In today’s dynamic startup ecosystem, venture capital firms in India have emerged as the backbone of entrepreneurial success. With a booming economy, rising innovation, and global investor confidence, India is now one of the top destinations for venture capital investments. Whether you are an aspiring entrepreneur, a finance professional, or a student planning to enter the field of investment, understanding venture capital firms in India is essential.

Table of Contents

ToggleAt RBei Classes, we mentor thousands of CFA and FRM aspirants who later join top venture capital firms in India, investment banks, and consulting firms. Through our placement cell, we bridge the gap between rigorous academic preparation and rewarding finance careers. This blog will provide a complete guide to venture capital firms in India, covering what venture capital is, top VC funds categorized by stage, future trends, and—most importantly—how certifications like CFA and FRM with RBei Classes mentorship can help you secure jobs in this competitive domain.

What is Venture Capital (VC)?

Venture Capital (VC) is a form of private equity financing provided to startups and small businesses that show high growth potential. Unlike traditional bank loans, venture capital investments are made in exchange for equity (ownership stake) in the company.

A venture capital firm in India typically pools money from investors, known as Limited Partners (LPs), and invests in promising startups through Venture Capital Funds. These firms not only provide financial backing but also bring industry expertise, mentorship, and strategic networks to accelerate business growth.

For finance professionals, especially CFA and FRM holders, working with venture capital firms in India opens doors to exciting opportunities in deal evaluation, portfolio management, risk analysis, and startup advisory.

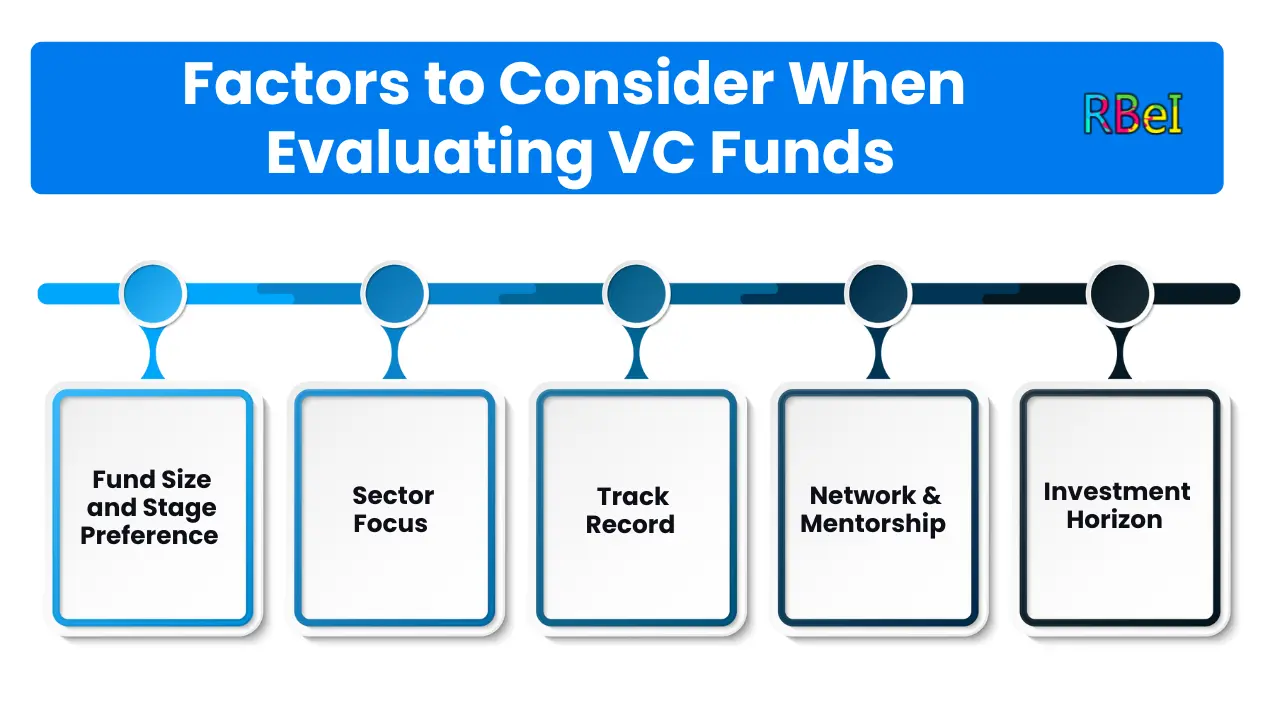

Factors to Consider When Evaluating VC Funds

When students at RBei Classes prepare for careers in venture capital, we train them to evaluate VC funds critically. Some key factors include:

- Fund Size and Stage Preference – Some VCs prefer seed-stage startups, while others focus on growth-stage companies.

