Table of Contents

ToggleIn today’s competitive job market, Financial Modelling for MBA students and Investment Banking for CA and Engineers have become essential skills. Employers no longer look only at degrees; they want professionals who can apply practical knowledge to solve real business problems. That’s why MBA students, Chartered Accountants, Engineers, and even commerce graduates are increasingly turning toward financial modelling and investment banking courses. These skills bridge the gap between classroom learning and corporate expectations, making students industry-ready while opening high-paying career opportunities.

In this detailed guide, we will explore why MBA students learn financial modelling, why Investment Banking for CA and Engineers is a career-transforming skill, how financial modelling for commerce students creates new opportunities, and what placement benefits come with acquiring these practical skills.

The Changing Landscape of Careers in Finance

The financial services industry is not what it used to be. Earlier, an MBA or CA degree was considered sufficient to land a top job. However, as the industry becomes more complex with mergers, acquisitions, private equity, and global investments, recruiters now expect candidates to demonstrate practical financial modelling and investment banking skills from day one.

For example, if you apply for a role in equity research, just knowing accounting standards is not enough. Recruiters will test whether you can build a DCF (Discounted Cash Flow) model, analyze company financials, and prepare an equity valuation report. Similarly, in investment banking roles, engineers and MBAs are often expected to prepare pitch books, merger models, and deal valuations before joining full-time.

This is where financial modelling courses and investment banking training bridge the knowledge gap and make you ready for global opportunities.

Why Financial Modelling for MBA Students is a Game Changer

For MBA students, financial modelling is no longer optional; it is essential. Let’s break down why:

- Placement Advantage – Recruiters often look for MBA students who can go beyond theory and apply skills in valuation, forecasting, and investment analysis. A student who can present a financial model during an interview immediately stands out.

- Summer Internships & Projects – Many MBA programs include case competitions, consulting projects, and internships where practical modelling skills are required. Imagine being able to prepare a real merger model for your internship company—it sets you apart.

- Entrepreneurship & Startups – MBA students planning to launch their ventures need to prepare financial projections for investors. Without financial modelling skills, pitching for funding becomes nearly impossible.

- Global Relevance – Whether you aim for jobs in India, Singapore, Dubai, or New York, financial modelling is a universal language in finance.

This is why top recruiters repeatedly say: “We hire MBA students who can apply skills, not just those who have degrees.”

Why MBA Students Learn Financial Modelling Beyond Classrooms

An MBA degree gives a strong theoretical foundation, but recruiters often complain about the gap between classroom teaching and industry requirements. This is where financial modelling steps in.

- Classroom Learning – You learn concepts like corporate finance, accounting, and valuation.

- Industry Expectation – You should be able to create an Excel model, forecast revenues, evaluate investments, and present them in a boardroom-style format.

That’s why MBA students need to go beyond textbooks. For example:

- A classroom might teach you what EBITDA means, but financial modelling teaches you how to calculate, analyze, and forecast it for future years.

- You might learn about valuation theories in class, but recruiters want to see if you can actually value a startup using DCF or market comparable.

Therefore, financial modelling for MBA students isn’t just about placements—it’s about bridging the academic-to-industry skill gap.

Investment Banking for CA and Engineers: Bridging the Skill Gap

Let’s talk about two categories of professionals who benefit immensely: CAs and Engineers.

1. Why Chartered Accountants Need Investment Banking Skills

CAs already have strong accounting and auditing knowledge. However, investment banking demands additional expertise in valuation, deal structuring, and financial modelling.

- A CA may understand financial statements deeply but may not know how to build a merger model or analyze the impact of debt financing in an M&A transaction.

- With investment banking training, CAs can move into lucrative roles in corporate finance, private equity, venture capital, and equity research.

2. Why Engineers Need Investment Banking Skills

Many engineers aim for finance roles after graduation or post-MBA. The challenge is that while they have analytical and quantitative skills, they lack exposure to finance-specific tools.

- With investment banking for engineers, they learn how to apply their quantitative mindset to financial modelling, risk analysis, and valuation techniques.

- Engineers with this training often transition smoothly into roles in quant finance, investment banking, and consulting.

In short, financial modelling and investment banking provide CAs with upward mobility in finance, while helping engineers pivot into entirely new, high-paying domains.

Financial Modelling for Commerce Students and Fresh Graduates

What about students who are pursuing B.Com or BBA? Do they also need these skills? The answer is a strong yes.

- Commerce students often aim for careers in accounting, corporate finance, or banking. With financial modelling, they gain an edge over peers and can move into valuation, equity research, or investment banking right from the start.

