms on strategic financial decisions.

Each function requires in-depth knowledge of financial models, market dynamics, and negotiation skills. This is why practical learning is crucial, and why our financial modelling and investment banking course focuses on hands-on training.

Front Office, Middle Office, and Back Office in Investment Banking

An investment bank is divided into three major parts:

- Front Office – The client-facing division that handles M&A, capital raising, trading, and equity research. This is where most investment bankers work.

- Middle Office – Risk management, compliance, and technology support ensuring transactions comply with regulations.

- Back Office – Operations, settlements, and administrative functions.

Aspirants targeting a career in investment banking usually aim for front-office roles because they directly impact revenue and involve high-level client interaction.

Types of Services Offered by Investment Banks

Investment banks offer a wide range of services:

- Mergers & Acquisitions (M&A) Advisory

- Initial Public Offerings (IPOs)

- Debt and Equity Financing

- Private Equity & Venture Capital Deals

- Equity Research and Analysis

- Restructuring and Risk Management

These services form the backbone of corporate finance and global capital markets, making investment banking a critical driver of the economy.

Jobs in Investment Banking in India

If you are planning for a job in investment banking in India, you will find immense opportunities in top financial hubs like Mumbai, Bangalore, and Delhi. With India’s growing economy, demand for skilled investment bankers has increased across domestic and international firms.

Some common job roles include:

- Analyst (entry-level, focused on financial modelling and research)

- Associate (client-facing, project execution)

- Vice President (managing teams, client relationships)

- Director / MD (deal origination, strategy, and leadership)

Salaries in India range from ₹10–20 LPA for freshers to ₹50 LPA+ for experienced professionals in top banks.

How to Build a Career in Investment Banking?

To build a successful career in investment banking, you need:

- Educational Background – Degrees in finance, economics, accounting, or engineering.

- Specialized Training – A structured investment banking course covering financial modelling, valuation, and M&A.

- Practical Skills – Hands-on exposure to Excel, pitch books, and case studies.

- Internships – Real-world experience in banks or financial firms.

- Certifications – CFA, FRM, or RBei’s Financial Modelling and Investment Banking course for added credibility.

Why RBei Classes is the Best Coaching Institute for Investment Banking and Financial Modelling

At RBei Classes, we believe in practical learning over theory. Our students work on live projects, case studies, and financial models that simulate real-world investment banking tasks. This is why RBei is recognized as the best coaching classes for financial modelling and investment banking course.

- Expert Faculty: Trainers with global investment banking experience.

- Structured Curriculum: Covers valuation, M&A, DCF, LBO, and equity research.

- Placement Support: Guidance for internships and job interviews.

- Flexible Learning: Online and classroom formats available.

Whether you are a fresher or a working professional, our program ensures you are industry-ready.

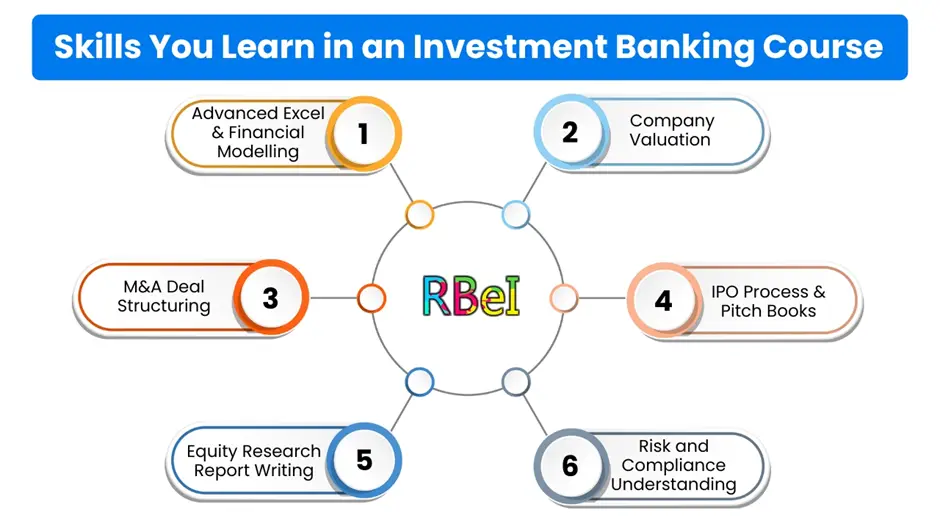

Skills You Learn in an Investment Banking Course

An investment banking course equips you with:

- Advanced Excel & Financial Modelling

- Company Valuation (DCF, Comparable, Precedent Transactions)

- M&A Deal Structuring

- IPO Process & Pitch Books

- Equity Research Report Writing

- Risk and Compliance Understanding

These skills are non-negotiable for anyone aiming to secure a job in investment banking in India or abroad.

FAQs on Investment Banking

- What is the eligibility for an Investment Banking Course?

Most courses require a background in finance, commerce, or related fields, but even engineers and non-finance graduates can join with proper training. - Is Investment Banking a good career in India?

Yes, with India’s growing economy, investment banking offers excellent career prospects, high salaries, and global exposure. - How much can a fresher earn in Investment Banking in India?

Freshers typically start with packages between ₹10–20 LPA, depending on skills and the institution they join. - What skills are needed for a Career in Investment Banking?

Key skills include financial modelling, valuation, Excel, communication, and problem-solving. - Where can I learn Investment Banking in India?

Institutes like RBei Classes provide the best practical training in financial modelling and investment banking courses.

Conclusion – Your Path to a Successful Investment Banking Career

Investment Banking is not just a job; it’s a gateway to global finance, strategy, and leadership. If you are serious about pursuing a career in investment banking, then the first step is to invest in a comprehensive investment banking course that equips you with the right skills. At RBei Classes, we have mentored thousands of students to break into this field, and we continue to be recognized as the best coaching classes for financial modelling and investment banking course.

Start your journey today by checking our Financial Modelling and Investment Banking Course and also explore our blog on What is Financial Modelling?. to build strong foundational knowledge.

With the right skills, guidance, and determination, a successful job in investment banking in India or globally is well within your reach.