- Sector Focus – Many VCs specialize in fintech, health-tech, edtech, or deep-tech.

- Track Record – Strong exits and portfolio performance signal a reliable VC.

- Network & Mentorship – The ability of a VC firm to connect startups with advisors, clients, and talent.

- Investment Horizon – Some funds prefer early exits, while others have long-term strategies.

These evaluation skills are taught in detail during CFA Level II (Alternative Investments) and FRM Risk Management modules, making RBei Classes students highly employable in this field.

Top Venture Capital Firms in India Categorized by Investment Stage

The Indian venture capital ecosystem is vibrant, with firms specializing in different funding stages. Below is a stage-wise classification of top venture capital firms in India.

3.1 Seed Stage VC Funds in India

Seed-stage VC firms invest in the idea or early prototype stage. They take high risks but also generate high returns if the startup succeeds.

- 100X.VC – One of India’s most active seed investors using iSAFE notes.

- Venture Catalysts – Known for early bets on BharatPe and Beardo.

- Indian Angel Network (IAN) – Large angel investor network supporting early startups.

- Axilor Ventures – Founded by Infosys co-founders, focused on seed-stage funding.

3.2 Early Stage VC Funds in India

These firms invest when startups have product-market fit and initial revenue traction.

Deepak Goyal CFA & FRM

Founder & CEO of RBei Classes

- 16,000+ Students Trained in CFA, FRM, Investment Banking & Financial Modelling

- 95% Students Successfully Placed • 94.6% Pass Rate In Exam

- Sequoia Capital India (now Peak XV Partners) – Backed Byjus, Zomato, Oyo.

- Accel Partners – Early investors in Flipkart, Freshworks.

- Blume Ventures – Focuses on tech-led startups with scalable business models.

- Matrix Partners India – Invested in Ola, Practo, and Country Delight.

3.3 Growth Stage VC Funds in India

Growth-stage VC firms invest in scaling businesses with proven models and high expansion needs.

- SoftBank Vision Fund – Major investor in Paytm, Oyo, PolicyBazaar.

- Tiger Global – Global fund with strong India exposure (Flipkart, Delhivery).

- Lightspeed Venture Partners – Backed Oyo, ShareChat, and Udaan.

- Nexus Venture Partners – Active in SaaS and fintech growth stories.

These firms represent some of the most influential venture capital firms in India, shaping the future of Indian startups.