- BBA graduates planning for MBA or CFA find financial modelling to be the foundation that helps them outperform others in exams and interviews.

- Even fresh graduates without work experience can use financial modelling to demonstrate practical readiness to employers.

This is why financial modelling for commerce students is becoming a buzzword across universities and colleges.

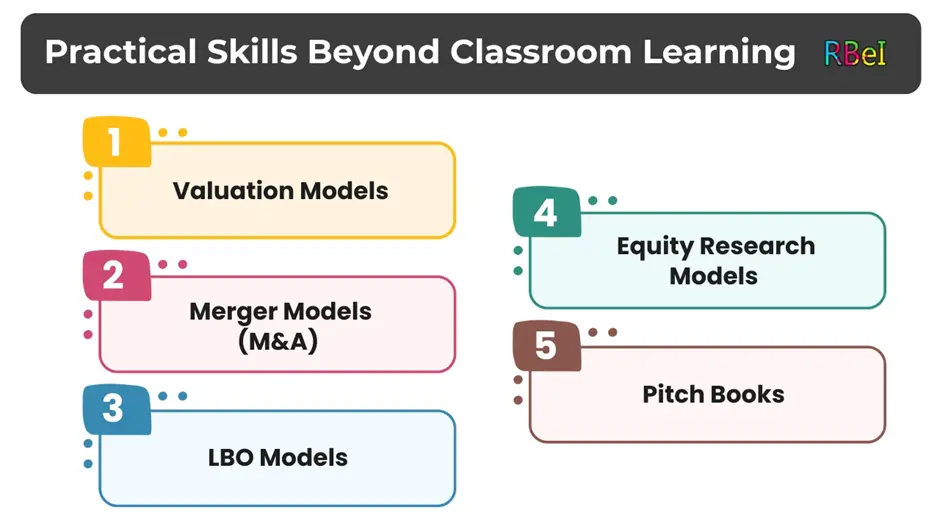

Here are the core practical skills you gain with financial modelling and investment banking training:

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

- Valuation Models – DCF, comparable company analysis, precedent transactions.

- Merger Models (M&A) – Evaluating synergies, accretion/dilution, deal financing.

- LBO Models – Private equity-style leveraged buyouts.

- Equity Research Models – Stock analysis, investment recommendations.

- Pitch Books – Professional presentations for clients.

These are hands-on skills that recruiters expect but universities rarely teach in depth. This is why the phrase “practical skills beyond classroom” is so crucial for MBA, CA, engineers, and commerce students alike.

Placement Benefits of Learning Financial Modelling and IB

The biggest attraction of these skills is the placement advantage. Let’s break it down:

- Broader Job Roles – Financial analyst, investment banking analyst, equity research associate, valuation consultant, corporate finance manager.

- Higher Salaries – Students with financial modelling and IB skills often secure packages 30–50% higher than peers.

- Global Opportunities – Investment banking and financial modelling skills are relevant worldwide.

- Faster Promotions – Because you can handle complex tasks from day one, career growth accelerates.

Recruiters openly admit: “We prefer hiring candidates who already know financial modelling and valuation, as they can start contributing immediately.”

Real Success Stories of MBA, CA, and Engineers

At RBei Classes, we have trained 10,000+ students from 25+ countries, and the results speak for themselves.

- MBA Student from IIM Lucknow – Secured a role in investment banking at JP Morgan after mastering financial modelling.

- CA from Delhi – Transitioned into corporate finance at KPMG with a salary jump of 60%.

- Engineer from IIT Bombay – Shifted from IT consulting to equity research at Nomura.

- Com Graduate from Mumbai University – Landed an entry-level analyst role at a boutique investment bank.

These stories highlight the placement benefits and career transformations possible with these skills.

Comparison with Other Courses

You might wonder how financial modelling and IB stack up against other finance qualifications.

- Financial Modelling vs CFA → (https://rbeiset.com/financial-modelling-vs-cfa) – CFA provides strong theoretical knowledge, but financial modelling gives you practical applications. Ideally, both complement each other.

- Financial Modelling vs Investment Banking → (https://rbeiset.com/financial-modelling-vs-investment-banking) – FM is the skillset, IB is the industry where you apply it. Together, they make you unstoppable.

This is why many students pursue FM + IB courses alongside degrees like CFA, MBA, or CA.