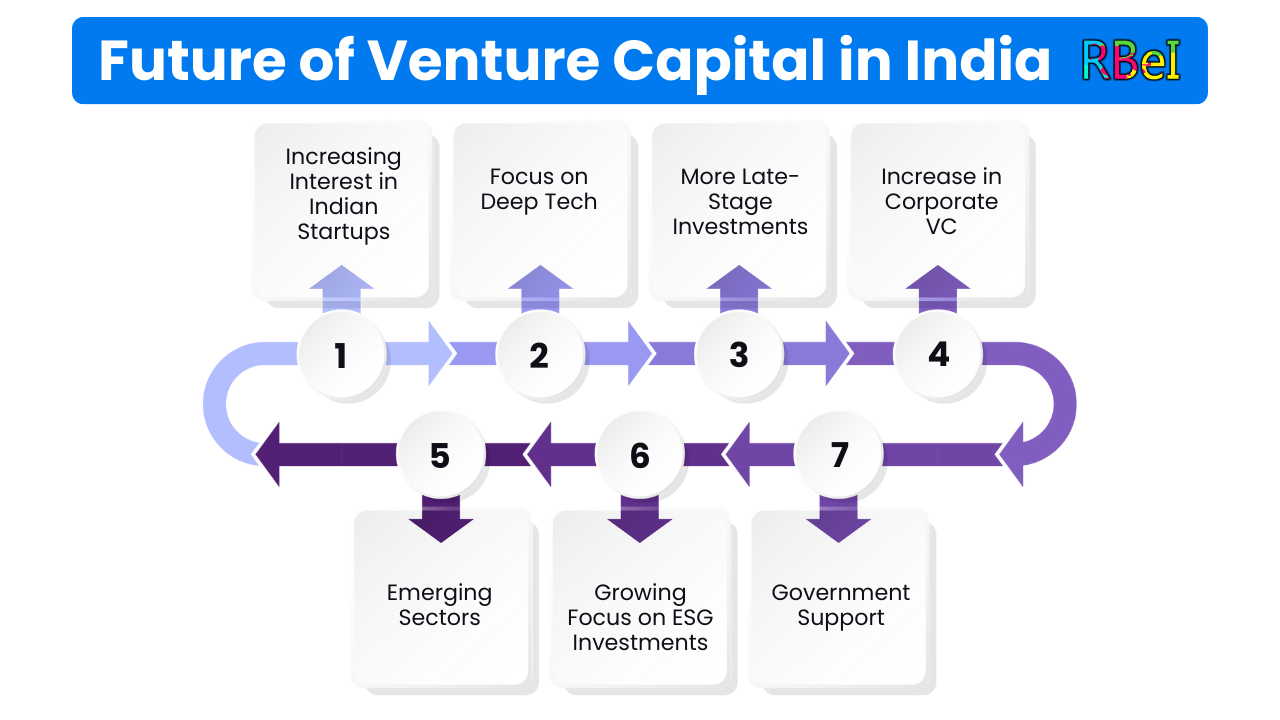

Future of Venture Capital in India

The future of venture capital firms in India looks promising due to several emerging trends. Let’s explore them in detail.

4.1 Increasing Interest in Indian Startups

Global investors continue to pour money into Indian startups, driven by a growing middle class and digital adoption.

4.2 Focus on Deep Tech

AI, blockchain, and clean energy startups are increasingly attracting VC attention.

4.3 More Late-Stage Investments

India is producing more unicorns, which require late-stage funding to scale globally.

4.4 Increase in Corporate VC

Large companies like Reliance and Tata are launching venture arms to back innovative startups.

4.5 Emerging Sectors

Fintech, edtech, agritech, and health-tech are booming sectors attracting VC funds.

4.6 Growing Focus on ESG Investments

With sustainability gaining importance, venture capital firms in India are supporting green finance and ESG-focused startups.

4.7 Government Support

Schemes like Startup India and easier FDI rules are making India a VC-friendly ecosystem.

How CFA or FRM Helps You Get Jobs in Venture Capital Firms in India

Breaking into venture capital is competitive, but certifications like CFA and FRM give you a strong edge. Here’s how:

- CFA Program – Equips you with knowledge in financial modeling, equity research, portfolio management, and alternative investments, directly applicable to VC roles.

- FRM Certification – Provides expertise in risk assessment, market risk, and credit risk—skills valuable for evaluating startup investments.

At RBei Classes, our students learn not only theory but also practical applications through case studies, mock interviews, and live projects. This holistic approach makes them stand out during placements at venture capital firms in India.

RBei Classes Placement Success Stories

Our placement cell has successfully placed students in leading venture capital firms, investment banks, and financial institutions. Here are a few inspiring examples:

- Rahul Sharma – Bangalore

- Cleared CFA Level II with RBei Classes guidance.

- Placed at Accel Partners (Early-stage VC firm).

- Starting CTC: ₹18 LPA.

- Simran Kaur – Mumbai

- FRM certified, mentored under Deepak Goyal Sir.

- Joined Sequoia Capital (now Peak XV Partners).

- Starting CTC: ₹22 LPA.

- Arjun Mehta – Gurgaon

- CFA + RBei Classes Financial Modeling Course.

- Landed a role at Nexus Venture Partners.

- Starting CTC: ₹20 LPA.

- Priya Nair – Hyderabad

- FRM + CFA candidate with strong case study practice.

- Selected by Lightspeed Venture Partners.

- Starting CTC: ₹19 LPA.