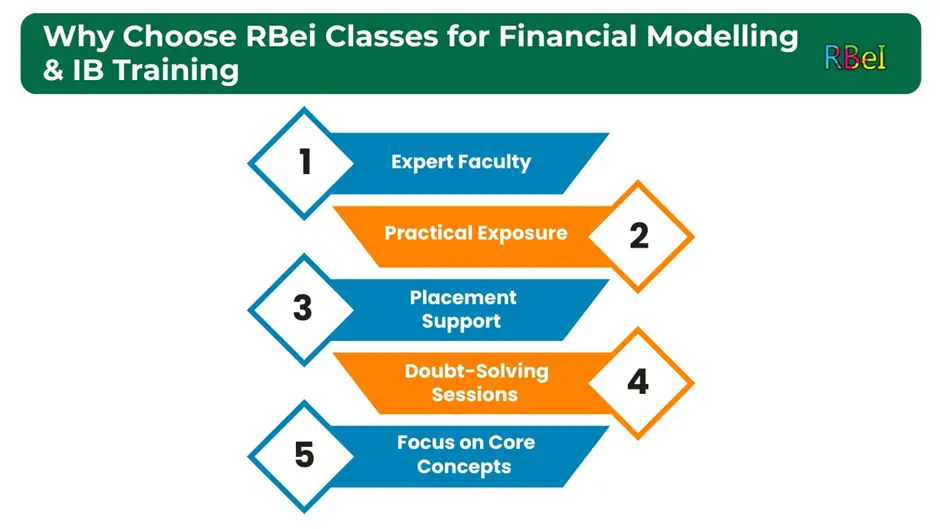

Why Choose RBei Classes for Financial Modelling & IB Training

Now that we’ve seen why these skills matter, let’s talk about the right place to learn them. At RBei Classes, we ensure you don’t just learn concepts—you master practical, job-ready applications.

- Expert Faculty – Industry professionals with real-world IB and corporate finance experience.

- Practical Exposure – Hands-on case studies in M&A, DCF, equity valuation.

- Placement Support – Resume building, interview prep, recruiter connects.

- Doubt-Solving Sessions – 24/7 support so you never feel stuck.

- Focus on Core Concepts – We make sure you build models from scratch, not just watch slides.

That’s why students call us the best coaching classes for financial modelling and investment banking course in India.

Conclusion: Future-Proof Your Career with Financial Modelling and Investment Banking

Whether you’re an MBA student preparing for placements, a CA looking to move into investment banking, an engineer planning a finance career, or a commerce graduate seeking an edge, mastering these skills will future-proof your career.

- Financial Modelling for MBA students ensures you excel in placements.

- Investment Banking for CA and Engineers helps you bridge skill gaps and move into high-paying roles.

- Financial Modelling for commerce students opens new pathways right after graduation.

At RBei Classes, we combine practical exposure, faculty expertise, and placement support to ensure you don’t just learn—you transform your career.

Check Out Our Financial Modelling & Investment Banking Course Page to take the next step.

FAQs

1. Why do MBA students need to learn financial modelling when they already study finance in their curriculum?

Answer: While MBA programs cover corporate finance, accounting, and valuation theories, recruiters expect MBA graduates to apply these concepts in real-world situations. Financial modelling teaches you how to:

- Build valuation models (DCF, comparable, precedent transactions).

- Forecast revenues and expenses for companies.

- Prepare pitch books and investment recommendations.

These are skills recruiters test during placements. MBA students with financial modelling proficiency stand out because they can hit the ground running in investment banking, equity research, and consulting roles.

2. How does investment banking help Chartered Accountants (CAs) in their career growth?

Answer: CAs are experts in accounting and taxation, but investment banking requires additional skills like deal structuring, mergers and acquisitions, leveraged buyouts, and equity valuation. By learning investment banking, CAs can transition from traditional audit/tax roles into high-paying careers in:

- Corporate finance

- Private equity

- Venture capital

- Investment banking

This not only enhances career growth but also significantly improves salary prospects. Many CAs who upskill in investment banking move into front-office roles where their financial expertise is applied at a strategic level.

3. Can engineers without a finance background really enter investment banking?

Answer: Yes, engineers can transition into investment banking, but they need to acquire finance-specific skills first. Engineers are naturally good at numbers, problem-solving, and analytics—traits highly valued in finance. By learning financial modelling and investment banking concepts, engineers can leverage their quantitative skills in:

- Equity research

- Risk analysis

- Quantitative finance

- Corporate strategy

Many top global investment banks actively recruit engineers after they demonstrate competence in valuation, Excel modelling, and financial analysis. Adding an MBA or a specialized course further accelerates the transition.

4. How does financial modelling benefit commerce students and fresh graduates?

Answer: For commerce students and fresh graduates (B.Com, BBA, etc.), financial modelling provides a career advantage right from the start. Unlike traditional accounting knowledge, financial modelling allows students to:

- Analyze company performance.

- Build projections and valuation models.

- Apply for roles in investment banking, equity research, and consulting.

Recruiters often prefer freshers who already have hands-on modelling experience, as it reduces their training time. Thus, financial modelling for commerce students is one of the best ways to stand out in a crowded job market.

5. What placement benefits do students get after learning financial modelling and investment banking?

Answer: Students who complete a Financial Modelling and Investment Banking course enjoy significant placement advantages, such as:

- Wider job opportunities → Analyst roles in IB, equity research, valuation consulting, corporate finance.

- Higher salary packages → Often 30–50% higher than peers without these skills.

- Global opportunities → Skills are recognized in India, Dubai, Singapore, London, New York, etc.

- Career acceleration → Faster promotions as you can handle complex tasks from day one.

At institutes like RBei Classes, students also benefit from placement support, resume building, and recruiter connections, making them job-ready immediately after completing the program.

Student Reviews for RBei Classes – Financial Modelling & Investment Banking Course

1. Ananya Mehta – IIM Bangalore (Bangalore)

“The lectures at RBei Classes were extremely structured, and the faculty made even complex financial modelling concepts easy to understand. What impressed me most was the focus on practical case studies—we built DCF and M&A models from scratch. The doubt-solving sessions were always supportive, and the placement prep really helped me during my internship interviews. Highly recommended for MBA students!”

2. Rohit Sharma – SRCC, Delhi University (Delhi)

“Being from a commerce background, I wanted to stand out in placements. RBei Classes gave me exactly that. The Excel tricks, valuation models, and live projects made me confident. The faculty is approachable, and the mock interviews during placement support boosted my confidence a lot. I secured a summer internship in equity research thanks to this course.”

3. Sneha Kapoor – Christ University (Bangalore)

“I had zero background in financial modelling, but within weeks, I was comfortable building complete models. The step-by-step teaching, doubt-solving sessions, and practical exposure gave me clarity. The faculty always stressed real-world applications instead of just theory. Now I feel ready for consulting and IB roles.”

4. Aditya Menon – NMIMS Mumbai (Mumbai)

“The way the lectures were delivered made a huge difference. At NMIMS, we study finance theory, but RBei helped me apply it in Excel with actual data. I loved the focus on core concepts and how they linked everything to placement preparation. I feel industry-ready now.”

5. Neha Singh – St. Xavier’s College, Kolkata (Kolkata)

“This course transformed my approach to finance. The faculty is amazing, always approachable, and the assignments ensured we never lost touch with practice. The placement support team helped me structure my CV for finance roles. I now feel confident to apply for investment banking internships.”

6. Arjun Khanna – Analyst, Deloitte (Gurgaon)

“As a CA working in auditing, I wanted to transition into corporate finance. RBei’s course gave me the investment banking exposure I lacked. The lectures were precise, the case studies relevant, and the doubt-solving sessions flexible for working professionals. The placement assistance also connected me with recruiters in valuation roles.”

7. Priya Nair – Associate, KPMG (Mumbai)

“Being in consulting, I needed strong financial modelling skills to move into deal advisory. This course provided everything—DCF, LBO, and merger models, explained in depth. The faculty’s industry knowledge is unmatched, and their focus on application over theory made me more confident at work. Definitely the best decision for my career.”

8. Karan Malhotra – Senior Engineer, Infosys (Pune)

“Coming from an engineering background, I was initially nervous about finance. But the lectures were beginner-friendly, gradually building up to advanced IB models. The practical exposure through case studies and doubt-solving made the transition smooth. Placement guidance gave me a roadmap for shifting into finance roles.”

9. Ritika Sharma – Analyst, JP Morgan (Hyderabad)

“Even though I was already in finance, my modelling skills were weak. RBei Classes focused on hands-on Excel and core concepts that made me faster and more accurate at work. The faculty’s practical insights from real IB deals made a huge difference. I highly recommend this course to anyone looking to grow in IB.”

10. Siddharth Verma – Credit Analyst, ICICI Bank (Lucknow)

“The doubt-solving sessions were a lifesaver. Even though I work full-time, the flexibility and support from faculty kept me consistent. The placement cell gave me great interview prep tips, and the lectures were always linked to practical applications. I can confidently say I gained skills beyond what my CA qualification gave me.”