These examples showcase how RBei Classes students break into venture capital firms in India with excellent salary packages and growth opportunities.

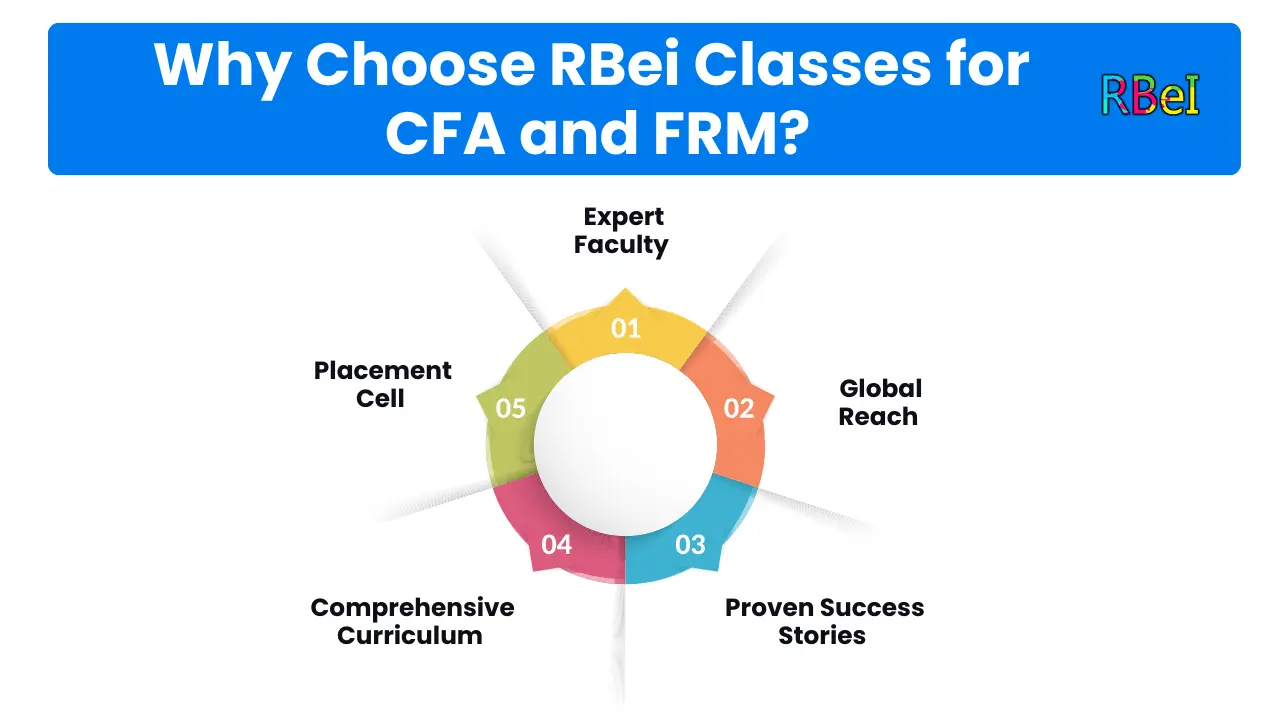

Why Choose RBei Classes for CFA and FRM?

- Expert Faculty – Deepak Goyal Sir and team with 15+ years of mentoring experience.

- Global Reach – 10,000+ students mentored from 25+ countries.

- Comprehensive Curriculum – Covering CFA, FRM, and Financial Modeling with real-world applications.

- Placement Cell – Dedicated support in resume building, networking, and interviews.

- Proven Success Stories – Consistent track record of students placed at leading venture capital firms in India and abroad.

Conclusion

The growth of venture capital firms in India is transforming the country into a global startup hub. From seed-stage investors to late-stage global giants, venture capital is reshaping entrepreneurship. For ambitious finance professionals, this sector offers high-growth career opportunities.

By pursuing CFA or FRM with RBei Classes, and leveraging our strong placement cell, you can confidently step into roles at top venture capital firms in India. Our success stories prove that with the right guidance, global-standard certifications, and dedicated mentorship, nothing is beyond your reach.

So, if you aspire to be part of India’s VC success story, start your CFA or FRM journey today with RBei Classes and unlock the path to a thriving career.